2022-3-10 03:30 |

As a violent credit unwinding seems inevitable, on-chain data suggests bitcoin holders remain convicted.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

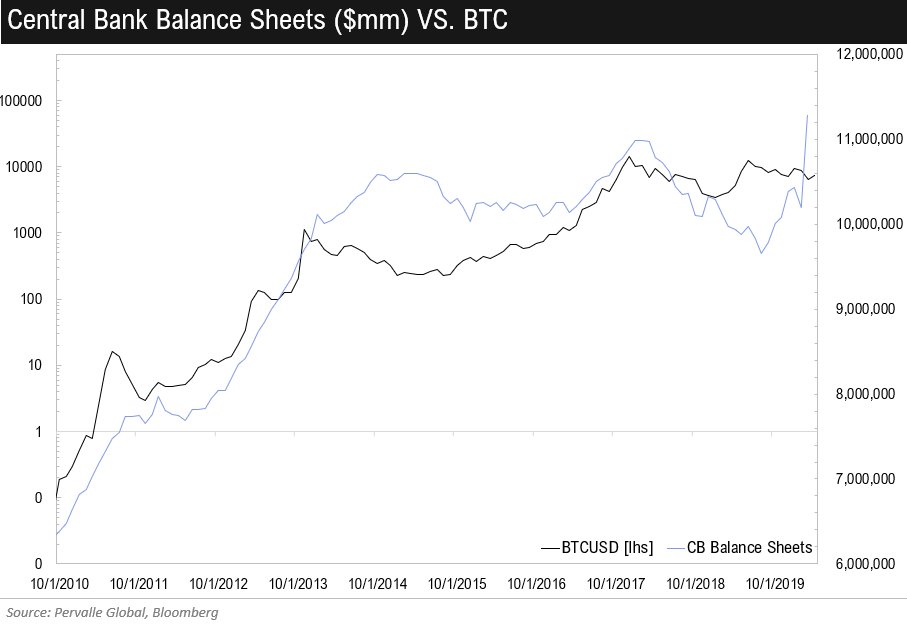

As we’ve noted in previous Daily Dives and analyses, we’re far more concerned with the current macro environment and the scenario of a violent credit unwinding in the market relative to the state of on-chain indicators and health of the derivatives market. We’re anticipating more downside before more upside in the short to medium term. Although there have been signs of bitcoin responding positively to the rising uncertainty and geopolitical conflict (as seen by Russian and Ukrainian exchange volume and a premium on spot buying) — bitcoin as a safe haven asset — it has proven to be an asset to thrive on risk and liquidity.

That said, the latest state of on-chain supply dynamics can provide us with HODLer sentiment and behavior which are still some of bitcoin’s strongest fundamentals. TLDR:

HODLers are largely unfazed as the percent of circulating supply that has not moved for more than three months is near all-time highs. We are likely to see forced sell-offs and capitulation in the event of debt/credit unwinding. The strength of supply dynamics won’t take much of a hit based on previous drawdowns.As of yesterday, 83.81% of supply has not moved in three months or more. This is just shy of the all-time high seen back in October 2021 of 85.41% and significantly higher than the 76.93% median seen throughout Bitcoin’s history. We use three months as a threshold as it’s a similar period of time for Glassnode’s threshold for long-term holders.

Recent data. shows that more than 83% of the bitcoin supply has not moved in at least three months. origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|