2023-11-17 19:00 |

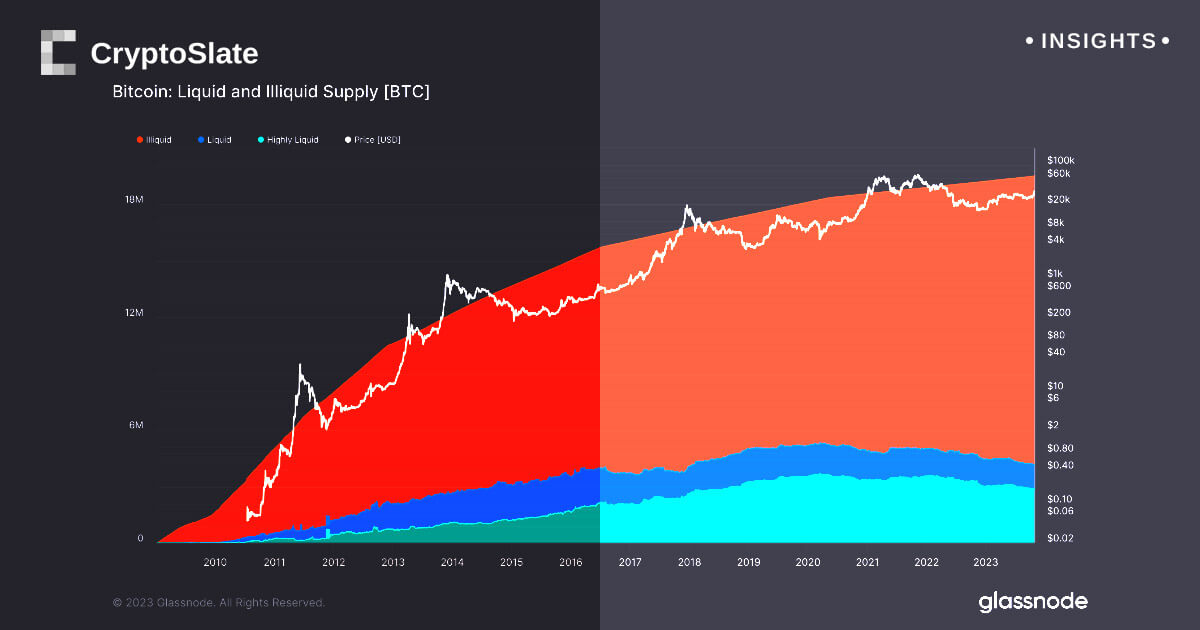

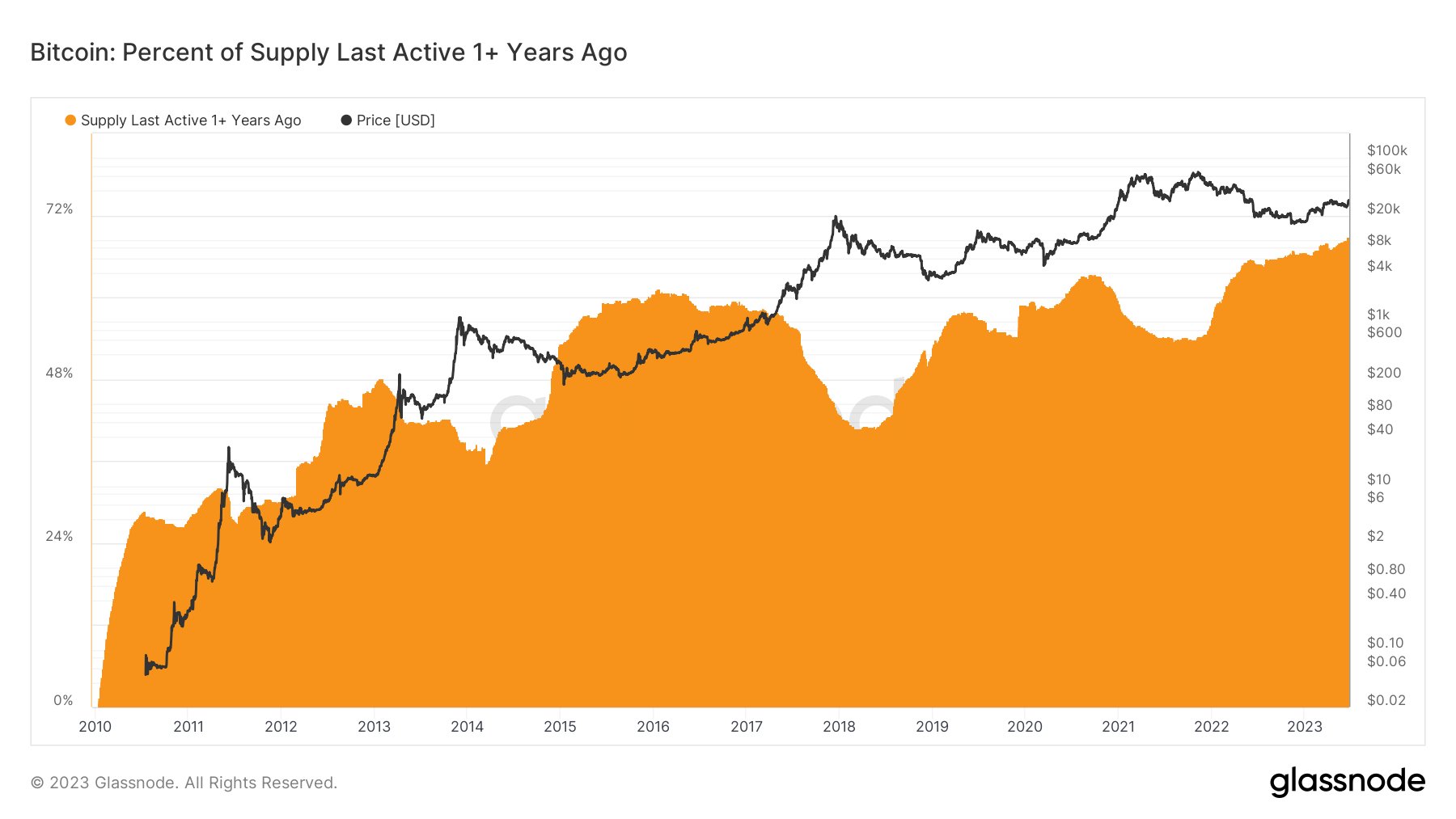

Despite a larger portion of Bitcoin’s total supply being “inactive” for over a year, recent data revealed impressive growth in investors holding on to their BTCs during the rally.

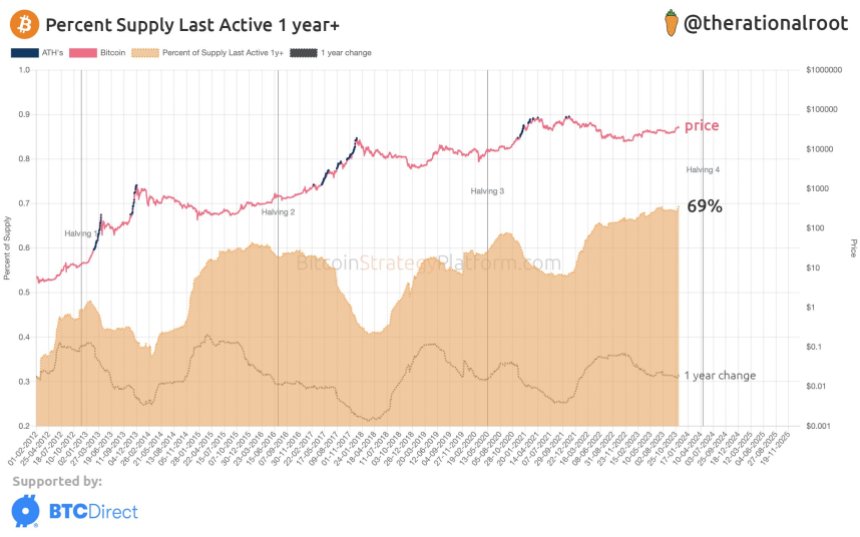

Bitcoin HODLing Yawns For Growth With Lesser SupplyOn Wednesday, November 15, a crypto analyst known as Root took to his official X (formerly Twitter) handle to share valuable data concerning Bitcoin. A yearly BTC supply chart also accompanied the analyst’s X post.

According to the analyst, a significant part of BTC’s total supply has been inactive for over a year. In addition, the inactive supply has recently reached an all-time high (ATH) of 69%. The analyst stated:

69%, an all-time high, of the #Bitcoin supply, hasn’t been active for over a year. Root stated.

This supply for one year or more is only a portion of a bigger group known as long-term holders (LTHs). One of the two major groups of Bitcoin investors comprises these LTHs, while the other is known as short-term holders (STHs).

Investors holding coins longer than five to six months are classified as long-term holders. Meanwhile, those who hold coins no more than this given time are classified as short-time holders.

In addition, even among LTHs, those who have passed the one-year mark would be considered “reliable gems.” However, this variety currently comprises the majority of the asset’s supply. This seems to have also increased significantly lately, as the graph indicates.

According to statistics, holders are less likely to switch their coins any time the longer they are kept inactive. Due to this, the LTHs tend to be the most devoted segment of the market during periods of Bitcoin’s upsides or downsides.

Double Top Pattern Resurfaces Driving The Crypto To A Downward TrendBTC has recently formed a double top pattern close to the $38,000 level, causing the token’s drop. The price has since fallen below the 100 hourly Simple moving average and the $36,500 mark.

However, it seems the bulls emerged at the $36,500 mark, giving the token momentum to sustain between $36,000 and $36,500. Following the formation of a low at $36,517, the price is currently correcting losses.

So far, there are no claims that the increase in Bitcoin HODLing has imparted the price growth of BTC. Nonetheless, this recent development sparks potential for the crypto asset over time if this continues.

Currently, the price of BTC is at $36,422 as of the time of writing, indicating a 2.94% decline over the past 24 hours. The asset’s 24-hour trading volume has also experienced an 8% drop, valued at $26,113,638,790, according to CoinMarketCap.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|