2019-11-2 09:30 |

The signals are strengthening as the winds of economic change blow harder. A global economic slowdown has already begun as central banks scramble to prop up their economies by printing more money. The last financial crisis was caused by banks and it is highly likely they’ll be responsible for the next one.

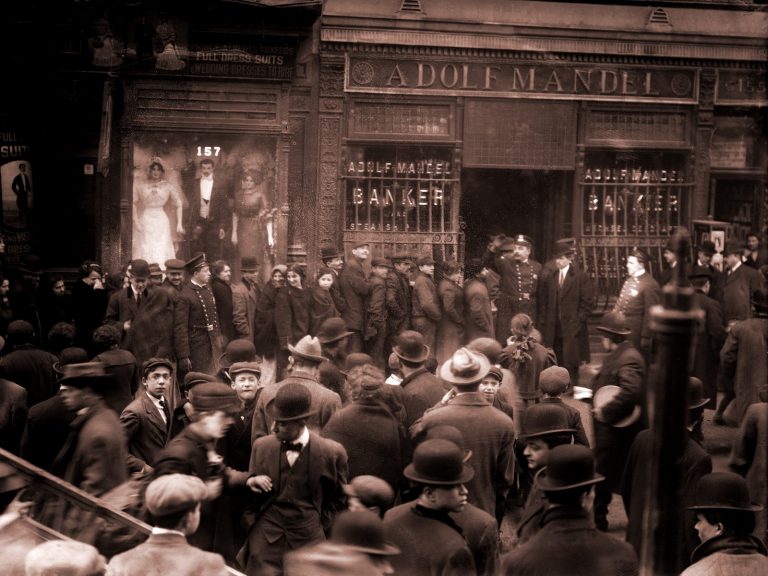

Keep On PrintingJust over a decade ago the world was plunged into the largest financial crisis since the 1920s. The US banking system single-handedly collapsed the world economy by over lending to cover derivatives trading. It took years to recover but it seems like the economic skies are darkening again.

Last week the US Federal Reserve reduced interest rates for the third time this year. The move is largely to encourage spending and borrowing while discouraging saving. For President Trump, however, this is not enough as he wants negative interest rates.

In another typical Trump tirade the POTUS blasted the FED again late last week stating that the central bank is a bigger economic threat than China, which is having its own banking problems.

“The Fed has called it wrong from the beginning, too fast, too slow. They even tightened in the beginning. Others are running circles around them and laughing all the way to the bank. Dollar & Rates are hurting…”

People are VERY disappointed in Jay Powell and the Federal Reserve. The Fed has called it wrong from the beginning, too fast, too slow. They even tightened in the beginning. Others are running circles around them and laughing all the way to the bank. Dollar & Rates are hurting…

— Donald J. Trump (@realDonaldTrump) October 31, 2019

Most economists are in agreement that Trump’s war on trade with China has caused more damage to the US economy than high interest rates.

With the FED creating more money the dollar value deflates even further. Since 1913 the greenback has plummeted in value. According to research, back then a person with $100 could buy the same amount of food, clothing, and other necessities as $2,529 would buy today.

Former congressman and Bitcoin bull Ron Paul also took a swipe at the current banking system adding;

“The dollars that you work hard for are always buying less and less, yet the government tells you there’s ‘not enough inflation’. The Fed is a government-created monopoly that counterfeits dollars by the trillions, and you’re supposed to believe that this is “capitalism.””

The dollars that you work hard for are always buying less and less, yet the government tells you there's 'not enough inflation'.

The Fed is a government-created monopoly that counterfeits dollars by the trillions, and you're supposed to believe that this is "capitalism."

— Ron Paul (@RonPaul) November 1, 2019

Bitcoin Solves ThisBitcoin, with a predetermined supply, immunity from central bank meddling, and decentralization from any state or nation makes it the perfect solution for this problem. In theory Bitcoin would become the world’s currency giving the control back to the people, not the banks. A massively flawed banking system was the catalyst that spawned Bitcoin in the first place. As Satoshi Nakamoto wrote himself;

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

The banks of the world are starting to take measures to prevent another 2008, but the writing could already be on the wall. Bitcoin does solve this as it was designed to.

Image from ShutterstockThe post How Bitcoin Can Solve The Dollar Depreciation Disaster appeared first on NewsBTC.

origin »SOLVE (SOLVE) на Currencies.ru

|

|