2022-2-23 16:00 |

Senator Cynthia Lummis and a former Federal Reserve vice chair recently discussed whether the U.S. central bank should hold bitcoin on its balance sheet.

During a February 16 webinar on “crypto” hosted by the Hatch Center, the policy arm of national think tank the Orrin G. Hatch Foundation, Hatch Foundation Executive Director Matt Sandgren was joined by U.S. Senator Cynthia Lummis, former Federal Reserve Vice Chair Randal Quarles and Bitstamp CEO Robert Zagotta.

The focus of the conversation was on ensuring that regulations coming out of D.C. wouldn’t hamper the cryptocurrency economy and the innovation happening around Bitcoin.

While there may have been mentioning of “crypto,” a word that is met with some significant pain in the broader Bitcoin community for its implied grouping of BTC with altcoins, the discussion very largely remained centered around Bitcoin itself. Discussion took a very bold (and arguably bullish) direction around the 29-minute mark, when Sandgren posed a question to Lummis.

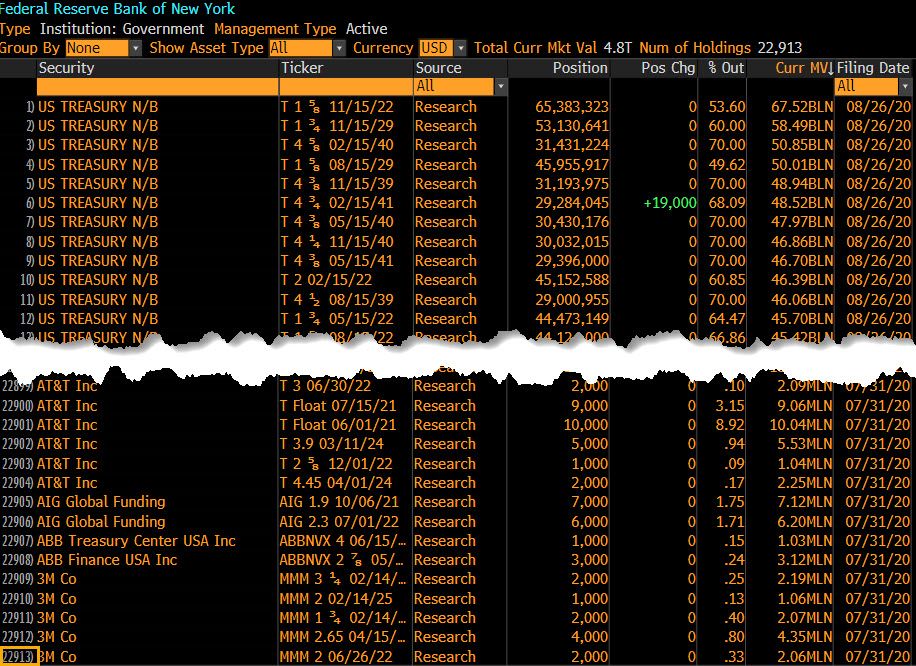

“Senator Lummis, the Fed currently holds more than $40 billion in foreign currencies on its balance sheet,” Sandgren said. “Why not add bitcoin?”

"I think it’s a great idea, to be honest,” Lummis responded. “Once there is a statutory and regulatory framework, that will make a lot of sense. The fact that it is completely decentralized is going to make it, over time, more ubiquitous. And I think it’s going to be something that the Fed should hold on its balance sheet.”

Adding bitcoin to the balance sheet of an entity such as the Federal Reserve may not only seem unlikely, but even extreme to some. However, let’s not forget that mortgage-backed securities were not added to the Fed’s balance sheet until the 2008 Global Financial Crisis, a move that was intended to be temporary in order to stimulate the economy.

Senator Lummis did a stellar job of discussing how bitcoin can not only co-exist along the U.S. dollar, but improve the landscape of financial inclusion, particularly among the impoverished — despite the fact that Bitcoin has come under fire by public officials, particularly from Senator Elizabeth Warren.

Lummis followed up with elaboration on the progress of coming legislation for Bitcoin, which she referred to as “comprehensive,” as well as by discussing the machinations of the deliberation and commenting phases between the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) with regards to said legislative submissions, shedding some light on why political dealings can require significant amounts of time and require patience by the wider market.

Quarles offered some minor pushback following Lummis’ remarks, explaining that, “I think it’s important that the Fed move as promptly as is practical to a balance sheet that is really, entirely treasuries… and part of that is to avoid the slippery slope of using the Fed’s balance sheet to politically allocate credit, or financial support...”

Could adding bitcoin to the Fed’s balance sheet provide a more diversified level of resilience to the economy? Could it enable a strategy for assisting in off-loading assets by the Fed, without shocking the broader equities market all together?

While adding bitcoin to the Fed’s balance sheet may seem like a fun idea to some sharing in exuberance over “number go up,” the problem comes more from the comparison of the two key capitalizations. The Fed’s balance sheet value has swollen to $9 trillion in value, nearly double where it was barely three years ago, while bitcoin struggles to maintain a $1 trillion market cap.

Individuals such as Greg Foss, a noted Bitcoin supporter with years of legacy financial perspective, may offer one of the most insightful perspectives on this potential move, combining knowledge of both spheres.

“I believe [it] is absolutely feasible and in fact imperative for our kids’ futures,” Foss concluded.

This is a guest post by Mike Hobart. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Currency Reserve (GCR) на Currencies.ru

|

|