Managers - Свежие новости [ Фото в новостях ] | |

Why Fund Managers Will Buy Bitcoin at $1 Trillion

Large funds are constrained by rules about profitability and portfolio balancing – hence they may be forced to shed assets like bitcoin that have the potential to return magnanimous gains. Diversification and Profitability Constraints Make Fund Managers Sell So far, stock selection rules and the fact that fund managers need to show profitability in their reports means big funds have missed on some of the biggest gainers, commented Jason Zweig at the Wall Street Journal. дальше »

2019-12-14 14:08 | |

|

|

Analysts Claim Indirect Investment in Cryptocurrency and Blockchain helps Manage Massive Risks

There has been an extra amount of negative sentiment directed towards cryptocurrencies in the last few weeks as Bitcoin slowly winded down from $8500 to $6800 over the course of a month. Many wealth managers believe it is better to gain exposure to this space by investing in publicly listed companies that are working withRead MoreRead More. дальше »

2019-12-9 20:00 | |

|

|

38% of Asset Managers with State Street Plan to Invest in Crypto Next Year

While Bitcoin used to be an asset that investors stayed away from, many asset managers are considering adding it to their own portfolios nowadays. In a statement by the managing director of digital product development and innovation at State Street, Jay Biancamano, it looks like next year could be lucrative for the crypto market, but […] дальше »

2019-12-8 21:15 | |

|

|

State Street: 38% of Clients Will Put More Money into Digital Assets in 2020

The majority of asset managers that bank with State Street are interested in digital assets, but none have asked the global custodian to store them yet. дальше »

2019-12-7 21:15 | |

|

|

3iQ Enters For Bitcoin Fund Initial Public Offer In Canada

3iQ is one of the most prominent investment fund managers in Canada and once again, it is making news, not for anything bad though. The venture has entered its initial prospectus regarding its bitcoin fund. дальше »

2019-11-29 18:12 | |

|

|

Ripple DoP's Xsongs might just be the music to everyone's ears

The life of an artist entails working long hours for their art, trying to meet the right people to get their artistry in the market, and paying a hefty amount to managers, labels, agents or promoters. дальше »

2019-11-29 17:00 | |

|

|

CEE’s Biggest International Banking and Fintech Event – Monex Summit Europe to take place on 27th – 28th of November 2019, in Warsaw, Poland

Monex Summit Europe, provides networking services and organizes professional B2B meetings: Monex Summit Europe aims to expand the knowledge and maximize deal-making opportunities for all participants within the region. дальше »

2019-11-19 19:31 | |

|

|

Asian asset managers show support for tokenized securities

Crypto-friendly Asian countries have long enjoyed both high trading volumes and proactive regulators. Now, a report from a group of Asia's largest asset managers suggests the region will be an early leader in the security token space. дальше »

2019-11-20 19:05 | |

|

|

Positive Regulation Hasn’t Yielded Positive Outcomes for Hong Kong’s Crypto Funds

Hong Kong announced a progressive policy implementation last year that would allow fund managers to invest in crypto assets. This hasn’t produced expected results as only one fund has been confirmed to have cleared the regulatory hurdles set by the Securities and Futures Commission (SFC). дальше »

2019-11-7 18:00 | |

|

|

Crypto Exchange Regulations are Coming to Hong Kong

Financial regulators in Hong Kong will introduce clear cut rules to govern the operations of cryptocurrency exchanges. Meanwhile, reports show that fund managers continue to struggle with the stringent requirements for crypto investment in Hong Kong. дальше »

2019-11-6 11:00 | |

|

|

Tokenized Securities Are Coming, Thanks to Asia’s Largest Asset Managers

Recently, the Asia Securities Industry and Financial Markets Association (ASIFMA) released a report outlining a path to the introduction of tokenized securities into the mainstream financial world. дальше »

2019-11-6 06:13 | |

|

|

Crypto Fund Managers in Hong Kong Have Been Stifled Due to Licensing Obstacles by the SFC

