2020-4-28 18:13 |

In the past week, the overall market added $25 billion while in the past month, the market recovery saw the inflow of $36 billion.

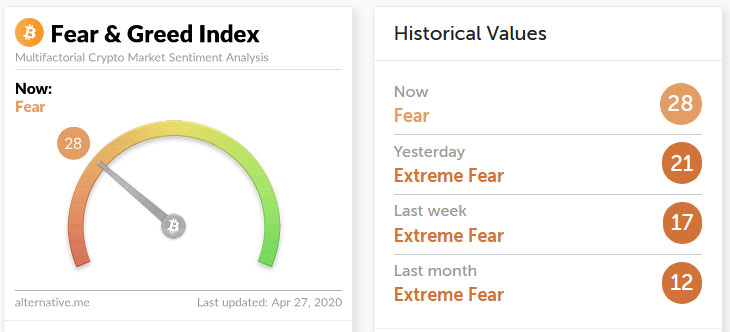

Market sentiments are making a shift with the Crypto Fear and Greed Index finally out of the “Extreme Fear” after seven long weeks.

Source: Crypto Fear and Greed IndexThe world’s leading cryptocurrency made a strong comeback as it jumped over $7,700. However, this didn’t spell more gains for altcoins.

Altcoins that have been enjoying gains while BTC was trading flat, slowed down after a hike in the price of bitcoin. Today, the market is either red or barely in the green.

“As is quite often the case, alts turn green for several days, bullish alt sentiment comes back only for them to get slammed down again by a significant BTC move,” said TraderXO.

Losers and WinnersWhen it comes to YTD gains, altcoins are leading with Bitcoin recording only +5% returns. Among the top cryptocurrencies, BSV (103%), Tezos (101%), Link (92%), Dash (92%), and Ethereum (50%) are leading the pack.

In the mid-cap cryptos, Kyber Network (261%), Hedera Hashgraph (153%), ICON (141%), Digibyte (139%), DigixDAO (118%), Steem (75%), and Enjin Coin (73%) are market movers.

Amidst this, out of nowhere in a typical altcoin fashion, HIVE jumped 500% in a week. Today, it climbed to its all-time high at $0.995 only to dump over 25%.

Earlier this month, Steem witnesses implemented a soft fork to freeze eight accounts collectively holding 17.6 million STEEM and were Hive network supporters. Angered by the acquisition by the Tron Foundation, a portion of the Steem community underwent a contentious split to build a new chain called Hive.

Now when it comes to the percentage since their ATH, Zcash is the biggest loser, down over 99% the same as Pundi X and Verge.

Other top cryptos doing extremely bad are Lisk (97.2%), IOTA (96.9%), Cardano (96.6%), NEO (95.7%), Dash (95.3%), Tron (95.2%), XRP (94.9%), XLM (93.3%), Monero (89.6%), Litecoin (88.2%), EOS (88%), VeChainThor (84%), and BAT (82%).

Bitcoin meanwhile is down only 61.5% since its all-time high. Also, since 2017 high, it made attempts to reach closer to this level.

Will altcoins return to form?While bitcoin had three rallies in the past, each time making a new high, altcoins had experienced only one rally in 2017, as such, it is to be seen if they will make new ATH or end up being a failure.

“I can't help but wonder if some of these 2017 bubble large caps simply never return to form,” said trader Jonny Moe.

An analyst with the pseudonym Pentoshi took to twitter to share why he is reducing his exposure to altcoins in favor of bitcoin.

He explained that with halving coming, the direction the BTC moves in, spike, or dump, altcoins will follow. With new CME contracts starting and altcoins following the same patterns while remaining coordinated, it’s best to stay away.

Also, altcoin pumps when bitcoin is near the .618 fibs are typically short-lived, he added.

“Being over-exposed to alts at this inflection point, seems risky,” said the analyst. He is cautioning to wait and manage the risk before jumping back in altcoins.

Unpopular decision:

I'm reducing my alt exposure by 75%. My focus will be on $BTC and here's why.

1. The halving nears. If BTC pumps, alts get rekt. If it dumps, alts get rekt.

2. #alts are just a game of musical chairs and the music always stops. I don't want to give

— Pentoshi (@Pentosh1) April 25, 2020

But not everyone is bearish on altcoins…

“Many of these Altcoin pumps won’t make sense. They will just keep going, with no explanation whatsoever. Don’t question it. Embrace the pump in its full glory,” said Bitlord.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|