2021-9-17 20:00 |

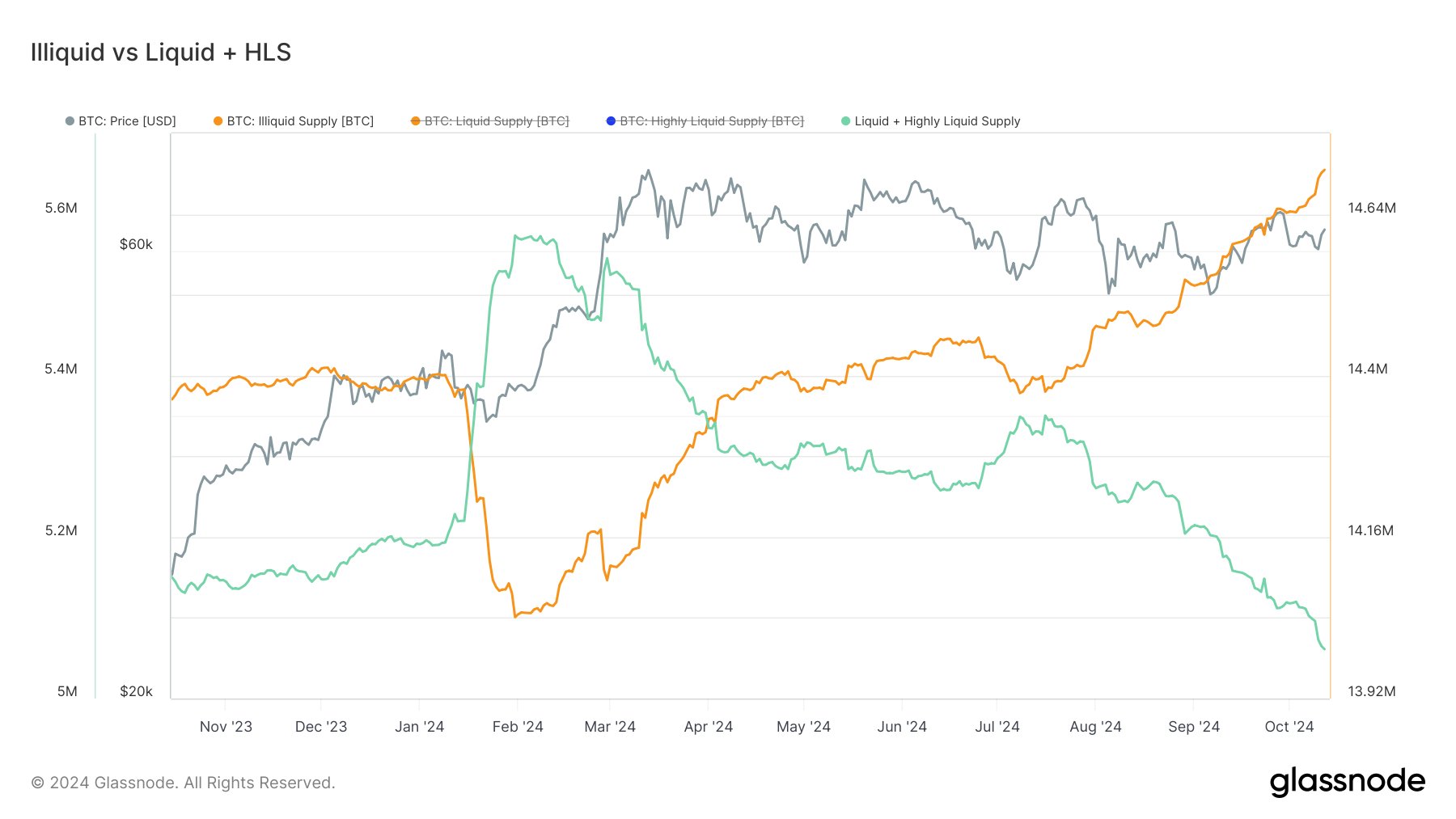

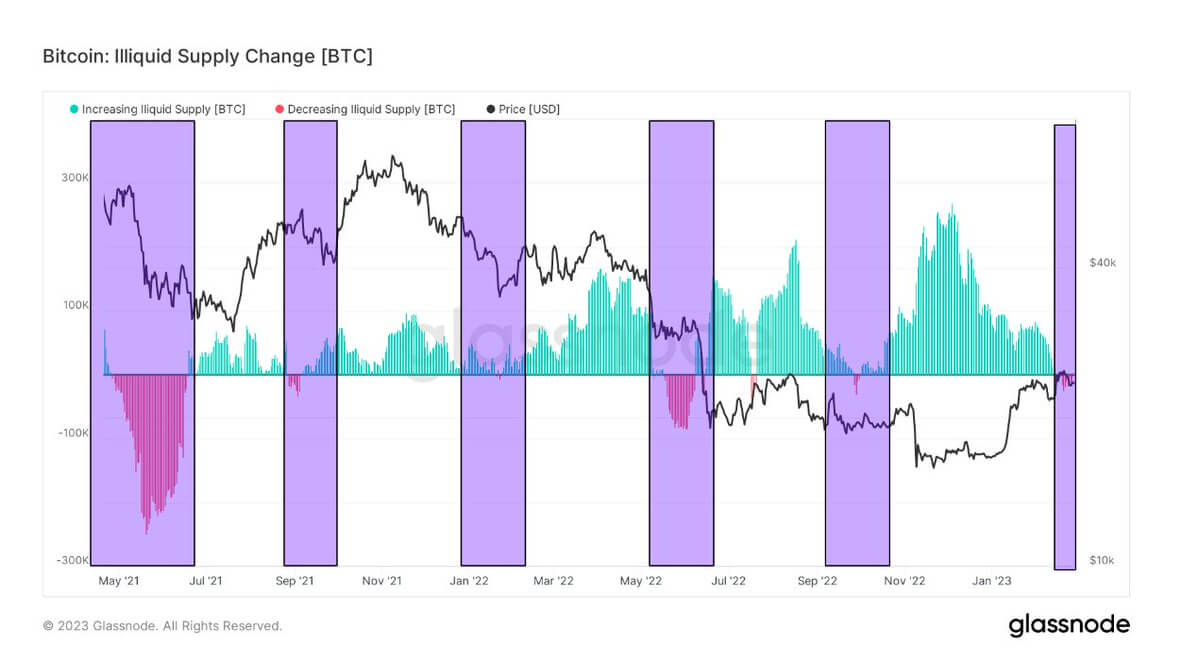

This year has been marked by numerous lows for bitcoin. The digital asset has seen yearly lows in the exchange reserves, transaction fees, and now, the short-term supply of bitcoin is down. The short-term supply has been shrinking for the past year. With declining volumes showing trends that have not been seen in the past five years. Given the low volume of bitcoin transactions, which has led to low transaction fees, only few bitcoins are moving around the network.

