2018-8-4 21:00 |

There is no doubt that cryptocurrencies have given astronomical returns to early investors. People that invested in bitcoin in its early years, around 2011 or 2012, and are now sitting on a profit higher than 3000 prevent. This has brought newer investors to the cryptocurrency market, leading to a meteoric rise in 2017.

A study estimated that 8 percent of American households have invested in digital currencies, with a more significant percentage also having a positive long-term outlook on digital currencies.

However, amidst this cash grab, it is possible that investors forget the original reason why cryptocurrencies were developed. Many argue that digital tokens are not equities but, in fact, money. They are to be primarily used as a means of payment and not a store of value.

Dow Jones and Bitcoin

The Dow Jones Industrial Average has given 24 percent returns to investors in 2017 which adjusts to 28.11 percent returns when taking dividends into account. Similarly, the Dow gave average gains of 25.08 percent in 2016. The performances seem impressive at a time when interest rates were near zero in most developed economies.

However, even these returns get dwarfed when compared to performances given by the world’s oldest digital currency. Bitcoin gave a whopping 1,900 percent return in 2017 as it hit its all-time peak value of $19,000 in December 2017.

The now defunct BitcoinMarket.com was the earliest bitcoin exchange when it listed bitcoin for trading at $0.003 on March 17, 2010.

Two months later in May 2010, the first bitcoin transaction representing real value was completed. Laszlo Hanyecz paid 10,000 BTC for two pizzas in Florida when the cryptocurrency was trading at around $.01.

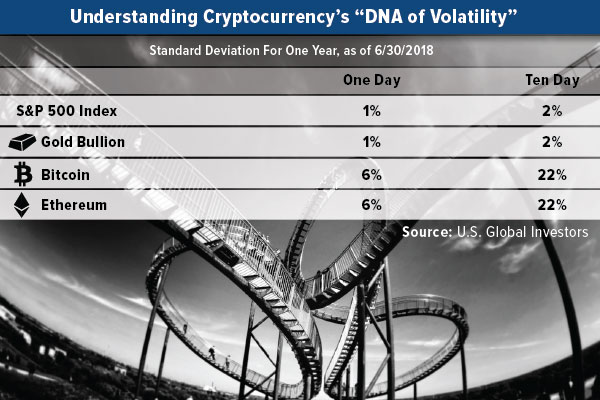

The digital asset rose by 900 percent within five days in July 2010 as the value of one bitcoin attained parity with the US Dollar in February 2011. On July 8, 2011, bitcoin saw its first bubble when it reached $31 and then soon fell to $2. Bitcoin and cryptocurrencies are inherently volatile due to some reasons.

Firstly, the entire cryptocurrency industry is still in its early stages and has two types of investors. Some ideological investors believe in the underlying technology and see digital currencies as an alternative to centralized fiat. These investors are typical examples of “hodlers” who will hold on to their digital currency holdings irrespective of a sharp rise or fall in prices.

The second type of investors in the cryptocurrency market are day traders. These traders employ some technical factors and use candlesticks, SMA, DMA and other such trading strategies. Such traders are also involved in operating maximum potential of arbitrage opportunities.

Due to some factors, digital currency prices may differ in geographies, and hence traders buy them at discounted rates on different exchanges and sell them at higher prices on a different exchange.

The Dow Jones Industrial Average was established on May 26, 1986, by Charles Dow and Edward Jones. The index followed the 12 largest publicly traded scrips of that time and its first ever recorded value stands at 40.94.

The Dow has since been expanded and now includes the top 30 publicly traded stocks in America.

Dow has been around for more than 122 years while bitcoin was developed only nine years ago. Thus, it is irrational to compare average annual returns of the Dow with bitcoin and vice versa.

Digital currencies are not equities

Any equity share represents part ownership in the underlying business and also a right to future earnings of the company until an investor is holding the share. On the other hand, cryptocurrencies and digital tokens, including currencies which cannot be mined or ERC standard tokens, do not represent any ownership in the underlying blockchain.

Merely acquiring a digital currency does not guarantee a stake in mining rewards either. There is no concept of dividends or book value in blockchain technology.

Cryptocurrency critics have been sharp to point out these reasons and lay these claims as the primary reasons why the asset class as a whole is doomed. Benjamin Graham, who is hailed as the father of investing, always argued only to acquire assets and companies which had positive cash flow and satisfied his criteria and thesis of investments.

Perhaps it is no surprise that his most successful pupil Warren Buffett is also a sharp critic of digital currencies. On multiple occasions, he criticised them for their lack of intrinsic value as he concluded that it was a very risky investment and one could lose all his life savings in it.

The risk factor is real not only in cryptocurrencies but also in equities, commodities and even government bonds. An equity crash of the magnitude of the collapse of 1929 and the crash of 2008 is sufficient to wipe out all savings made by an investor in his lifetime.

Government bonds can be argued to be a safe bet as the government and reserve banks guarantee them but they may not be immediately honored if the economy is itself mired in turmoil.

Furthermore, it is factually incorrect to label cryptocurrencies alone as volatile. Shares of Facebook Inc. plummeted by almost 20 percent soon after it announced its Q2 2018 results. Further analysis of the company’s result and balance sheet attributes a drop in profits due to lower advertising revenue.

The social media giant has already faced some sharp criticism from masses as well as authorities after the Cambridge Analytica data breach surfaced. However, a 20 percent price correction does little, or almost no harm in the long-term outlook for the company and neither affects any fundamentals of its business.

This is precisely true for cryptocurrencies as well. Neither a sharp price rally nor a sharp drop can affect the underlying blockchain technology or its real potential.

Hence calling cryptocurrencies alone as volatile when even large capital stocks are vulnerable to a price drop is incorrect. Thus, the same criticism levied on cryptocurrencies could also be aimed at traditional investments.

Cryptocurrency as means of payment

For any currency to be accepted by a majority, it must satisfy three criterias: They need to qualify as a store of value, medium of exchange and unit of account. Cryptocurrencies are already being used as a store of value. Investors are holding digital currencies with a long-term outlook anticipating prices to rise further.

Such an investment should be scrutinized. Investors need to realize that cryptocurrency prices will stabilize at some point in time and then it will become impossible to receive high returns. Buying units of digital currencies today for a better value tomorrow in the long term is as good as holding to $1 in a bank account for an extended period.

While the investor may earn some interest on his $1, he would have lost money all this time. When the returns would be adjusted for inflation, he will realize that he lost money by holding onto the $1. He should have instead used it as a means of exchange rather than accumulate it as the store of value.

Cryptocurrencies had given higher returns because they were in their early days. Prices of digital currencies will stabilize as soon as the market for it peaks out. This will happen when the masses have adopted them and there is no new market to expand into.

For now though, perhaps it is worth considering that digital tokens are another form of currency and must not be used as an investment vehicle.

The post Here’s Why Cryptocurrencies Will Never Replace Traditional Equities appeared first on BTCMANAGER.

origin »Bitcoin (BTC) на Currencies.ru

|

|