2020-9-21 23:09 |

The Ethereum network has been placed under immense pressure to handle significant demand for its blockspace, with users interacting with smart contracts, DEXs, and AMMs directing massive transactional volume to the network.

This has resulted in high fees – the likes of which have never been seen before. These high fees have driven investors’ capital towards other layer ones, with debates mounting regarding which “Ethereum killer” may capture a sizeable share of the market.

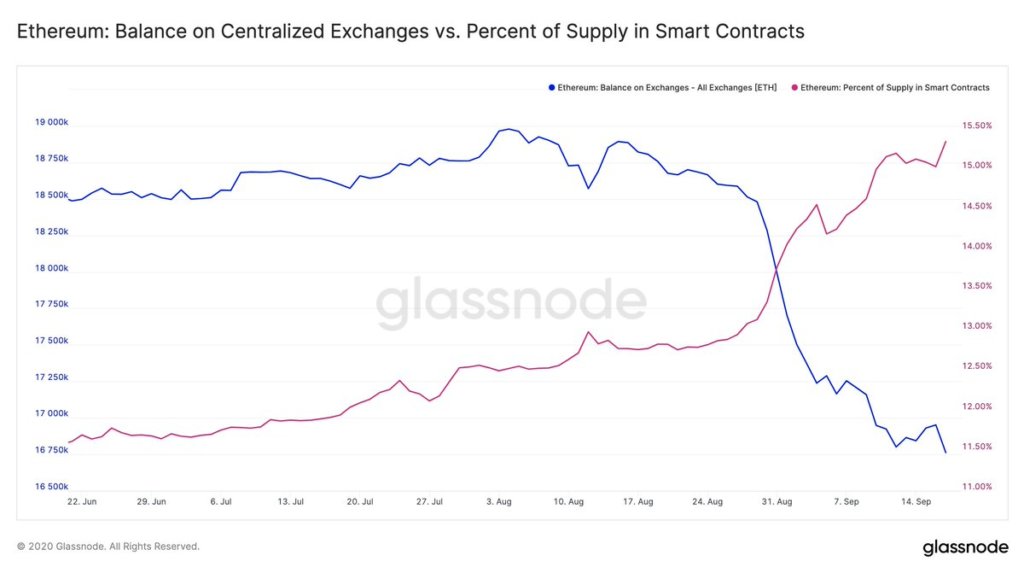

One interesting trend that the DeFi crazed has created for Ethereum – in addition to sky-high fees – is a migration of ETH tokens away from centralized exchanges and into smart contracts.

Data reveals that there is now more ETH held within smart contracts than there is on centralized exchanges.

This could bode well for Ethereum’s price, as it makes these tokens less readily available for trading, which could, in turn, provide some stability.

Ethereum network congestion reaches new heights as DeFi trend persistsThe DeFi ecosystem is nearly exclusively built upon Ethereum and drives demand to the blockchain through multiple different facets.

Users looking to acquire tokens use AMMs and DEXs to do so, with each conversion requiring both an approval and an actual swap. This alone has placed some strain on Ethereum.

The yield farming trend has compounded this, as investors lock their tokens within smart contracts and liquidity pools to generate returns on their capital.

Analytics platform Santiment explained in a recent tweet that the current congestion that the Ethereum network is facing is the highest ever seen.

“ETH gas fees have notably skyrocketed the past couple months as DeFi solutions and ‘yield farming’ platforms have extensively risen in popularity. The Ethereum network has NEVER faced a congestion hitch quite this drastic before.”

During peak activity times on the platform, users often have to pay north of $60 worth of gas to have their transactions processed promptly.

ETH supply largely shifts away from centralized exchanges and towards smart contractsHigh fees and network congestion aren’t the only impacts that DeFi has had on Ethereum.

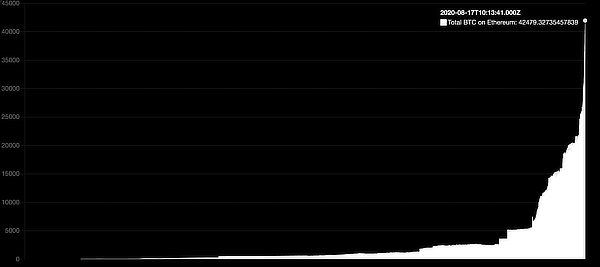

Data also shows that the amount of ETH being held on centralized exchanges has seen a drastic decline in recent times, with most of it being shifted into smart contracts.

Glassnode, an analytics firm focused on on-chain data, recently put forth a chart showing that nearly 16 percent of the Ethereum supply is now held within smart contracts, whereas 11.5 percent is held on centralized exchanges.

Data Source: GlassnodeThis trend suggests that high transaction fees may not go away anytime soon. Still, it also indicates that the cryptocurrency’s price could be well-positioned to see heightened stability in the weeks and months ahead.

The post Ethereum network congestion rockets as ETH supply moves into smart contracts appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Santiment Network Token (SAN) на Currencies.ru

|

|