2023-7-10 10:40 |

The recent accumulation stage in the Bitcoin market is indicative of the strong conviction and long-term investment strategy adopted by larger holders of the cryptocurrency. Despite the relatively stagnant boring price movement within the $30k to $31k range, these “sharks” and “whales” continue to accumulate substantial amounts of Bitcoin. This behavior suggests that they believe in the long-term potential and value of Bitcoin, regardless of short-term price fluctuations.

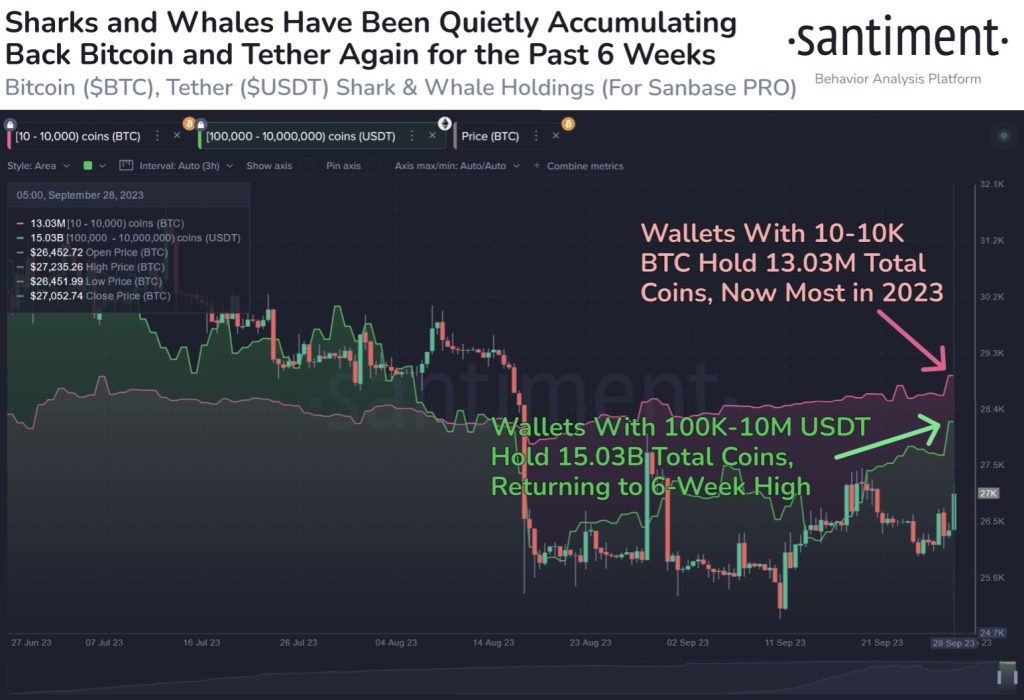

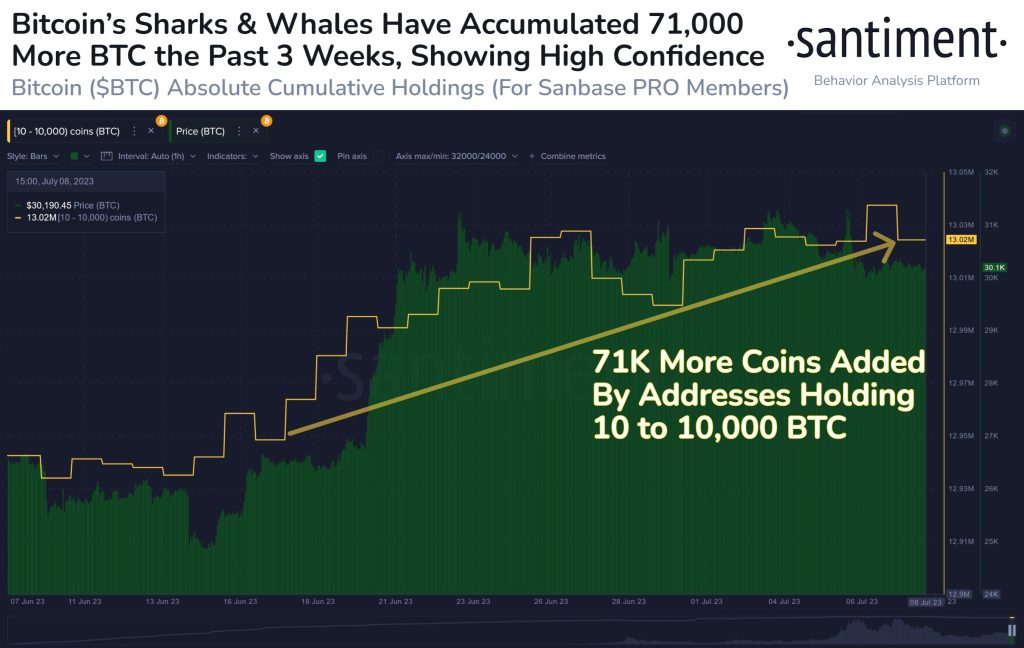

Source: Santiment Market Sentiment InsightAccumulation phases are not uncommon in the cryptocurrency market, particularly during periods of consolidation or when prices enter a range-bound pattern. These stages often signify a transition between market cycles and can provide valuable insights into the sentiment and intentions of influential market participants.

71K $BTC Additional Accumulation RecordedThe fact that addresses holding 10-10k BTC have accumulated an additional 71k coins, equivalent to $2.15 billion, since June 17th is a testament to the confidence these large holders have in Bitcoin. Such accumulation can have multiple implications. It may indicate that these holders believe Bitcoin is currently undervalued and presents an attractive buying opportunity. Alternatively, they may be strategically positioning themselves for future market movements, anticipating an upward price trend in the medium to long term.

Accumulation Can Impact Market DynamicsThe accumulation of Bitcoin by these larger players can also impact market dynamics. Their increased holdings potentially reduce the circulating supply of Bitcoin, which, when combined with steady demand or increased institutional interest, can create upward price pressure. While accumulation by major players is a positive sign for Bitcoin’s long-term prospects, it does not guarantee immediate price appreciation or the absence of short-term volatility.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

Image Source: igorigorevich/123RF // Image Effects by Colorcinch

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|