2020-5-17 18:13 |

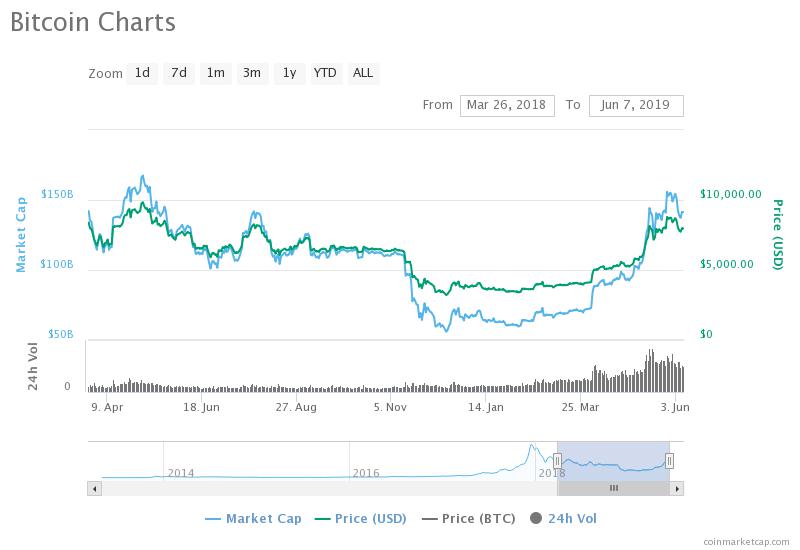

After making yet another attempt towards $10,000, Bitcoin failed to take over this important level and is currently trading under $9,500.

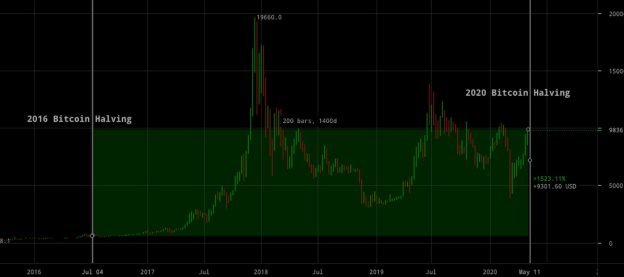

Interestingly, the world's leading cryptocurrency is challenging the downtrend experienced after the 2017 bull run.

#Bitcoin challenges the post 2017 downtrend. Interesting times. pic.twitter.com/nsFXrcKNcJ

— Charlie Morris (@AtlasPulse) May 15, 2020

But this time a lot of factors are in bitcoin’s favor. For starters, bitcoin looks to be decoupled from the stock market.

Also, this week, the 7-day average “real” trading volume pushed to the highest levels of 2020. This week followed last week’s volatile but solid volume.

The last time bitcoin price was at this level was in July 2019, when the BTC price peaked at $13,900.

CME Captures Market ShareThis week, the regulated market CME really shone as well. Over the last month, CME bitcoin futures saw significant growth in terms of open interest. Prior to the March crash, CME accounted for 4%-8% of all the open interest in the bitcoin futures market.

But this crash made a visible trend shift that has CME gaining the market share as it now accounts for 15% of OI. Arcane Research noted,

“This growth may indicate that professional money managers have loaded up on bitcoin following the market crash, seeking to allocate cash into a provably scarce asset class.”

Excluding Paul Tudor Jones’ $75 million worth of OI on CME bitcoin futures, still $400 million is held by other investors.

However, open interest in OKEx bitcoin futures has dropped which means traders are taking profits on their positions. As we reported, the bitcoin options market has surged to an all-time high this week.

Deribit remains the biggest player in the options market with its OI steadily fluctuating between 80% to 90% of the total market. CME that used to play a minor role now accounts for about 1-2% of total OI after recording over an 11% increase on Thursday.

CME #bitcoin options open interest is up 10x this month pic.twitter.com/D7tIpx5t8B

— skew (@skewdotcom) May 15, 2020

Fast and strong growthWhen it comes to the Bitcoin network, the 40% crash in bitcoin hash rate in the days following the halving that reduced mining profitability to half had some miners moving back to bitcoin forks.

Meanwhile, Network Value to Transaction ratio indicated bitcoin price might be about to enter a period of “fast and strong growth.”

Source: ArcaneResearchNVT ratio measures the BTC price relative to the value transferred over the network. Over the past three years, the ratio exceeding 10 could indicate a fast and strong pace growth as seen in 2017, 2019, and 2020 and above 12, it could be a local top.

Also, network traffic must increase for the price to continue rising and in USD terms, network traffic is rising sharply.

Bitcoin (BTC) Live Price 1 BTC/USD =$9,510.0734 change ~ 1.11%Coin Market Cap

$174.79 Billion24 Hour Volume

$7.15 Billion24 Hour VWAP

$9.42 K24 Hour Change

$105.9881 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin (BTC) на Currencies.ru

|

|