The securities regulators of Hong Kong started to let companies apply for a crypto fund license about a year ago, but not many licenses were issued so far. According to a recent report made by Reuters, the Securities and Futures Commission of the region is denying most of the applications, which is getting in the […] дальше »

2019-11-6 02:16 | |

|

|

Hong Kong Licence Process Forces Crypto Fund Managers to Jump Through Hoops

Last year, there was much excitement as Hong Kong took active steps to clarify the rules for crypto fund managers, which allowed them to apply for a license to trade in the space. However, it appears as if the barriers to entry for such licenses are too high and slowing the drive for fledgling crypto fund managers. дальше »

2019-11-6 00:23 | |

|

|

Сумма открытых длинных позиций по биткоину на CME удвоилась за октябрь

В октябре трейдеры удвоили сумму открытых длинных позиций по биткоин-фьючерсам с 500 BTC до более чем 1000 BTC на Чикагской товарной бирже (CME). Long positions held by institutional accounts at the CME have been rising again in October. дальше »

2019-10-23 18:42 | |

|

|

Аналитики отметили рост длинных позиций институционалов по BTC-фьючерсам CME

Длинные позиции институциональных инвесторов по биткоин-фьючерсам Чикагской товарной биржи (CME) растут в этом месяце после обвала в сентябре, обращает внимание аналитическая платформа skew. Long positions held by institutional accounts at the CME have been rising again in October. дальше »

2019-10-23 18:33 | |

|

|

Fidelity, a $2.46 Trillion Asset Management Company, Rolls Out Crypto Custody Solution

One of the largest asset managers in the world, Fidelity has rolled out its crypto custody solution. A Boston-based mutual fund that has about $2.46 trillion assets under management last year announced the launch of a separate company Fidelity Digital Assets, with the goal to offer trade execution and institutional custody services. Now, the company […] дальше »

2019-10-18 20:20 | |

|

|

88% of Chinese workers trust a bot over their human boss

The main worries surrounding artificial intelligence (AI) and its future is how one day, it’ll prove to be the biggest job-killing technology of all-time, or worse even, the autonomous bots will group together and wipe out the human race completely. дальше »

2019-10-17 12:46 | |

|

|

Why the Real Dow Jones Rally Hasn’t Started, Even After a 300-Point Gain

The Dow Jones is up by more than 300 points on the day but fund managers are still defensive and the bond markets are strong, which may pave the way for a larger rally. As the U. S. and China reached a partial trade deal on Oct. дальше »

2019-10-13 00:45 | |

|

|

Vanguard Joins Nasdaq-backed Symbiont for Blockchain Platform for Currency Trades

Coinspeaker Vanguard Joins Nasdaq-backed Symbiont for Blockchain Platform for Currency TradesBy leveraging the blockchain-powered peer-to-peer trading for investors, Vanguard plans to allow asset managers to trade currencies without involving banks as intermediaries. дальше »

2019-10-10 12:51 | |

|

|

Bitcoin Has Potential to Boost Investment Portfolio Returns, VanEck Says

Bitcoin is a great tool to diversify an investment portfolio, investment management firm VanEck concluded in a blog post. The Cryptocurrency Shows Low Correlation to Traditional Assets It is not a secret that Bitcoin demonstrates almost no correlation to traditional assets. дальше »

2019-10-10 17:00 | |

|

|

Hong Kong Issues Rules for Crypto Asset Managers

The Securities and Futures Commission of Hong Kong released guidance for crypto asset fund managers, demonstrating openness toward cryptocurrencies. The post Hong Kong Issues Rules for Crypto Asset Managers appeared first on Bitcoin Magazine. дальше »

2019-10-9 18:28 | |

|

|

Hong Kong Regulators Issue Crypto Guidance as ATMs Run Dry

The weekend saw fresh violence erupting on the streets of Hong Kong as protesters increased their presence and the police amplified their responses. It seems a strange time for regulators to publish a paper on crypto as ATMs on the island nation ran out of cash. дальше »

