2023-7-4 13:01 |

Quick Take

Understanding global liquidity is crucial in financial analysis, as it provides insights into the available financial resources for investment. It comprises several components, including:

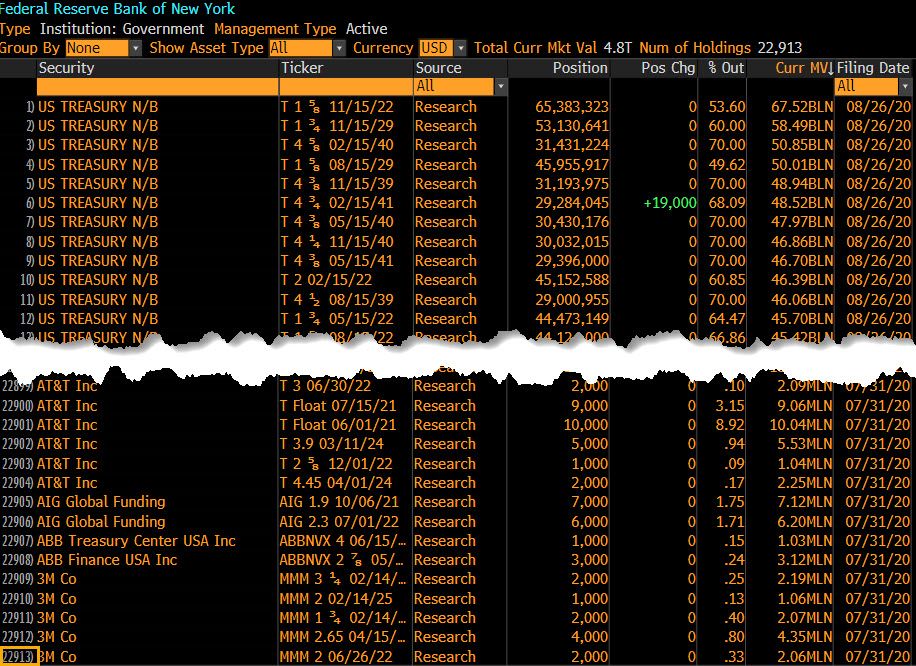

Federal Reserve (Fed) Balance Sheet Reverse Repurchase Agreements (Reverse Repo) Treasury General Account (TGA) Fed Remittances Balance sheets of major central banks: Bank of Japan (BOJ), European Central Bank (ECB), People’s Bank of China (PBoC), and Bank of England (BOE).In 2023, the Fed’s balance sheet has only decreased by about 2%. A vital component is the reverse repo operation, which the Fed uses to control cash in the financial system and regulate inflation. Meanwhile, the TGA, which funds government expenditures, plays a role in how much money flows into the economy.

An essential aspect of the Fed’s balance sheet is the remittances to the TGA, which represents the Fed’s profits. Despite recent losses, any shortfall is recorded as a “deferred asset,” symbolizing a claim on future income.

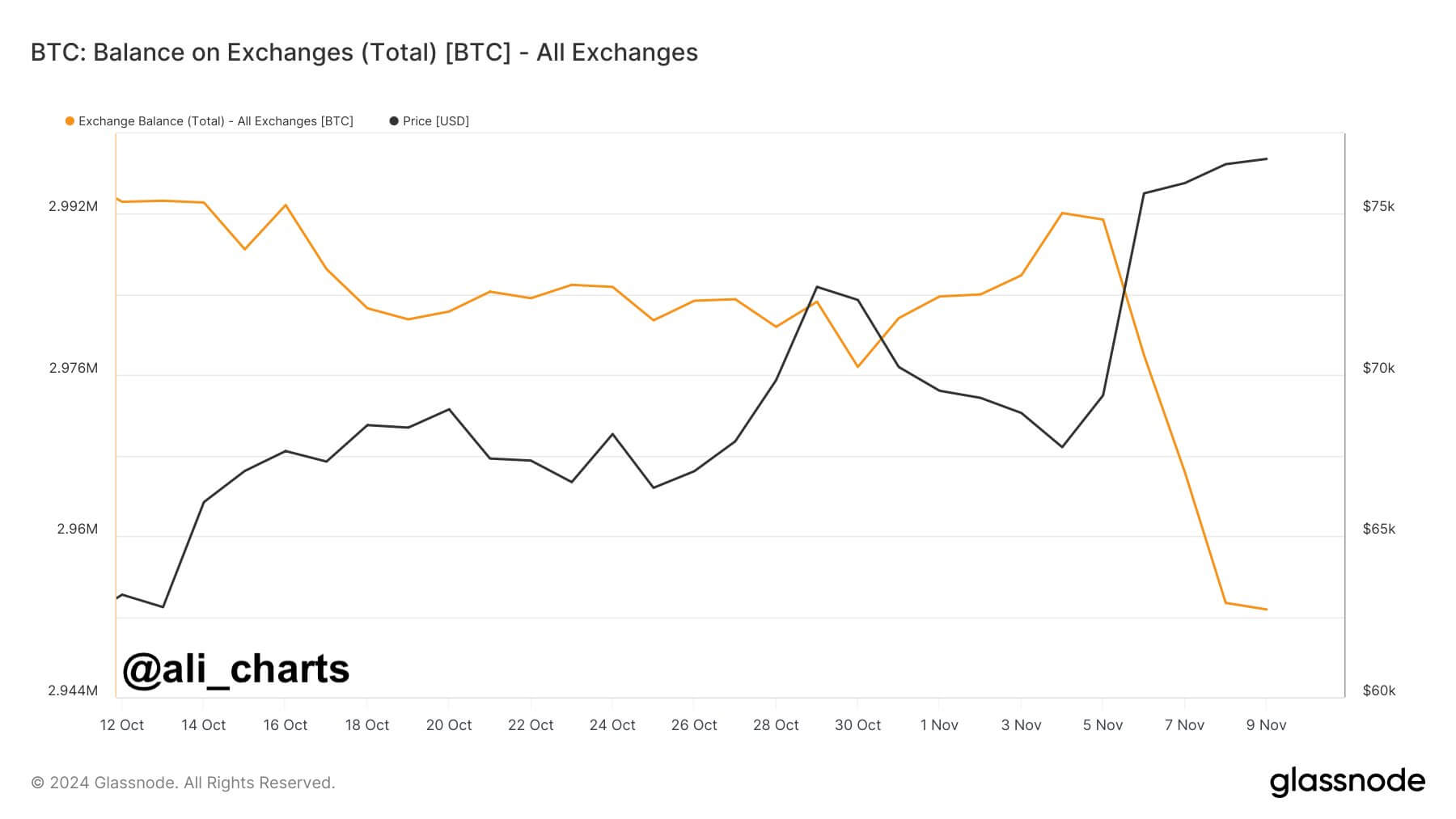

Central banks of other major economies are also experiencing a decline in their balance sheets this year due to quantitative tightening:

ECB: -1.67% BOE: -1.79% Fed: -1.97% BOJ: -7.18% PBoC: -8.48%Interestingly, we observe a significant divergence between the S&P 500, Bitcoin, and global liquidity. Since 2015, these have been tracked at a high correlation of 0.968. Current variations may be due to the hype around AI and the announcement of the BlackRock ETF filing.

Liquidity: (Source: @Tech_Pleb)The post Global liquidity tightens amid central banks’ balance sheet contraction: impact on S&P 500 and bitcoin appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Central African CFA Franc (XAF) на Currencies.ru

|

|