2023-8-29 01:04 |

A paradigm shift appears on the horizon of the cryptocurrency market. A series of spot Bitcoin Exchange Traded Fund (ETF) applications have reached the United States Securities and Exchange Commission (SEC). Each hopes to offer investors a new channel into the digital gold rush.

Before diving into the current Bitcoin ETF applications and deadlines, it is essential to grasp the concept of an ETF and its potential implications for the cryptocurrency industry.

What Is a Bitcoin ETF and How Does it Work?An ETF, or Exchange Traded Fund, is a hybrid between individual stocks and mutual funds. It offers a basket of assets – like stocks, bonds, or commodities – tradable on major stock exchanges.

Unlike mutual funds priced once at the end of the trading day, ETFs mirror the real-time price fluctuations of their underlying assets. Therefore, investors can buy and sell them as they would with regular stocks.

On the other hand, a Bitcoin ETF is a natural evolution of this idea, catering to the crypto industry. In essence, it is an ETF that tracks the value of Bitcoin.

Instead of direct ownership of BTC, where investors need to engage in sometimes complex storage and security measures, a Bitcoin ETF allows for an investment in BTC in a format familiar to traditional investors. This means that while investors might hold a stake in Bitcoin’s value movements via the ETF, they would not necessarily hold BTC itself.

Read more: Top 11 Public Companies Investing in Bitcoin

Own Bitcoin Directly or Through an ETF. Source: StatistaThe allure of a Bitcoin ETF lies in its potential to bridge traditional finance and cryptocurrency. For investors accustomed to the regulated environment of stock markets, ETFs offer a more accessible avenue to invest in crypto without navigating the intricacies of digital wallets or decentralized exchanges.

This can usher in a fresh wave of capital and interest in cryptocurrency, further legitimizing and stabilizing the market.

Read more: What Causes Bitcoins Volatility?

However, the journey to approving Bitcoin ETFs is not without hurdles. Concerns about market manipulation, liquidity, and the inherent volatility of crypto are among the reasons regulators like the SEC have been cautious.

The Full List of Spot Bitcoin ETF ApplicationsWith this context, the current slew of Bitcoin ETF applications underscores a transformative moment in financial history, marking the intersection of traditional investment vehicles with digital assets. Indeed, Bitcoin has witnessed several financial institutions vying for the creation of a spot ETF to provide investors with a more accessible route to its returns.

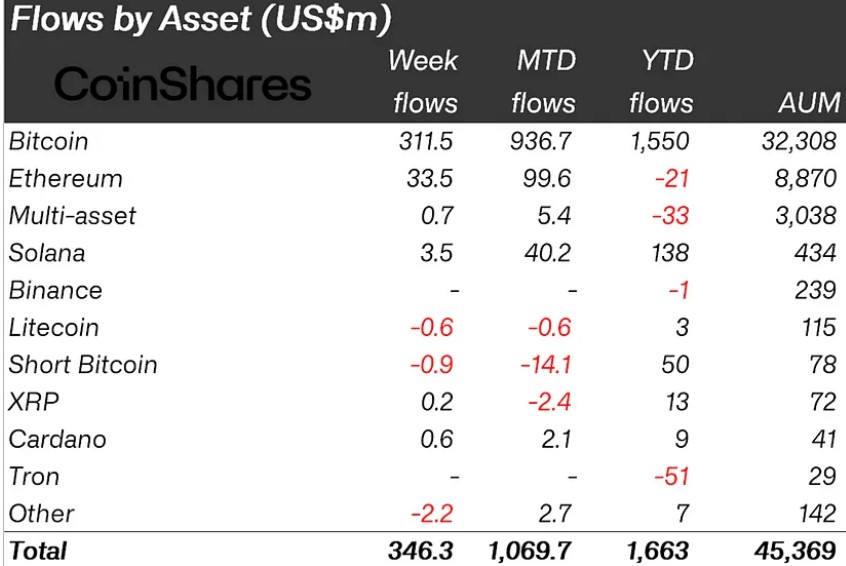

As the US Securities and Exchange Commission evaluates the applications, here is a detailed list of all spot Bitcoin ETF applications:

ARK 21Shares Bitcoin ETF (ARKB) by 21Shares & ARK iShares Bitcoin Trust by BlackRock Bitwise Bitcoin ETP Trust by Bitwise VanEck Bitcoin Trust by VanEck Wisdomtree Bitcoin Trust (BTCW) by Wisdomtree Invesco Galaxy Bitcoin ETF by Invesco & Galaxy Wise Origin Bitcoin Trust by Fidelity Valkyrie Bitcoin Fund (BRRR) by Valkyrie Estimate Deadlines for Spot Bitcoin ETF Applications. Source: SEC 7 Bitcoin ETF Applications Await ApprovalThe ARK 21Shares Bitcoin ETF is leading the charge, a collaboration between Ark Investment Management and 21Shares. Their venture is an ongoing saga, having sought approval since 2021.