2019-10-7 14:00 | |

|

|

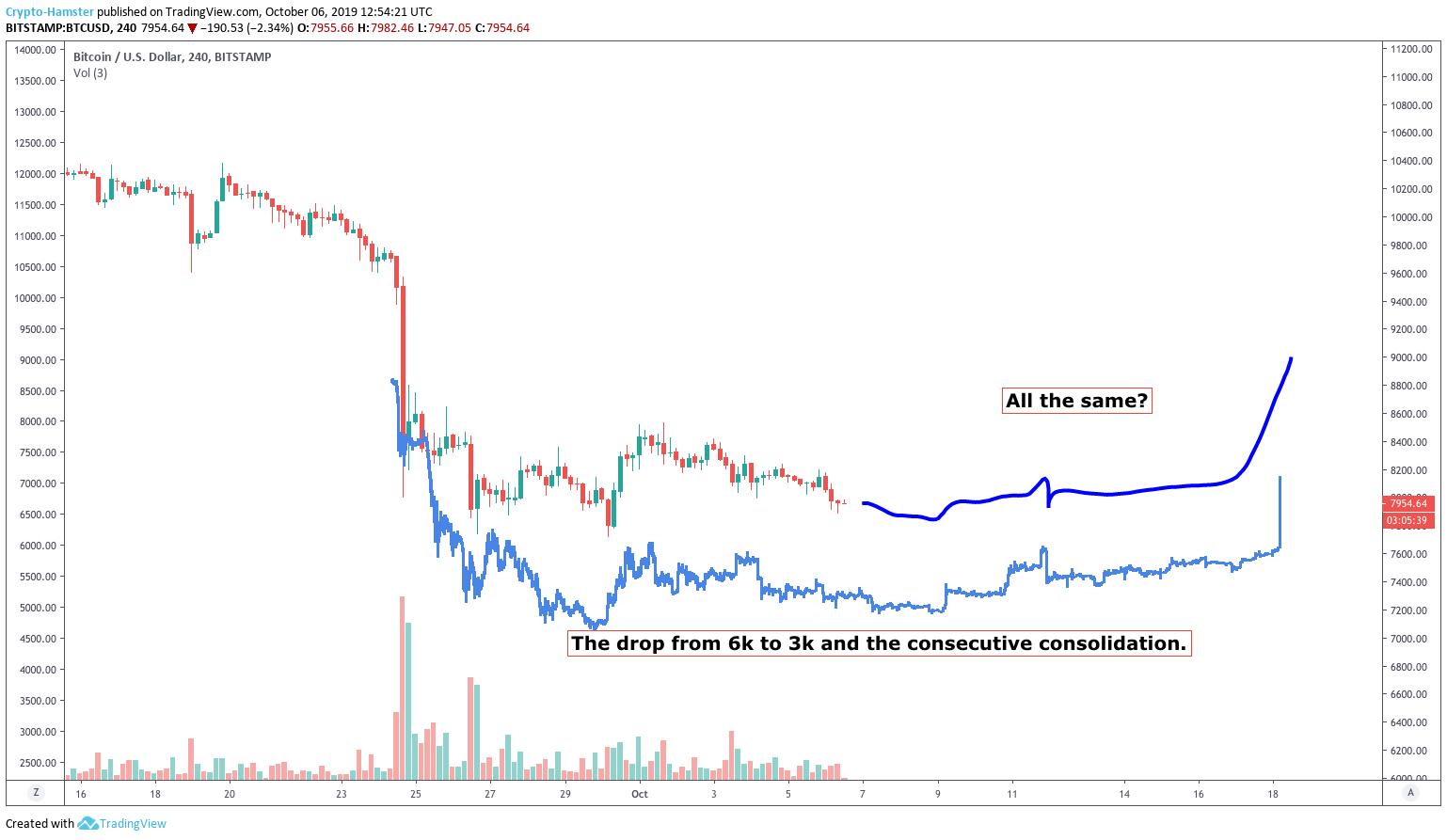

Institutions Long on Bitcoin as Analysts Expect Upward Price Breakout

Despite the harrowing price drop seen in late September, institutions are expecting for the Bitcoin (BTC) price to soon head higher — at least for institutions involved in the Chicago Mercantile Exchange (CME) futures market. дальше »

