2021-1-15 17:49 |

In a strong move in the second half of the week, Bitcoin went back to $40,000 and is currently keeping around $38,000.

The stock market is also enjoying gains, but gold is still stuck around $1,850 per ounce. However, the dollar's rebound from a three-year low did falter after US Federal Reserve Chair Jerome Powell said interest rates wouldn’t be rising any time soon. There isn’t a reason to raise interest rates, according to Powell,

“unless we see troubling inflation or other imbalances that could threaten achievement of our mandate.”

Lower interest rates = Higher Bitcoin https://t.co/XxuUR8FBiG

— Cantering Clark (@CanteringClark) January 14, 2021

Another reason has been President-elect Joe Biden planning to introduce two new bills, with an expected price tag of about $2 trillion. Analyst Mati Greenspan in his daily newsletter Quantum Economics wrote,

“Ever since the 2008 financial crisis, world leaders have been running the largest economic experiment in history. We've gone from quantitative easing to full-blown Modern Monetary Theory in just 10 years.”

“Now they're talking about rescue and recovery. To me, it seems a bit much, but at the same time, I am fully aware that this is likely just the beginning of it.”

This is likely to be very damaging to the US dollar in the long term, which has been “falling both in purchasing power and against other fiat currencies.”

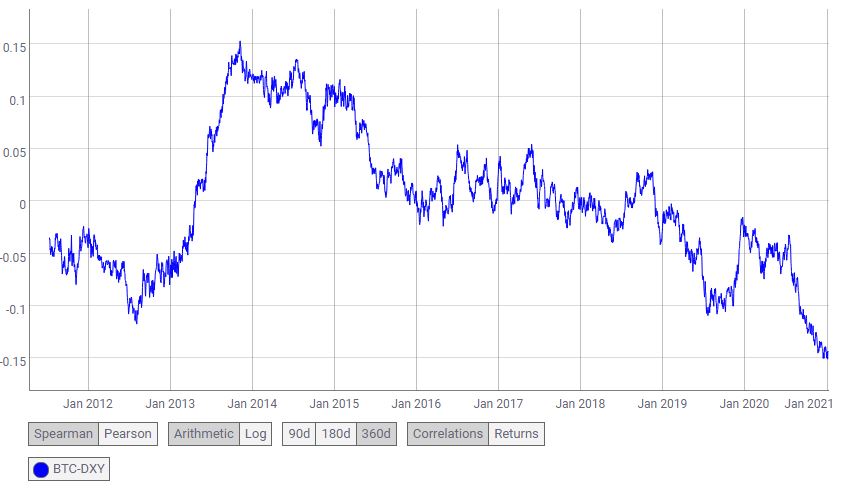

The fall of the USD actually coincides with Bitcoin gains that have the inverse correlation between both at historical levels, as per Coin Metrics.

“A reading of -0.15 doesn't represent a particularly tight correlation, but that makes sense, since the volatility of bitcoin is so much greater,” further noted Greenspan.

Source: CoinMetrics

The benchmark 10-year Treasury yield is also above 1% for the first time since March in response to the dovish tone from both Powell and Biden.

In his live-streamed interview with a Princeton University professor, Powell said the economy remains far from where the Fed wants it to be; as such, there is no reason to change the things “until the job is well and truly done.”

The asset-buying program of the central banks weighs on the dollar as it increases the supply of the currency, diminishing its value. “We know we need to be very careful in communicating about asset purchases,” he said Thursday during a virtual discussion.

“Now is not the time to be talking about exit. I think that is another lesson of the global financial crisis, is be careful not to exit too early.”

No increase in rate and the greenback remaining week is good for Bitcoin price and could send it higher to become a trillion-dollar digital asset.

The post “Now is Not the Time” to Stop Asset-Buying Program or Increasing Rates says Fed Chair first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Chronobank (TIME) на Currencies.ru

|

|