Новости о Tokenized Bond [ Фото новости ] [ Свежие новости ] | |

Bitfinex Securities partners with Mikro Capital to pioneer tokenized bond

In an announcement shared with crypto.news on Nov. 15, Bitfinex Securities Ltd, the first global digital asset platform licensed and registered in the AIFC, has shared the news of its new tokenized bond, which has since gone live. дальше »

2023-11-17 20:05 | |

|

|

Standard Chartered Investment Arm Launches Tokenization Platform

Libeara will enable the creation of a tokenized Singapore dollar government bond fund. дальше »

2023-11-15 12:31 | |

|

|

Bitfinex Securities to list tokenized bond denominated in USDT

Bitfinex Securities has announced the launch of its first tokenized bond offering. According to a tweet from Paolo Ardoino, the current CTO and incoming CEO of Bitfinex, this milestone marks a “new era for capital raises through deep liquid markets and stock/fond markets,” with Tether’s USDT. дальше »

2023-10-26 18:30 | |

|

|

Euroclear and World Bank collaborate on €100 million digital bond issuance via blockchain

Euroclear has joined forces with the World Bank to unveil a novel tokenized securities issuance service, marked by a €100 million digital bond issuance, aiming to integrate DeFi technology into TradFi services and enhance efficiency, transparency, and accessibility. дальше »

2023-10-25 22:27 | |

|

|

Goldman Sachs uses JP Morgan’s blockchain to execute its first repo trade

American investment bank Goldman Sachs has completed its first repurchase agreement (repo trade) by tapping into the blockchain network of its rival, JP Morgan. A report unveiled this news on June 23, noting that the bank conducted the transaction on June 17, where it changed a tokenized version of a US Treasury bond for JPMCoin, […] The post Goldman Sachs uses JP Morgan’s blockchain to execute its first repo trade appeared first on Invezz. дальше »

2021-6-25 18:40 | |

|

|

DBS Bank Issues Digital Bonds in First Security Token Offering

In hopes to grow its financial products on the DBS Digital Exchange (DDex), Singapore’s DBS Bank just announced its issuance of a $11.3 million digital bond in its security token offering (STO). A security token offering is similar to that of an IPO, in that it’s a type of public offering where tokenized digital securities […] дальше »

2021-6-1 08:09 | |

|

|

Singapore Private Bank Unveils First Tokenized Bond

The Singapore private bank DBS has announced its first tokenized bond. The first digital security offering made available on its digital exchange. The post Singapore Private Bank Unveils First Tokenized Bond appeared first on BeInCrypto. дальше »

2021-5-31 17:20 | |

|

|

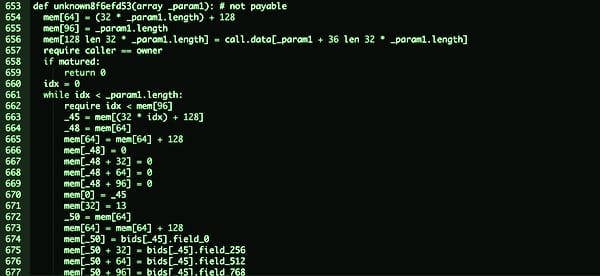

Fintech Startup Yield To Roll Out Tokenized Zero-Coupon Bonds Using ERC20-Based yTokens

Yield, a fintech startup is developing a new protocol for the Ethereum network on the issuance of fixed-rate lending and borrowing. In traditional finance, such issuance is called a zero-coupon bond, where the buyer can only cash out once the bond reaches its maturity stage and they are guaranteed to receive a higher amount than […] дальше »

2020-5-9 21:11 | |

|

|

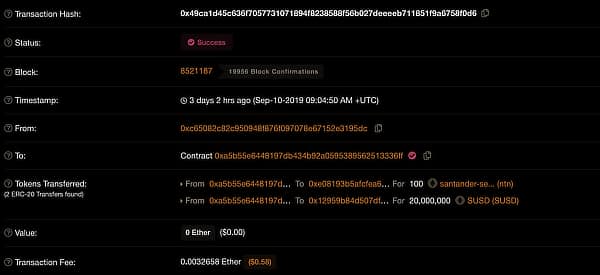

Ethereum blockchain-issued Santander bond accrues first quarterly interest

Cryptocurrency transactions tracker, Whale Alert, recently tweeted about how the tokenized bond on the Ethereum blockchain from the Spanish banking giant, Santander, had accrued $99,000 in interest foThe post Ethereum blockchain-issued Santander bond accrues first quarterly interest appeared first on AMBCrypto. дальше »

2019-12-11 13:45 | |

|

|

Deutsche Bank Bond Tokenized on EOS Network

A bond issued by the problem-ridden Deutsche Bank has been tokenized on the EOS network. The creation of tokenized assets is nothing new, but this time, the decision raised eyebrows. EOS-Supported Tokenized Bond Met with Skepticism EOS, a much-touted project, is still seen as dubious, hosting significant bot activity in its distributed app market. дальше »

2019-10-16 15:00 | |

|

|

NBA star turning his Brooklyn Nets contract into a blockchain tokenized bond

Brooklyn Nets guard Spencer Dinwiddie is reportedly set to turn his three-year, $34 million contract into a blockchain tokenized bond. Investors will be able to put money into the contract and earn interest based on his basketball performance. дальше »