2019-10-7 01:00 | |

|

|

Hong Kong’s SEC-like Commission Releases New Regulations On Asset Management Of Crypto’s

Hong Kong securities authority sets out the first-ever cryptocurrency regulations as asset managers and portfolios invested in virtual assets targeted. The new regulations come at a time the island country is witnessing increased levels of Bitcoin trading as pressure from mainland China intensifies. дальше »

2019-10-7 21:37 | |

|

|

Vanguard Group to Disrupt FX Market Via Blockchain-Powered P2P Trading Platform

Coinspeaker Vanguard Group to Disrupt FX Market Via Blockchain-Powered P2P Trading PlatformA new blockchain platform for asset managers to run direct foreign exchange trading is currently being tested by the Vanguard Group. дальше »

2019-10-4 15:21 | |

|

|

Symbiont And Vanguard Start Testing Blockchain-based Technology For Forex Trading

Giant mutual fund company Vanguard Group is reportedly testing a blockchain-powered foreign exchange (FX) trading platform to allow asset managers to easily trade currencies. According to a report by Bloomberg, Vanguard Group has teamed up with Symbiont which offers blockchain technology to develop the FX trading platform. The new platform will allow asset managers to […] дальше »

2019-10-3 23:27 | |

|

|

SETL launches sandbox for its blockchain settlement infrastructure

SETL launches sandbox for its blockchain settlement infrastructure - CryptoNinjas SETL, an institutional payment and settlement infrastructure based on blockchain technology, has today announced SETL Labs, an open initiative for innovators, product managers and technology architects to engage a working version of the SETL distributed ledger framework. дальше »

2019-9-26 15:38 | |

|

|

Why apps should enhance real-world experiences, not replace them

Most mobile apps seek to be the center of attention. They are created by owners and product managers who obsess over extending as many user sessions as possible. Unfortunately, they don’t place a high consideration on the impacts of their customers’ well-being. дальше »

2019-9-21 20:00 | |

|

|

How product managers can bring human insights to agile development

Today’s product manager is “the mini-CEO of the product,” a McKinsey report says. It’s a huge job, occupying the intersection between customers, business issues, and products. Product managers must understand customer needs, prioritize features, and work with the engineering team to build them. дальше »

2019-9-20 14:00 | |

|

|

This Vegan ETF Is the Most Woke Millennial Thing Ever

The New York Stock Exchange welcomed its newest ETF recently, known as the U. S. Vegan Climate ETF, which trades under the symbol VEGN. Passive ETFs are all the rage, as investors seem more interested in passively investing in general concepts as opposed to permitting fund managers to actively shift assets around in a themed ETF. дальше »

2019-9-18 03:05 | |

|

|

Dow Jones in Trouble? Fund Managers Expect Full Blown Recession to Hit in 1 Year

A growing number of fund managers expect a recession to hit the global economy in the next 12 months, casting doubts over the Dow Jones and the stock market. “Recession concerns continue to temper investor risk appetite as 38% of Fund Managers in latest BofAML survey expect a recession over the next 12mths vs 59% […] The post Dow Jones in Trouble? Fund Managers Expect Full Blown Recession to Hit in 1 Year appeared first on CCN.com дальше »

2019-9-18 21:00 | |

|

|

JPMorgan Chase Traders Accused Of Market Manipulation, Again

The U. S. Department of Justice has charged top managers at JPMorgan Chase of market manipulation, Reuters reports. For the better part of a decade, according to DoJ charges, traders Gregg Smith, Michael Nowak and Christopher Jordan allegedly manipulated prices of gold, silver, platinum and palladium futures on the New York and Chicago Mercantile Exchanges. дальше »

2019-9-17 23:02 | |

|

|

JPMorgan Chase Accused Of Market Manipulation, Again

The U. S. Department of Justice has charged top managers at JPMorgan Chase of market manipulation, Reuters reports. For the better part of a decade, according to DoJ charges, traders Gregg Smith, Michael Nowak and Christopher Jordan allegedly manipulated prices of gold, silver, platinum and palladium futures on the New York and Chicago Mercantile Exchanges. дальше »

