2022-8-4 16:30 |

Be[in]Crypto takes a look at Bitcoin (BTC) on-chain indicators, focusing this week on the Reserve Risk, Balanced price and the Cumulative Value-Days Destroyed (CVDD).

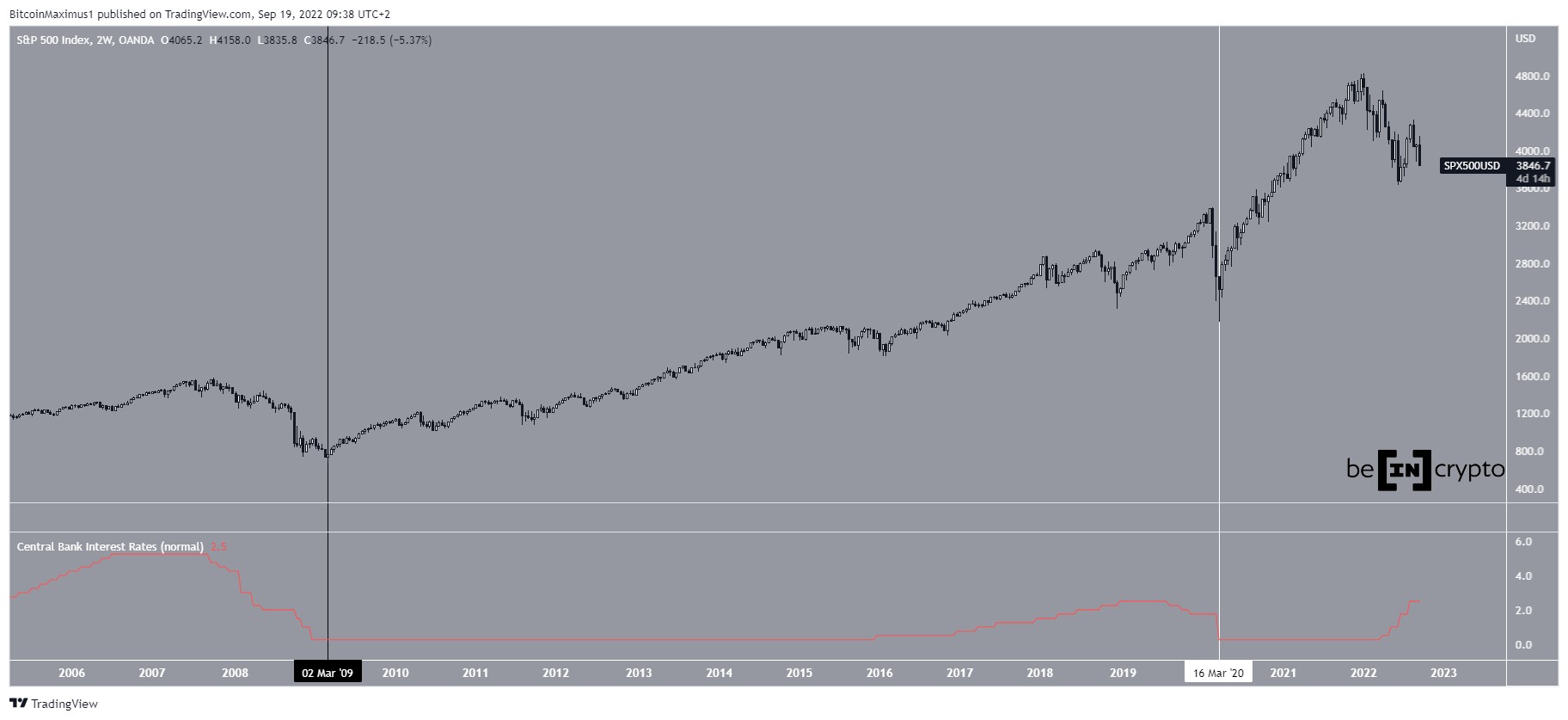

Reserve RiskThe Reserve Risk is a cyclical BTC on-chain indicator that measures the confidence of long-term holders relative to the current asset price.

When confidence is high but the price is low, reserve risk gives low values. These times have historically offered the best risk to reward ratios.

The Reserve Risk indicator fell to a new all-time low of 0.00099 on July 6. This is the first time in history that the indicator has fallen below 0.001. Therefore, it is possible that a low has been reached.

Historically, the BTC bottom has been confirmed once the indicator breaks out from its descending trend line (black). In order for the breakout to be confirmed, Reserve Risk has to move above 0.002.

Reserve Risk Chart By Glassnode CVDDCumulative Value-Days Destroyed (CVDD) is the ratio of the cumulative USD value of Coin Days Destroyed and the market age (in days). Historically, the indicator has been an accurate indicator for absolute market bottoms. This was the case in the 2015, 2019 and 2020 bottoms (black circle).

Interestingly, the price never decreased below CVDD, rather bounced prior to reaching it.

The line is at about $15,000, which is only slightly below the current bottom of $18,700 (red circle).

So, when comparing this to previous bottoms, this means that either a bottom has been reached or BTC will decrease towards $15,000 once more prior to bottoming. However, a touch of the $15,000 is unlikely, since BTC has historically bounced prior to reaching the CVDD line.

CVDD Chart By Glassnode BTC balanced priceBalanced Price is the difference between Realized Price and Transfer Price. Transfer Price is the cumulative sum of Coin Days Destroyed in USD, adjusted by circulating supply and total time since Bitcoin’s inception.

Historically, the bottom has been reached once BTC decreases slightly below the indicator before reclaiming it (black circle).

In the current decrease, BTC reached the balanced price on June 18 and bounced afterwards.

Similar to CVDD, this indicator suggests that either a bottom has been reached or there will be one final decrease in prior to the bottom.

Balanced Price Chart By GlassnodeFor Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

The post Bitcoin (BTC) on-Chain Analysis: Market Indicators Show Bottoming Signs appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|