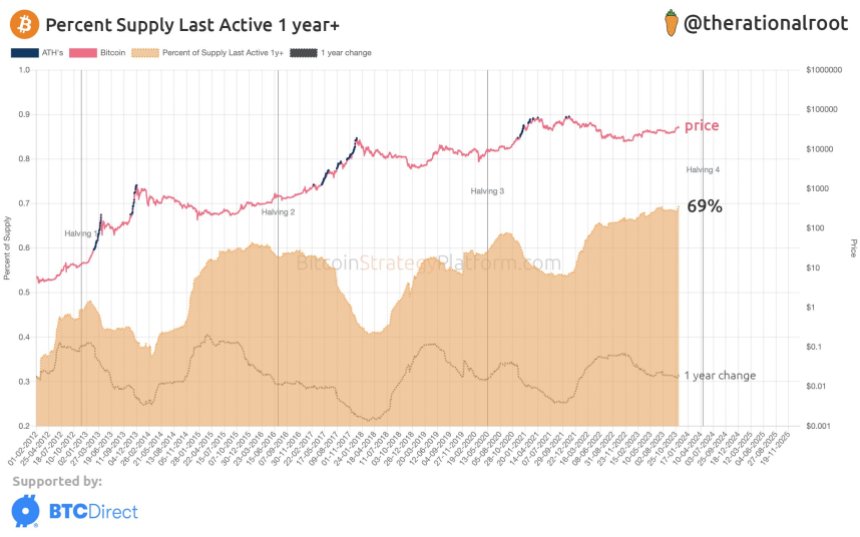

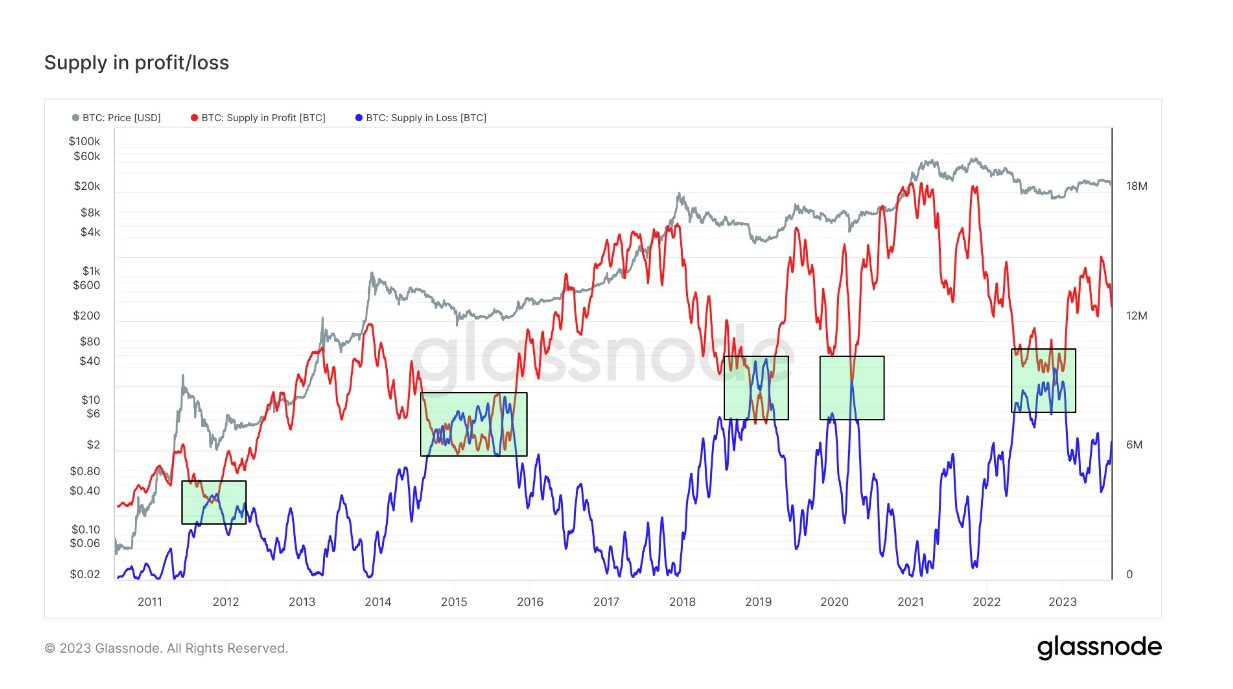

One And Three-Month Lows Show ShrinkageBitcoin is no longer being spent as it was in the past. One of the leading ideas behind the creation of the digital asset was so it could double as a currency, one which was not controlled by any one person or entity. Early adopters stuck to this initial vision. Using BTC for purchases where they can. Metrics show that in the past month, 6.8% of the asset’s total supply has been spent. While the three-month trend shows that only 15.8% of the total supply has been spent by investors.

Related Reading | Bitcoin Suffers As Mid Caps Cryptos Establish Market Dominance With Wide Margin

The three-month lows show the short-term supply of bitcoin is shrinking to 2015 lows. In the month of August, short-term supply hit a low of 6.75%. With a slight increase that only happened after the asset had recovered back towards the $50,000 mark. But this did not last long. The supply per month is in a declining trend, indicating that subsequent months will also see shrinking short-term supply.

BTC supply has continually shrunk for the past three months | Source: Arcane Research How Short-Term Supply Affects Bitcoin PriceAlthough low, the declining short-term supply of bitcoin does spell good news for the asset. It indicates that investors are still holding on to their coins, showing bullish sentiment amongst the investor community. It also shows that bitcoin’s recent gains have motivated investors to hold their funds. Instead of moving it onto exchanges to sell and cash out their gains.

Related Reading | New To Bitcoin? Learn To Trade Crypto With The NewsBTC Trading Course

With hold sentiment on the rise, it will play into the favor of BTC. The asset’s value is likely to rise with more investors holding their BTC bags. Increased sell pressure also motivates new investors to buy into the coins. Simultaneously motivating old investors to stay and ride out the low periods in wait for the bull markets.

BTC price trading above $48,000 | Source: BTCUSD on TradingView.comThe current trends show declining short-term supply has happened when the asset has witnessed a crash or dip in its price. It is obvious that investors are taking advantage of these price dips to top up their bags. Panic selling has also dropped dramatically in the market with more understanding of price movements. Leading to more diamond hands in the market. Bitcoin, it seems, has entered the era of holding.

Featured image from Master The Crypto, chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|