2020-2-29 22:34 |

Investor confidence was tested today as Federal Reserve Chairman – Jerome Powell – suggests that the central bank may not have the firepower to combat the next recession.

To soothe investor fears, Powell issued a short statement on Friday, reaffirming that the central bank would use its tools and “act as appropriate to support the economy.”

The “fundamentals of the US economy remain strong” Powell argued, further noting that “the coronavirus poses [an] evolving risk to economic activity” and the Fed “is closely monitoring developments and their implications for the economic outlook.”

This statement came as markets in the US tumbled for the seventh day, as the continued spread of the coronavirus has investors fearful that the world is on the cusp of a pandemic and recession.

50bps Rate Cut Now Priced for MarchAs new cases of coronavirus outside China continue to grow, Powell’s comment has a 50bps cut now fully priced in for March.

“It was certainly an attempt to calm things down,” Torsten Slok, an economist at Deutsche Bank, explained. “This is the strongest hint you can make that a rate cut is coming.”

President Trump also played down the economic threat to the US from the virus and added his hopes that the Fed would cut rates soon.

“I hope the Fed gets involved and I hope it gets involved soon,” Trump told reporters. This isn’t anything new coming from the president that has regularly criticized the Fed for not cutting rates more aggressively.

Last week, Powell said the current low level of interest rates “means that it would be important for fiscal policy to support the economy if it weakens.”

James Bullard, the president of the Federal Reserve Bank of St. Louis, also said during his speech in Florida that “we could cut rates if we got a global pandemic that actually develops with health effects that seem to be approaching the same level as seasonal influenza, but that doesn’t look like the baseline as of today.”

European Central Bank President Christine Lagarde however, told European lawmakers that “Monetary policy cannot, and should not, be the only game in town.”

Stock Market's Worst Day is Business as Usual for BitcoinStock market indexes have slumped amid deadly virus worries, with money pouring into gold, which has surged to 7-year highs alongside US govt securities as people look for safe investments, driving prices up while pushing yields to record lows.

The stocks have suffered their biggest weekly fall since 2008. With Dow Jones Industrial Average shedding 10% of its value in February, the S&P 500 also lost 8.4%, and the Nasdaq down by 6.4%.

Stocks down 10% in a week? Bitcoin calls that a "Thursday"

— Blockfolio (@blockfolio) February 28, 2020

During this financial uncertainty, the Hong Kong government is handing out cash to its adult permanent residents.

Its aim appears to be an attempt to boost spending and ease the financial burden, with the government explaining that the “economy is facing enormous challenges this year.”

The government has announced that $10,000 Hong Kong dollars ($1,280) will be given to approximately seven million people over the age of 18.

The German government has temporarily suspended constitutional limits on public borrowing to provide debt relief to struggling municipalities.

Also, Italy has put a hold on payments due between Feb. 21 and March 31, from residents and businesses in towns subject to containment measures to stop the spread of coronavirus.

Govt. to Use its Tools as we Head Into Bitcoin Halving“Governments are getting aggressive,” says economist and trader Alex Kruger. “The coronavirus may be triggering a new age of fiscal policy. And MMT is getting closer.”

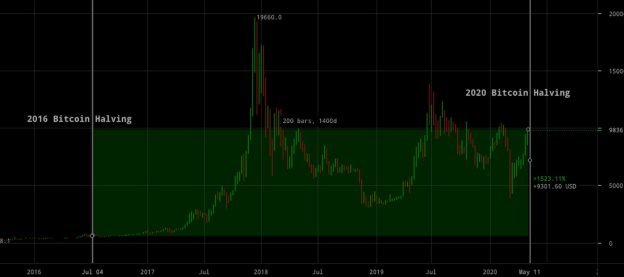

Cutting interest rates and printing money are the central banks’ tools and “they’re going to abuse them at the exact moment we head into the Bitcoin halving,” says Morgan Creek Digital co-founder – Anthony Pompliano.

Where I live the entire yieldcurve is negative: 1Y interest rate, 5Y, 10Y, 30Y all below zero. Soon in US too. This is a problem because banks already charge negative rates on savings accounts. Also, pension funds have trouble making enough return. #Bitcoin could be the solution. pic.twitter.com/C3tbozEG0n

— PlanB (@100trillionUSD) February 28, 2020

The solution to these aggressive policies could be as analyst PlanB points out – Bitcoin (BTC). The leading cryptocurrency is currently hovering around $8,600 but could see a boost with all the free money being pumped into the market by the central bank.

origin »Bitcoin price in Telegram @btc_price_every_hour

Central African CFA Franc (XAF) íà Currencies.ru

|

|