2023-8-9 02:59 |

Bitcoin price has been ranging around $30,000 for most of 2023, taking even the highest timeframes down to a record low volatility state — something highly unusual for cryptocurrencies.

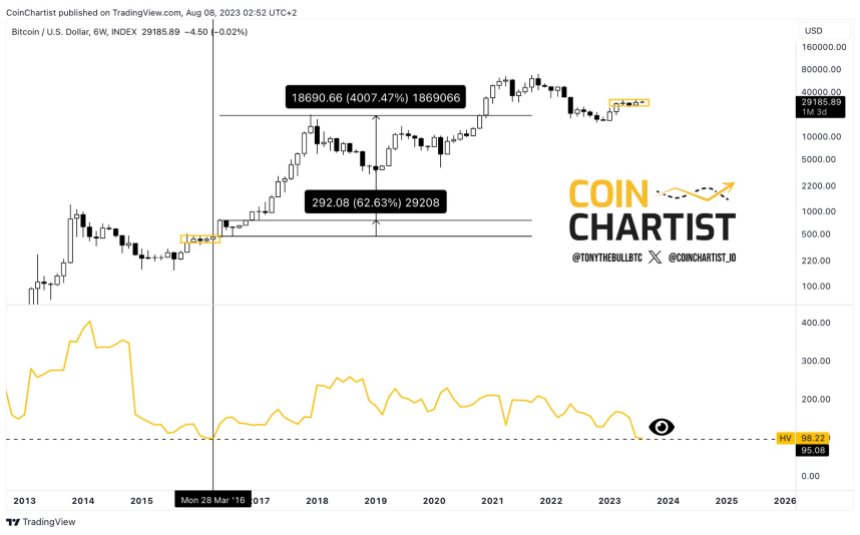

As a result, Historical Volatility in the 6W BTCUSD chart has fallen to the second lowest ever reading. The last time this signal appeared, it awakened a behemoth rally. Prices soared in the short- and long-term. Keep reading to find out by how much.

Low Volatility Suggests Behemoth Bitcoin Rally Could Be ComingNewsBTC has extensively covered the lack of volatility in Bitcoin using the Bollinger Bands. The Bollinger Bands are part of a trend-following, band-breakout trading system that also can be used to measure volatility.

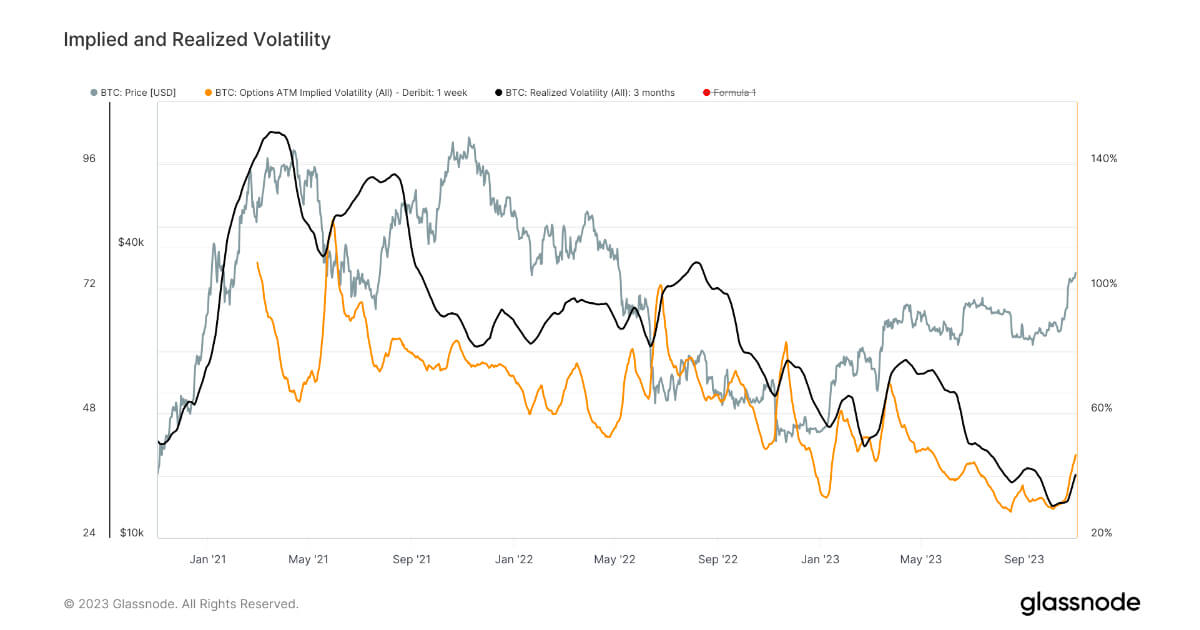

But it’s not the only way to read it. Other volatility metrics include Implied Volatility, which uses the VIX to potentially predict future volatility, and Historical Volatility (HV). HV, just like it sounds, looks at volatility from the past.

The 6W Historical Volatility in BTCUSD is now at its second-lowest level ever. This is important because when an extended sideways phase ends, it ends by awakening a monster rally or decline.

Is Another Monster 4,000% Move In BTCUSD PossibleConsidering it’s only happened once before, the sample size is too small to come to a conclusion about which direction prices might head. However, the last time the 6W Historical Volatility got this low, and then broke out, the direction was up.

Not only was it up, but it was an immediate more than 60% move higher in a single 6W candle. The move that began around March 2016 also kicked off a more than year-long bull market that ended with more than 4,000% ROI following the period of inactivity.

The power of volatility once it returns to an asset long trending sideways cannot be understated. Another 4,000% is unlikely after seven years of adoption, but something massive is waking up regardless of the final numbers and direction.

origin »Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|