2021-8-3 17:14 |

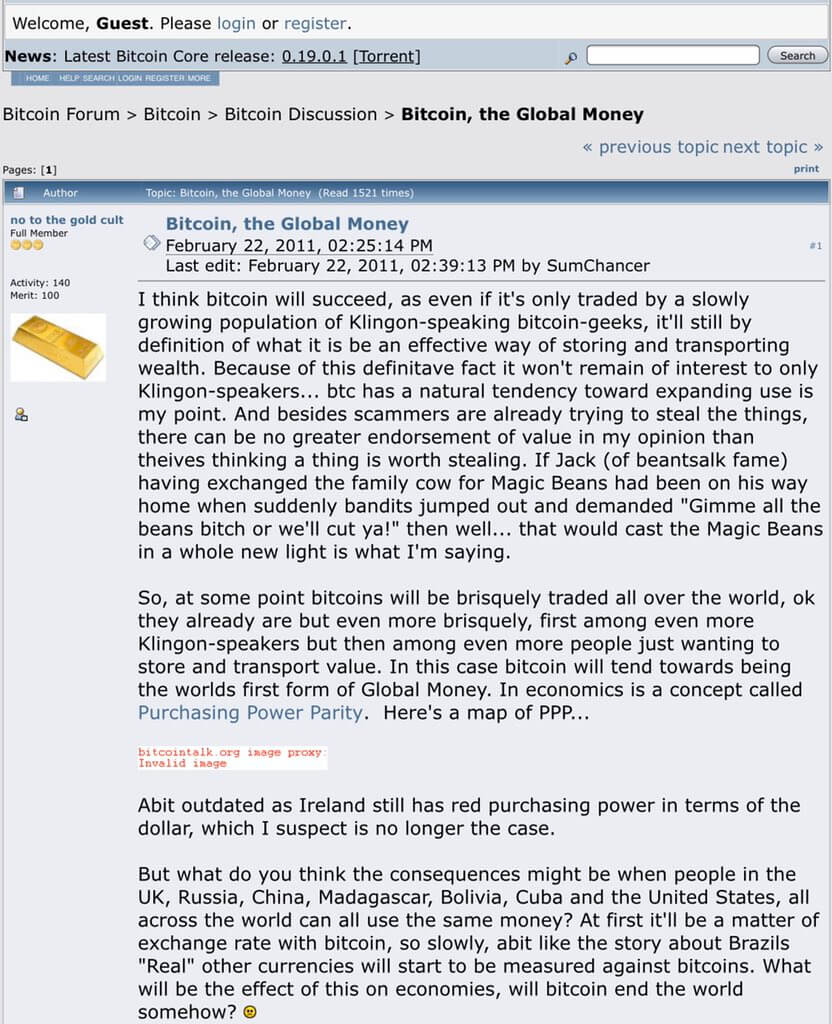

The Joint Committee on Taxation estimates to raise $28 billion over a decade to fund its infrastructure plan by strengthening tax enforcement on the cryptocurrency industry. This will be used to offset the package’s $550 billion in new spending for roads, highways, bridges, and other infrastructure projects.

The nearly $1 trillion Infrastructure bill aims to raise this amount by increasing the requirements for crypto brokers and investors to report their transactions to the Internal Revenue Service (IRS).

The cryptocurrency industry, however, is strongly against this proposal released by the Senate last week. Even some officials like Senator Ron Wyden and Pat Toomey have come in support of the crypto market.

This push back against the bill is due to the definition of a broker in the bill to report information on their clients to the IRS, which covers not just cryptocurrency exchanges but also the likes of miners, lightning nodes, DEX protocols, and validators that don’t have any clients.

In the latest move by the government to regulate the growing crypto space, Representative Don Beyer introduced a bill in the House that seeks to provide a regulatory definition for the top 90% of all cryptocurrencies by market capitalization.

Meanwhile, U.S. Securities and Exchange Commission Chair Gary Gensler, who was the chair of the CFTC during the Obama administration, will be giving a speech about crypto on Tuesday at the Aspen Security Forum.

Gensler has asked Congress to pass a law that would give the agency the legal authority to monitor crypto exchanges but said the SEC’s powers are already broad. While regulating crypto exchanges is the easiest way for the government to get a quick handle on digital token trading, Gensler is also concerned about DeFi, reported Bloomberg.

According to him, regulation will help boost the broader adoption of the technology that can spark economic progress.

“If somebody wants to speculate, that’s their choice, but we have a role as a nation to protect those investors against fraud,” said the 63-year-old former Goldman Sachs partner.

Hester Peirce, a Republican commissioner on the SEC and ‘crypto mom’, is a crypto advocate calling for “more clarity,” who says it’s “high time” the SEC approved a crypto ETF.

While Gensler won’t comment on the potential for approving a Bitcoin exchange-traded fund that would provide an easy on-ramp on investors, he has spoken positively about the ETFs during his days at MIT.

Currently, there are at least seven SEC initiatives looking at different crypto issues, including ICOs, trading venues, lending platforms, DeFi, stablecoins, custody, and ETFs, and other coin funds, he said.

And behind the scenes, Gensler has pushed the agency’s staff members to take a look at them. “I’ve asked the staff to use all of our authorities anywhere we can,” he says.

The post Joint Committee on Taxation Estimates Billion from Crypto Taxes to Fund its Infrastructure Plan first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

RSK Infrastructure Framework (RIF) на Currencies.ru

|

|