2023-7-13 11:30 |

Recent information suggests that both sharks (experienced traders with large capital) and whales (entities with substantial cryptocurrency holdings) are closely observing the price range of Bitcoin, specifically in the $30k to $31k range. This indicates that these market participants are interested in this particular price level and are likely assessing the market conditions before making significant moves.

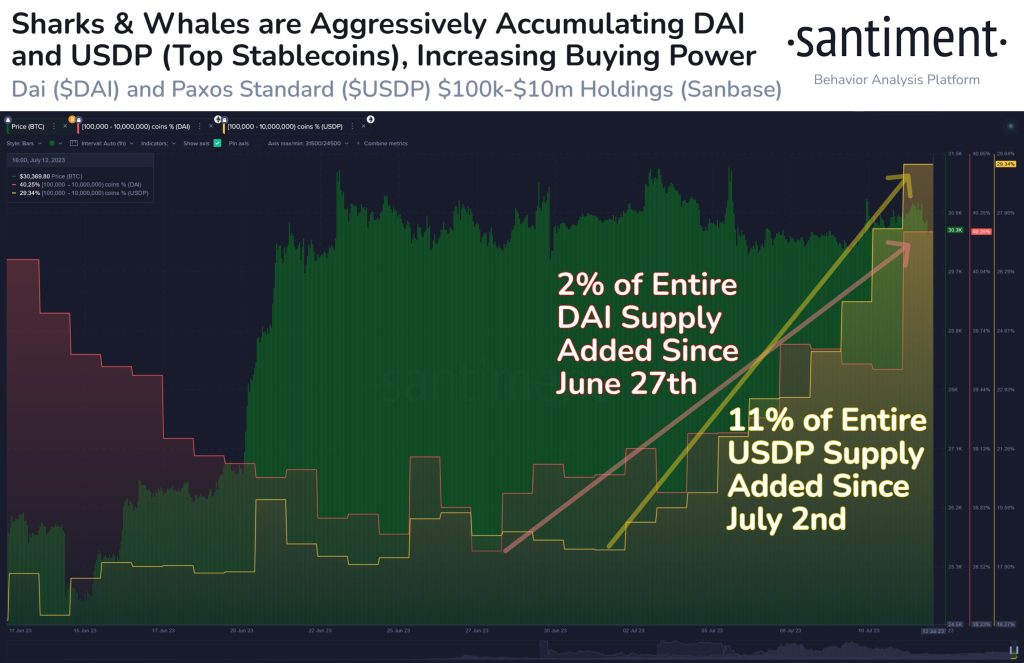

Source: Santiment Whales Target StablecoinsFurthermore, it is noted that these sharks and whales are accumulating stablecoins such as USDP and DAI at a rapid pace. The data indicates that 11% of the entire USDP supply has been added since July 2nd, while 2% of the entire DAI supply has been added since June 27th. This accumulation of stablecoins by influential market players suggests their intention to hold a significant amount of these stable assets, potentially in preparation for future significant cryptocurrency purchases.

Signal For Future Prospects Of CryptocurrencyThe accumulation of stablecoins by sharks and whales can be interpreted as a signal of their confidence in the future prospects of cryptocurrencies, particularly Bitcoin. Stablecoins are often used as a means to hedge against market volatility or as a tool for quick and secure transactions within the crypto ecosystem. The substantial increase in stablecoin holdings may indicate that these market participants anticipate a favorable market condition or potential price increase in the near future, prompting them to stock up on stable assets before executing larger cryptocurrency purchases.

Final ThoughtsOverall, the accumulation of stablecoins by sharks and whales suggests their strategic positioning and potential readiness to make significant moves in the crypto market. However, the specific intentions and strategies of these market participants can only be speculated upon, and further analysis and observation of market trends are required to gain a clearer understanding of their actions.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

Image Source: wedninth/123RF // Image Effects by Colorcinch

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|