This year marked their renewed effort, having faced previous setbacks from the SEC due to concerns about market manipulation and inadequate investor safeguards.

However, Ark’s CEO, Cathie Wood, remains optimistic. She envisions the SEC granting approval for multiple ETFs simultaneously, with success largely contingent on marketing prowess and effective communication.

“Because most of these essentially will be the same, it will come down to marketing and communicating the message. We are trying to get the word out there that our research is deep, and we have been doing it since 2015,” Wood said.

Read more: Bitcoin Could Fall Outside SEC’s Supervision, Says Gary Gensler

Yet, not everyone is on board. Scott Farnin, a legal representative from Better Markets, contends that the spot Bitcoin markets are easily manipulated, posing an undue risk to investors.

“The spot Bitcoin markets (1) have a history of artificially inflated trading volumes due to rampant manipulation and wash trading; (2) are highly concentrated; and (3) rely on a select group of individuals and entities to maintain Bitcoin’s network. These are features of the bitcoin network that make a proposed spot Bitcoin-based ETP extremely vulnerable to manipulation by bad actors, posing unnecessary risks to investors and the public interest. The proposed rule changes offer little to neutralize these threats,” Farnin said.

Still, BlackRock’s iShares Bitcoin Trust has piqued interest. BlackRock’s application is tough to ignore as the world’s foremost asset manager, wielding over $10 trillion Assets Under Management (AUM). The proposed ETF, benchmarked against the CME CF Bitcoin Reference Rate, plans to use Coinbase as its custodian.

Sui Chung, CEO of CF Benchmarks, commented on its robust foundation, emphasizing a dedication to market transparency and integrity.

“CF Benchmarks takes price data exclusively from cryptocurrency exchanges that adhere to the highest possible standards of market integrity and transparency. This protects investors as products benchmarked against it can then consistently and reliably track the spot price of the underlying asset. BlackRock’s increasing engagement shows Bitcoin continues to be an asset of interest for some of the world’s largest financial institutions,” Chung said.

The Competition for a Bitcoin ETF Heats UpBitwise Asset Management has also reignited its pursuit for a spot Bitcoin ETF. This move, only days after BlackRock’s application, displays the intensified competition within the sector.

Despite prior SEC rejections rooted in fraud and manipulation concerns, Bitwise remains steadfast. Matt Hougan, Bitwise’s Chief Investment Officer, hinted at a measured approach and improving conditions for approving a spot ETF.

“It is important that we have had Bitcoin Futures ETFs trading well in the market for two years. It is important that the CME market is big and more established. It is important that we have better regulations and a better understanding of custody. It is going to take not a silver bullet but a fuselage of accurately placed shots. The good news is that these are the best applications we have seen in a decade,” Hougan affirmed.

In similar endeavors, VanEck’s Bitcoin Trust resurfaced with a recent filing at the Cboe BZX Exchange. However, past rejections by the SEC, marked by the explicit concerns of Commissioners Hester M. Peirce and Mark T. Uyeda, illustrate the challenges ahead.

“In our view, the Commission is using a different set of goalposts from those it used—and still uses—for other types of commodity-based ETPs to keep these spot bitcoin ETPs off the exchanges we regulate,” commissioners Peirce and Uyeda declared.

Read more: SEC Chair Gary Gensler: 7 Reasons Why He Should Quit

Not to be overshadowed, WisdomTree re-submitted its application for the WisdomTree Bitcoin Trust. Despite two unsuccessful attempts, they are driven by the prospect of exposing investors to Bitcoin’s price movements. The firm’s dedication mirrors Invesco’s, a colossal investment firm managing approximately $1.49 trillion.

Both applications highlight the risks that US investors face in the absence of a spot ETF, showcasing the urgency of their proposition.

Finally, Fidelity Investments threw its hat in the ring, revisiting its aspirations for a spot Bitcoin ETF with the Wise Origin Trust. The application, comprising a hefty 193 pages, delves into the nuances of market risk, emphasizing the peril of investors seeking riskier alternatives. The firm’s expertise and $11 trillion in AUM make it a formidable contender.

The post Here Is the Full List of Spot Bitcoin ETF Applications and Deadlines appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|