2021-4-30 17:49 |

JPMorgan has taken notice of Ethereum, and its latest crypto report addresses “Why is ETH outperforming?”

ETH is hitting new all-time highs almost every day; lately, just today, we went even higher to hit $2,775. As BTC continues to trade around $55,000, ETH rallied to 0.05100 BTC.

BTC -3.04%

Bitcoin / USD

BTCUSD

$ 52,911.26

-$1,608.50

-3.04%

Volume 45.59 b

Change -$1,608.50

Open $52,911.26

Circulating 18.69 m

Market Cap 989.15 b

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[scripts.length - 1];

var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}};

(function () {

var appName = encodeURIComponent(window.location.hostname);

if (appName == "") {

appName = "local";

}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=BTC&tsym=USD';

s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

4 h

SBI Group CEO Reveals Ripple IPO Plans After Settlement With SEC Over XRP Lawsuit

5 h

Ethereum (ETH) Price Trading Analysis April 29; Up Over 50% In The Last 30 Days

6 h

Wealthfront Allows Clients to Invest in Crypto; Germany Passes Legislation on Spezialfonds to Allocate 20%

eToro market analyst Simon Peters attributes this uptrend to demand from institutional investors as “Ethereum is the natural next pick” after Bitcoin.

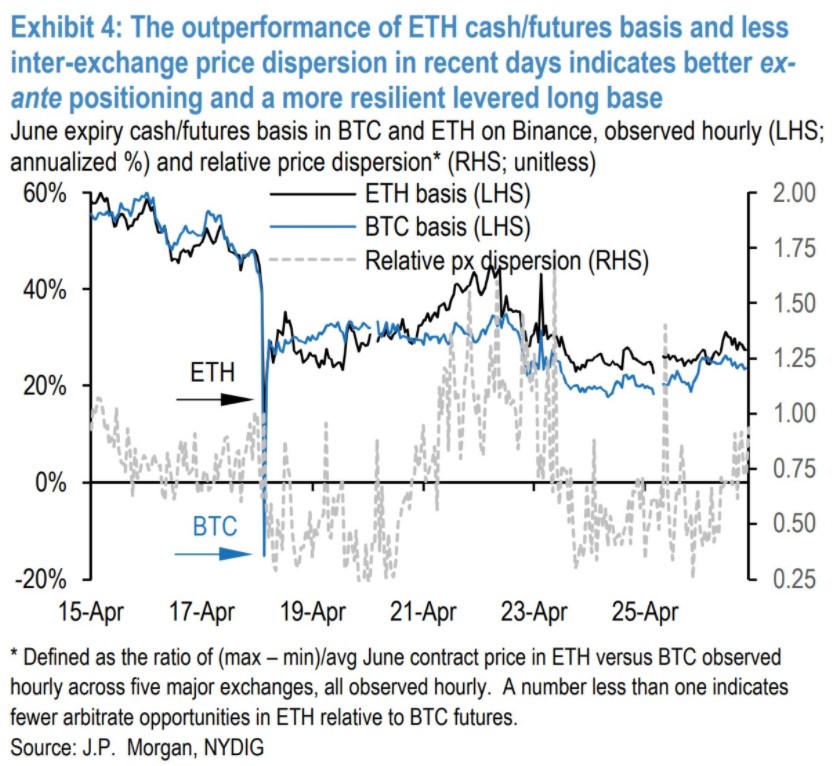

According to the banking giant, the second-largest cryptocurrency may be less dependent on demand from leveraged traders than for Bitcoin, which can work in Ethereum’s favor. The analyst wrote,

“Both BTC and ETH markets experienced comparable liquidity shocks earlier this month, which triggered a comparable de-leveraging of their respective derivatives markets in subsequent days.”

After the recent market sell-off, the report notes that Ether’s spot market recovered quicker than bitcoin’s. The bank suggests better liquidity conditions in ETH futures as well while pointing to open interest data suggesting “that the other side of these trades were easier to source.”

Source: JPMorgan

As we reported, after over a million traders lost more than $10 billion in liquidation during the recent sell-off, the funding on the futures exchanges remains extremely low despite the ongoing strength in the price.

“Ether is actually less leveraged and less vulnerable to a downtrend via a major long liquidation cascade,” noted trader CL.

“The cash in the ecosystem isn't capital-efficient enough in just arbing the futures' curve,” commented SplitCapital as a potential reason for the same.

According to JPMorgan, a large number of tokens on its blockchain, which can be considered highly liquid, may have blunt the impact of futures liquidations, allowing for a rapid recovery. The analysts wrote,

“In combination with the continued growth for DeFi and other components of the Ethereum-based economy, this suggests some technical but occasionally important bullish tailwinds versus bitcoin.”

Ethereum/USD ETHUSD 2,712.2493 -$11.66 -0.43% Volume 32.14 b Change -$11.66 Open$2,712.2493 Circulating 115.67 m Market Cap 313.73 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=ETH&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~ETH~USD"); The post JPMorgan Explains “Why is ETH Outperforming?” As Ethereum Aims for ,000 & Hits 0.051 BTC first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|