2023-7-25 15:30 |

As the eagerly anticipated Federal Open Market Committee (FOMC) meeting approaches, the financial world is abuzz with speculation about the potential implications for Bitcoin and crypto. Tomorrow, on Wednesday, July 26th, at 2 pm EST, the FOMC will announce its interest rate decision. As usual, Federal Reserve (Fed) chair Jerome Powell will face the media at 2:30 pm EST.

According to the CME FedWatch tool, the majority of the market is expecting a 25 basis point increase (99.8%). However, the real intrigue lies in what comes after this move and whether it marks the end of the rate hike cycle.

After tomorrow’s decision, the market expects the Fed to keep the key interest rate high for a longer period of time. A first rate cut could come in March 2024 at the earliest, if not in May.

Tomorrow is #FOMC day, expect volatility. #Bitcoin #Crypto

98.9% probability of a 25 bps hike by the Fed.

Market expects the Fed to keep the key interest rate high for a longer period of time. A first rate cut could come in March ’24 at the earliest, if not in May. pic.twitter.com/C8wscv6BMd

— Jake Simmons (@realJakeSimmons) July 25, 2023

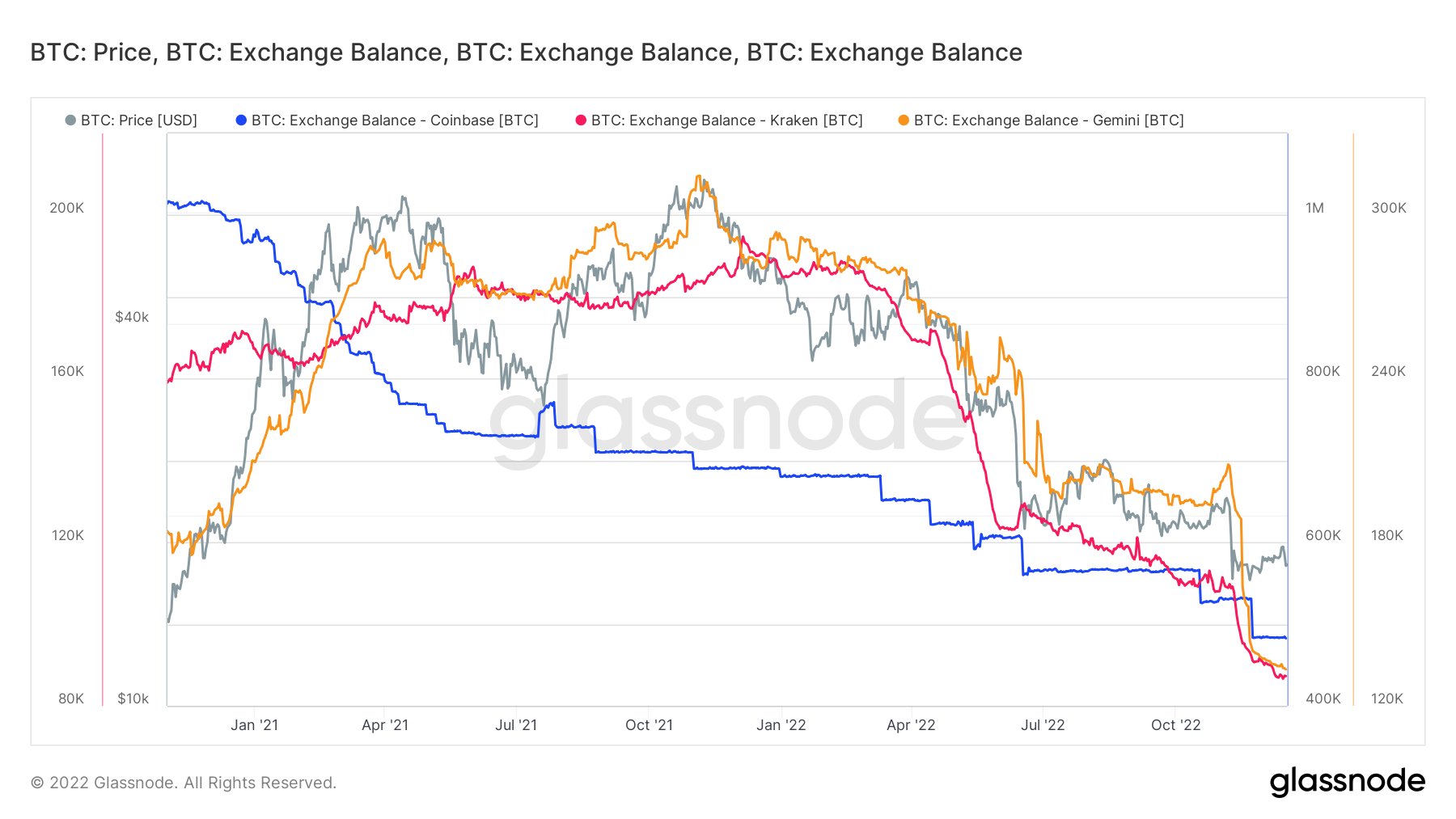

Implications For Bitcoin And CryptoFor the past 16 months, the U.S. Federal Reserve has been grappling with inflation while hiking interest rates to levels not seen in 20 years. But all signs point to a possible end of the tightening cycle. The market is firmly expecting the 0.25 bps hike to a range of 5.25 to 5.5% will be the last.

Meanwhile, Bitcoin and crypto have experienced a period of relative immunity to macroeconomic events and rate hike speculations in the first seven months of the year. However, investors must be aware that such conditions might not last indefinitely.

