2020-11-5 17:00 |

It’s been quite a volatile past day for the American public. The presidential election has begun, and while both sides are claiming victory, there is not a clear winner as of the time of this article’s writing.

Bitcoin has seen strong reactions to electoral trends, first rallying strongly past $14,000 on expectations of a Biden win, then dropping to $13,500 on expectations of a Trump win. BTC’s volatility is tied to that of the U.S. Dollar, which has seen equally as severe reactions to intra-day election results.

Further uncertainty around the election is expected to cause further confusion amongst Bitcoin investors.

However, once the dust settles, data shows that Bitcoin will continue its ascent to the upside, no matter who will be sitting in the White House come January.

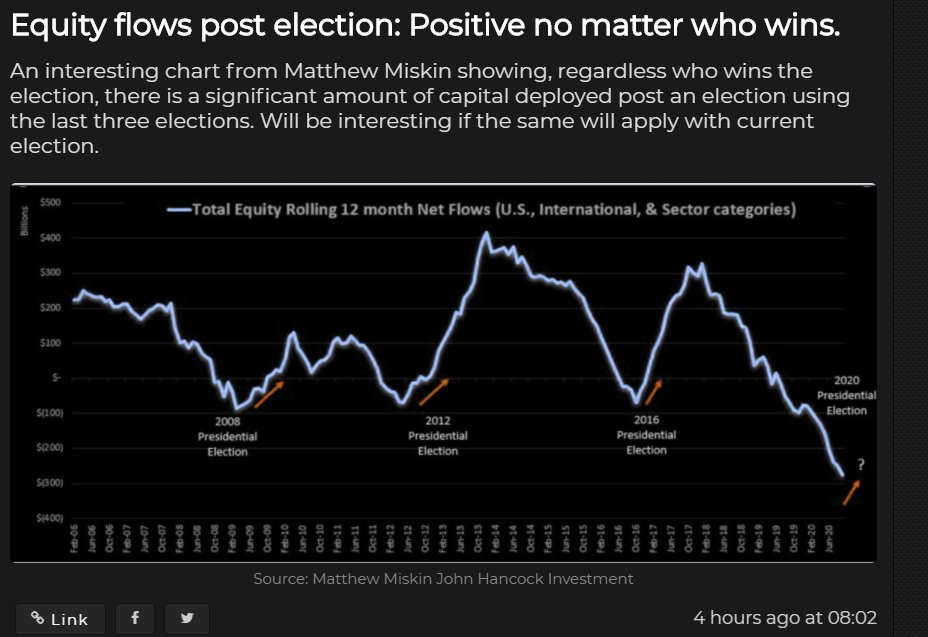

Expect a Bitcoin and stock rally after the election, data showsAccording to a research note shared by the crypto-asset analyst “Light,” historical data shows that after the previous three elections, risk-taking amongst investors was commonplace.

As the chart of net flows into equities shows, after every election began a strong uptick in the amount of capital that flooded into the stock market, no matter who the candidate elected was.

Should history rhyme, capital will flood into markets after the election. Bitcoin will benefit from this as it is still seen as a “risk-on” asset, despite it gaining some store of value characteristics over the years.

Chart of the equity rolling 12-month net flows into the U.S. and international markets over the past decade and a half. Chart from Light (@LightCrypto on Twitter).This seems to come down to the uncertainty around a candidate’s fiscal policy.

When there are unknowns about who will be running the biggest economy in the world, investors are less hesitant to put capital into the market if they know that things could change on a dime.

Of note, data shows that Bitcoin has seen immense growth starting after the prior U.S. presidential elections. As this outlet reported previously, Messari analysts found that after Trump was elected in 2016, Bitcoin surged 2,500 percent. There was nothing notable about Trump’s election that boosted Bitcoin, but it just seems that for some reason, each election lines up with the start of strong BTC rallies:

Fundamental trends still favor bullsBoosting Bitcoin’s chances at moving higher is the odds of fiscal stimulus passing.

Trump put a moratorium on stimulus discussions heading into the elections, but that will be lifted in the weeks ahead.

Many expect a multi-trillion-dollar stimulus bill to pass that should result in the further devaluation of the U.S. dollar, boosting Bitcoin as a result.

The post No matter who wins the U.S. election, Bitcoin will likely rally: historical data appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

WinStars (WINS) на Currencies.ru

|

|