2021-7-29 16:16 |

Trading above $2,300, Ether’s year-to-date gains are back above 200%, but the cryptocurrency is still down about 50% from its all-time high around $4,380 hit three months back.

Interestingly, Ether was traded more than Bitcoin in the first half of the year as the trading volume of the former grew faster than the latter, according to a report from Coinbase.

BTC 0.04%

Bitcoin / USD

BTCUSD

$ 39,715.63

$15.89

0.04%

Volume 37.71 b

Change $15.89

Open $39,715.63

Circulating 18.77 m

Market Cap 745.45 b

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[scripts.length - 1];

var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}};

(function () {

var appName = encodeURIComponent(window.location.hostname);

if (appName == "") {

appName = "local";

}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=BTC&tsym=USD';

s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

11 h

A Shift in Momentum: Binance Yields to Regulatory Pressure, the Definition of HQ Changing for CZ Too

12 h

US Lawmakers See All the “Flashing Warning Signs” of Cryptocurrency Putting USD at Risk

12 h

Big Institutions Are Buying ETH for the First Time, Over 25% of Supply Already Used in Smart Contracts

Based on data from 20 major cryptocurrency exchanges worldwide, Coinbase found that the trading volume for Bitcoin for H1 reached $2.1 trillion, up 489% from $356 billion over the first half of last year.

In the same period, Ether’s total trading volume climbed to $1.4 trillion, up 1,461% from $92 billion in the first half of 2020.

According to Coinbase, the largest exchange in the US, this was the first sustained period of time ever that Ether’s trading pace exceeded that of Bitcoin.

Coinbase further noted that many of its largest institutional clients, including hedge funds, endowments, and corporates, increased or bought ETH for the first time during this period, believing the asset has long-term staying power tantamount to BTC’s.

Depleting SupplyAmidst this growing adoption, the most anticipated upgrade, the London hard fork with EIP-1559, is coming in about a week at block 12,965,000.

EIP-1559 is already implemented on the testnet, and its deployment on the mainnet will mean Ether will officially effectively become a deflationary asset as, according to this proposal, the base fee paid on Ethereum Network in ETH will be burned, decreasing Ether’s supply and boosting Ether’s price.

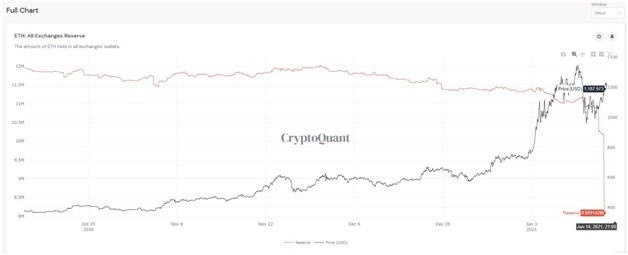

But already, ETH’s liquid supply continues to deplete.

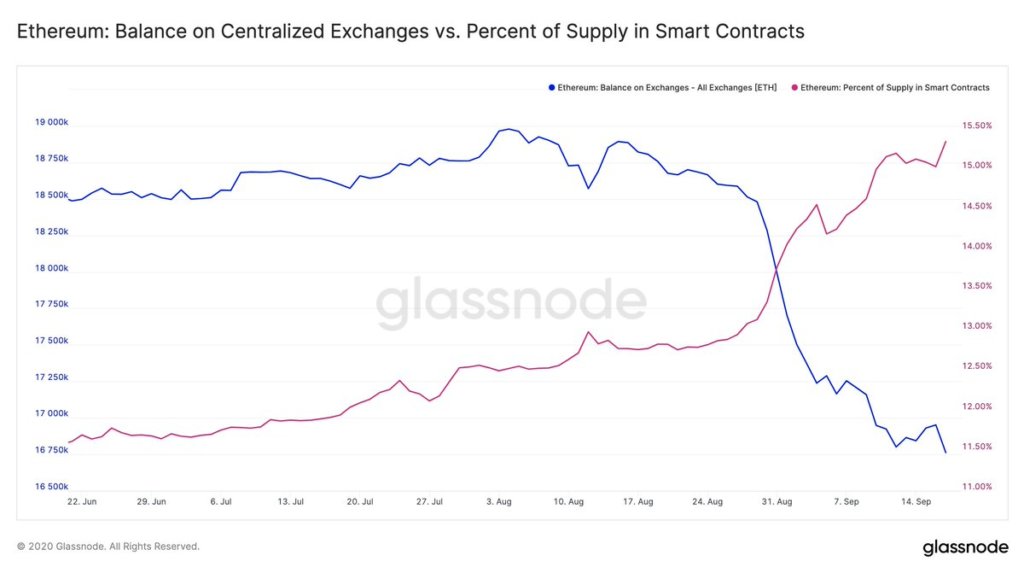

Before even the supply of ETH paid in base fees could be burned, one-fourth of it is now used in smart contracts in terms of DeFi and staked at ETH 2.0, for instance. While the ETH locked in smart contracts is on an incline at over 25%, up from about 12% a year back, the supply held on exchanges that could be easily sold, is in decline at under 13.4%.

I'm probably not the first to notice this but holy smokes, over 25% of all ETH are now used in smart contracts#SomethingSomethingETHisMoney pic.twitter.com/1MG0THA1OD

— Lasse Clausen (@lalleclausen) July 27, 2021

Ethereum blockchain is actually the biggest fees earner by a wide margin, which captured over $11 million in fees in the past 24 hours, followed by $3.1 million by BSC, while Bitcoin is recording under $634k.

In the last 365 days, Ethereum has generated $4.3 billion in total revenue compared to Bitcoin’s $1.1 billion at the second spot, as per Token Terminal.

On the third spot is the popular DEX Uniswap at $937.4 million, while its biggest competitor SushiSwap is at the fifth spot with $309.4 million, with BSC in between at almost $327 million.

Interestingly, as CryptoCobain explained in his recent episode of the UpOnly podcast, Ethereum generates more fees during bull runs as everyone is participating in the frenzy, clogging the network and pushing the fees skywards, which after EIP 1559 will means, more fees being burned, leading to even higher prices.

But during downtrends, as we saw recently, gas fees fall in single digits, which doesn’t help prop up its price at all.

ETH basically gets insanely bullish in bull markets and then crazy bearish in bear markets which makes it the best bet during uptrends to increase your wealth but not so much to protect your investment in downtrends.

Ethereum/USD ETHUSD 2,286.3632 -$14.40 -0.63% Volume 18.38 b Change -$14.40 Open$2,286.3632 Circulating 116.88 m Market Cap 267.23 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=ETH&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~ETH~USD"); The post Big Institutions Are Buying ETH for the First Time, Over 25% of Supply Already Used in Smart Contracts first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Supply Shock (M1) на Currencies.ru

|

|