2019-9-16 23:02 | |

|

|

Project Managers are business MVPs. Join their ranks with this $39 training bundle

You can get the training as well an all-important step toward certification with the Project Management Professional Certification Training Suite of courses. The package includes over $1,200 worth of instruction, but it’s on sale now for only $39 from TNW Deals. дальше »

2019-9-11 15:00 | |

|

|

This Billionaire is Plowing Cash into $1 Billion Crypto Venture

A new crypto venture is on the horizon, boasting a $1 billion treasury and a mentor that Forbes in 2013 listed as “one of the 40 highest-earning hedge fund managers.” The unnamed platform is a part of Elwood Asset Management, a London-based firm which handles the personal cryptocurrency assets of Alan Howard, the head of […] The post This Billionaire is Plowing Cash into $1 Billion Crypto Venture appeared first on CCN Markets дальше »

2019-8-31 11:36 | |

|

|

Why Bitcoin Being Talked About by Money Managers Is a Good Sign

For the most part, investors abiding by traditional investment strategies have avoided Bitcoin (BTC) like the plague. Legendary investor Warren Buffett, for instance, once called the cryptocurrency “rat poison squared”, later explaining that there isn’t much inherent value in the project. дальше »

2019-8-23 15:00 | |

|

|

Bitcoin is ‘Schmuck Insurance’: Morgan Creek Capital Founder

Bank of America Merrill Lynch recently surveyed fund managers and found that investors are the most bullish they’ve been on bonds since the end of 2008. But that popularity comes as long-term risks are developing for traditional asset classes. дальше »

2019-8-17 01:00 | |

|

|

SEC Reschedules The Decision On Three Bitcoin ETFs Again As BTC Price Remains Vulnerable To Further Losses

On August 12, the SEC put off their decision on bitcoin exchange-traded ETFs put forward by NYSE Arca and Cboe BZX exchanges earlier this year. The proposals for these ETFs were filed months ago by Bitwise, VanEck SolidX, and Wilshire Phoenix asset managers. дальше »

2019-8-13 14:32 | |

|

|

SEC Delays Decision On Bitcoin ETFs

The Securities and Exchange Commission has delayed its decision regarding three proposed bitcoin ETFs from asset managers Bitwise Asset Management, VanEck/SolidX, and Wilshire Phoenix. All decisions have been pushed to dates in late September and mid-October. дальше »

2019-8-13 00:38 | |

|

|

Microsoft Project is project management done right–train up for under $30

Microsoft Project has been helping managers keep projects on track since the 80’s -- and you can get onboard with this time-tested software with the training in The MS Project 2019 A to Z Bundle. дальше »

2019-8-10 15:00 | |

|

|

CoinAlts Fund Symposium commences in Chicago on September 26th!

CoinAlts Fund Symposium is excited to announce its fourth conference for over 300 fund managers and allocators in Chicago on September 26, 2019. This year’s conference is produced by leading blockchain media & events company, BlockWorks Group, and will take place at the Art Institute of Chicago. дальше »

2019-8-9 12:30 | |

|

|

Keep 1-5% Portfolio in Bitcoin, Pompliano Tells Investors

Investors are irresponsible if their portfolios have no exposure to bitcoin, according to Anthony Pompliano of Morgan Creek Digital Assets. The co-founder & partner said in his latest “Off the Chain” podcast that it makes sense for fund managers and investors to keep 1 to 5 percent of their capital in bitcoin. дальше »

2019-8-8 15:00 | |

|

|

Grayscale chooses Coinbase Custody to store its digital assets

Grayscale chooses Coinbase Custody to store its digital assets » CryptoNinjas Coinbase Custody, the custody arm of crypto exchange Coinbase, has announced that Grayscale, one of the largest digital asset fund managers, has chosen Coinbase Custody to store its digital assets. дальше »

2019-8-5 06:49 | |

|

|