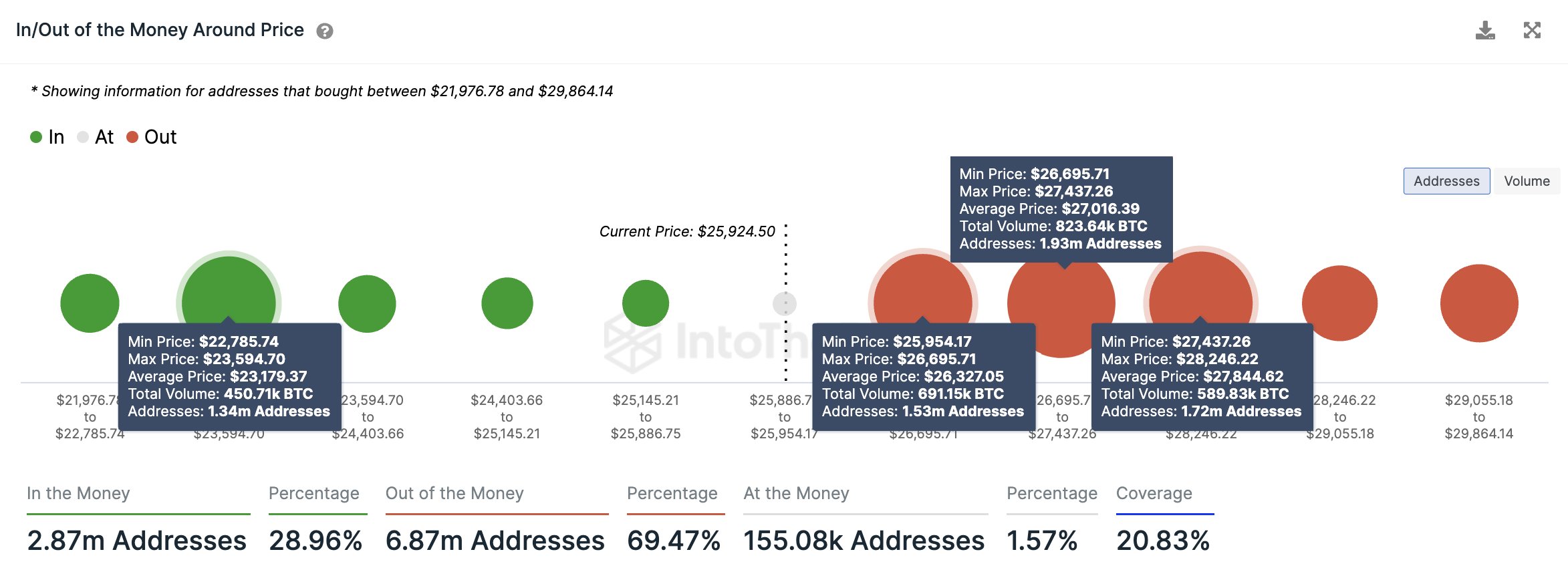

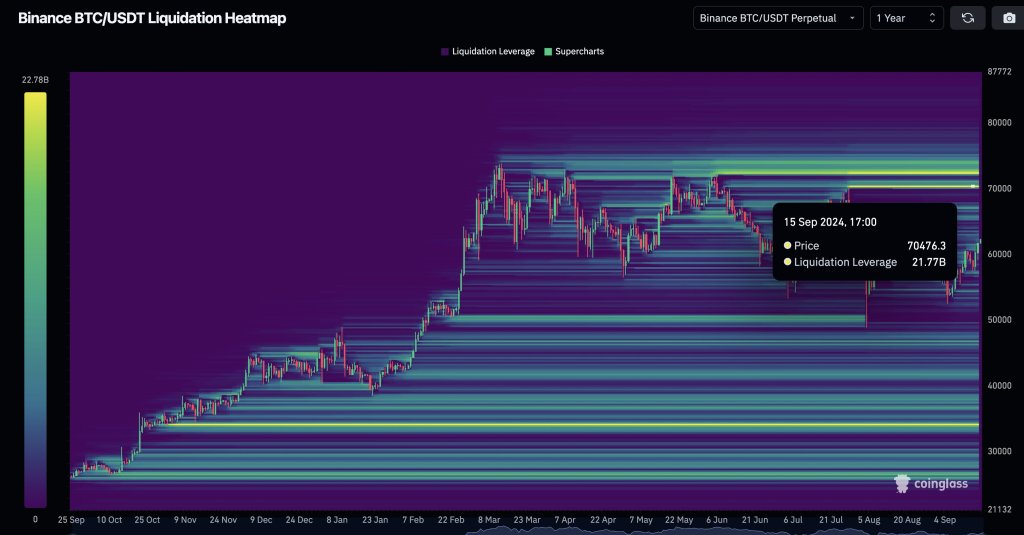

On Monday, the Bitcoin price retraced to $29,000 support level. Seemingly, market participants have been cautious in the lead-up to the FOMC’s July meeting, aware that the FOMC meeting can have a profound impact.

In June, Fed Chairman Jerome Powell hinted at the possibility of further rate hikes this year, with some committee members advocating for two more increases. The market now anxiously awaits the outcome of this meeting to ascertain the central bank’s future policy stance.

However, factors such as declining inflation in the United States and a weaker labor market strengthen the market expectations. The previously skyrocketing inflation, which led to the tightening cycle, has shown signs of abating. June’s Consumer Price Index (YoY) data revealed a decline in inflation to 3.0% from 4.0%. The core rate fell from 5.3% in May to 4.8% in June. Both declines were stronger than previously anticipated. Remarkably, the core rate is now trading below the level of the US federal funds rate, which was pretty rare in the last 20 years.

The prolonged strength of the US labour market has long been the biggest headache for the Federal Reserve because of the imbalance between supply and demand. At the peak of this imbalance, there were two job openings for every available worker, which drove up wages accordingly. As demand and supply approach equilibrium, job creation numbers have declined. Also, there are even early indications of declining consumer spending.

So, what does all of this mean for Bitcoin and crypto investors? As always, it’s essential to approach the market with a balanced perspective. While BTC and cryptocurrencies have shown resilience in the face of traditional economic events, they are not entirely insulated from larger macroeconomic trends.

Investors should closely monitor the FOMC’s interest rate decision and Jerome Powell’s subsequent statements. Any signals about the future rate hike cycle could have repercussions for both the traditional as well as Bitcoin and crypto markets, triggering a further sell-off.

At press time, the market continued to show indecision. BTC was trading at $29,200.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|