2021-11-6 00:41 |

Expect increased institutional inflow as Bitcoin’s volatility rate continues to deplete

Key takeaways

Bloomberg hints that Bitcoin price volatility could have been reduced significantly.The reduction has been attributed to growing institutional adoption and a maturing market. The trend which has long been anticipated is expected to bring in even more adoption.Volatility – which is aggressive up and down movement in price, in the cryptocurrency market and Bitcoin, in particular, has been well discussed in the industry. While skeptics point to price volatility as why most crypto-assets have no better use than being highly risky speculative assets, crypto proselytes name volatility as a feature and not a bug and expect it to reduce significantly as time passes.

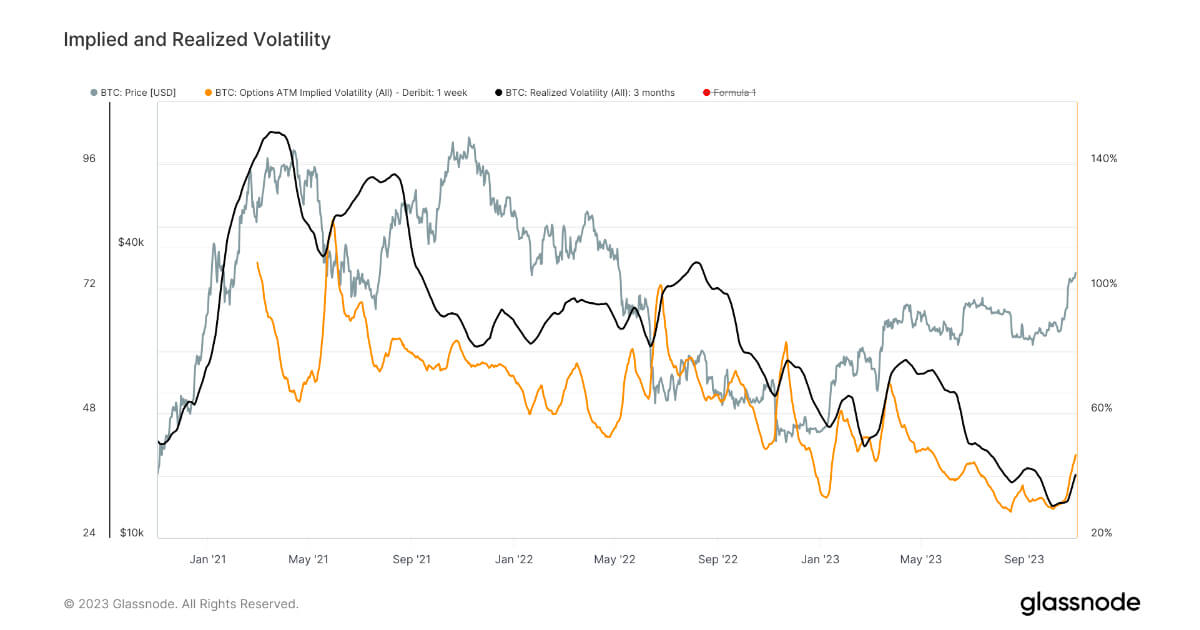

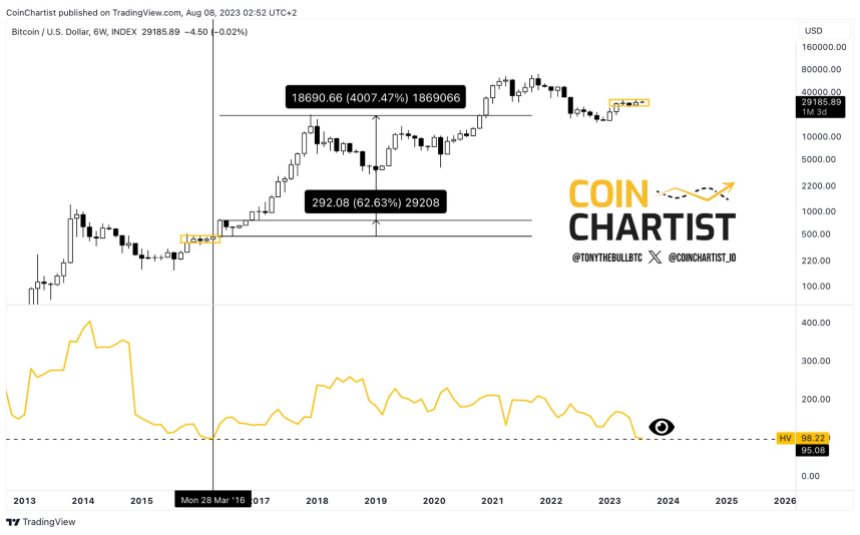

Their belief may be playing out already in the market as Bloomberg reports that price volatility in the Bitcoin market appears to be decreasing significantly when viewed in a wide time frame. Their data supports this by pointing out that in the latest rise to an all-time high in the Bitcoin market, “volatility measured over a 260-day period dropped to around 66, levels unseen since May when Bitcoin dipped under $40,000.” This occurrence deviates significantly from other times when the market pumps to new highs, as those have usually been followed by wild swings in price.

For Bloomberg Intelligence commodity strategist Mike McGlone, the reducing volatility is due to the market reaching a natural maturation, and institutional adoption that is growing and has even reached a point where a Bitcoin futures ETF was approved in the U.S. Bloomberg also thinks that these factors will play a key role in further reducing volatility going into the future.

By all standards, reduced volatility is very bullish for Bitcoin for several reasons. As the asset becomes less volatile, it is bound to gain the trust of more and more institutional investors whose participation in the market will drive the price up as they can invest much more than retail investors and be more focused on holding for the long term.

A case in point is MicroStrategy which has been accumulating Bitcoin and has no plans to sell any of its holdings in the foreseeable future.

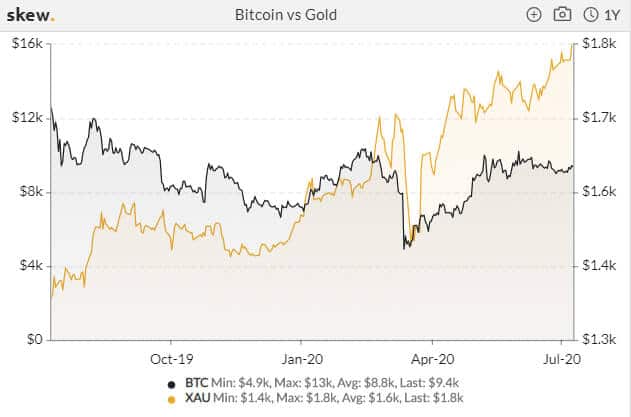

Similarly, countries looking to adopt Bitcoin as legal tender but which are still bothered about its volatility will be more at ease to make their move. This is because a lot of critics weighing on El Salvador’s adoption of Bitcoin as legal tender have noted that the price volatility of Bitcoin could hurt the country’s economy. When volatility reduces, bringing more trust for the network, countries will stand to reap benefits for their economies by adopting the Bitcoin standard.

However, Bitcoin proponents consider volatility to be a price to pay for Bitcoin’s fixed supply and decentralization, features that give the network and the cryptocurrency value, according to a CNBC report.

origin »Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|