2019-9-17 00:51 | |

|

|

NBA Player Spencer Dinwiddie Tokenizes Contract with Blockchain

Professional basketball player for the Brooklyn Nets Spencer Dinwiddie has opted to turn his National Basketball Association (NBA) contract into a tokenized bond. Investors will be able to invest in the security and earn interest based on Dinwiddie’s performance on the field of play, reports The Athletic on September 12, 2019. дальше »

2019-9-15 16:51 | |

|

|

Santander issues $20 million bond on Ethereum blockchain

The fifth-largest bank in Europe, Banco Santander, is the first financial institution to issue an “end-to-end” debt-based bond on Ethereum’s public blockchain. The move is an indicator of ETH’s growing importance in finance. дальше »

2019-9-13 13:26 | |

|

|

$280 Million Real Estate-backed Tokenized Bonds to Be Issued to Investors Worldwide

Fundament, a blockchain firm focused on developing products for the real estate industry, has reportedly obtained approval for issuing a crypto token-backed bond to individual traders and investors. The Berlin-headquartered company announced on July 23,. дальше »

2019-7-23 16:18 | |

|

|

Liechtenstein Financial Market Authority Approves State-of-the-Art Tokenized Real Estate Investment Product

CROWDLITOKEN AG pioneers and starts distribution of a digital bond – European retail investors benefit as well For the first time in Europe, the Liechtenstein Financial Market Authority (FMA) has approved the offering prospectus for a tokenized real estate investment […] The post Liechtenstein Financial Market Authority Approves State-of-the-Art Tokenized Real Estate Investment Product appeared first on CoinMarketCap. дальше »

2019-7-22 22:23 | |

|

|

PR: Liechtenstein Financial Market Authority Approves Tokenized Real Estate Investment Product

CROWDLITOKEN AG pioneers and starts distribution of a digital bond – European retail investors benefit as well For the first time in Europe, the Liechtenstein Financial Market Authority (FMA) has approved the offering prospectus for a tokenised real estate investment product. дальше »

2019-7-17 12:30 | |

|

|

Liechtenstein Financial Market Authority Approves State-of-the-Art Tokenized Real Estate Investment Product

CROWDLITOKEN AG pioneers and starts distribution of a digital bond for benefiting European retail investors as well. For the first time in Europe, the Liechtenstein Financial Market Authority [FMA] has approved the offering prospectus for a tokenized real estate investment product. дальше »

2019-7-16 09:30 | |

|

|

Liechtenstein Financial Market Authority Approves State-of-the-Art Tokenized Real Estate Investment Product

Triesen, 15 July 2019- CROWDLITOKEN AG pioneers and starts distribution of a digital bond – European retail investors benefit as well. For the first time in Europe, the Liechtenstein Financial Market Authority (FMA) has approved the offering prospectus for a tokenised real estate investment product. дальше »

2019-7-16 19:55 | |

|

|

Liechtenstein Financial Market Authority Approves State-of-the-Art Tokenized Real Estate Investment Product

CROWDLITOKEN AG pioneers and starts distribution of a digital bond – European retail investors benefit as well For the first time in Europe, the Liechtenstein Financial Market Authority (FMA) has approved the offering prospectus for. дальше »

2019-7-15 16:21 | |

|

|

Liechtenstein Financial Market Authority Approves State-of-the-Art Tokenized Real Estate Investment Product

Coinspeaker Liechtenstein Financial Market Authority Approves State-of-the-Art Tokenized Real Estate Investment ProductCROWDLITOKEN AG pioneers and starts distribution of a digital bond – European retail in-vestors benefit as well. дальше »

2019-7-15 09:52 | |

|

|

Liechtenstein Financial Market Authority Approves State-of-the-Art Tokenized Real Estate Investment Product

Media Release Triesen, 15 July 2019 CROWDLITOKEN AG pioneers and starts distribution of a digital bond – European retail investors benefit as well For the first time in Europe, the Liechtenstein Financial Market Authority (FMA) has approved the offering prospectus for a tokenized real estate investment product. дальше »

2019-7-15 09:32 | |

|

|

Startup Arca Applies for SEC Approval to Issue Tokenized Securities on Ethereum Blockchain

Coinspeaker Startup Arca Applies for SEC Approval to Issue Tokenized Securities on Ethereum BlockchainArca plans to tokenize the shares of a bond fund which will be a stablecoin compatible with the ERC20 standards and recorded on the Ethereum blockchain network. дальше »

2019-4-17 13:40 | |

|

|

Crypto Asset Backed Bonds Cleared on Ethereum Will Take UK Regulatory Test

Fineqia International Inc. announced on Wednesday that its subsidiary Fineqia Limited had partnered with Nivaura Limited to launch tokenized bonds in the UK. The two companies will be working together to launch fully automated tokenized bond issuance and administration on Nivaura’s white label capital markets platform. дальше »

2019-1-10 21:29 | |

|

|

VNX Exchange ICO

VNX.io is the first exchange enabling accredited investors (demand) to trade tokenized venture capital portfolios (supply) selling equity stakes in startups held by the inventory provider). These VC tokens are essentially tokenized financial instruments (like a bond, or a futures contract) that will pay token holders a share of the future incomes of the VC portfolio being tokenized and sold on the VNX platform. These once they are listed and admitted to trading дальше »

2019-1-8 17:33 | |

|

|

Smart Contract Developers May Be Held Liable by the SEC

Nick Szabo invented them but has reservations about what they’ve become. Vitalik Buterin adopted them but now regrets using their name. Dangerous when coded badly, and powerful when used intelligently, smart contracts have become a critical component of the cryptoconomy. дальше »

2018-11-18 19:45 | |

|

|