2019-2-24 15:37 |

Table of Contents

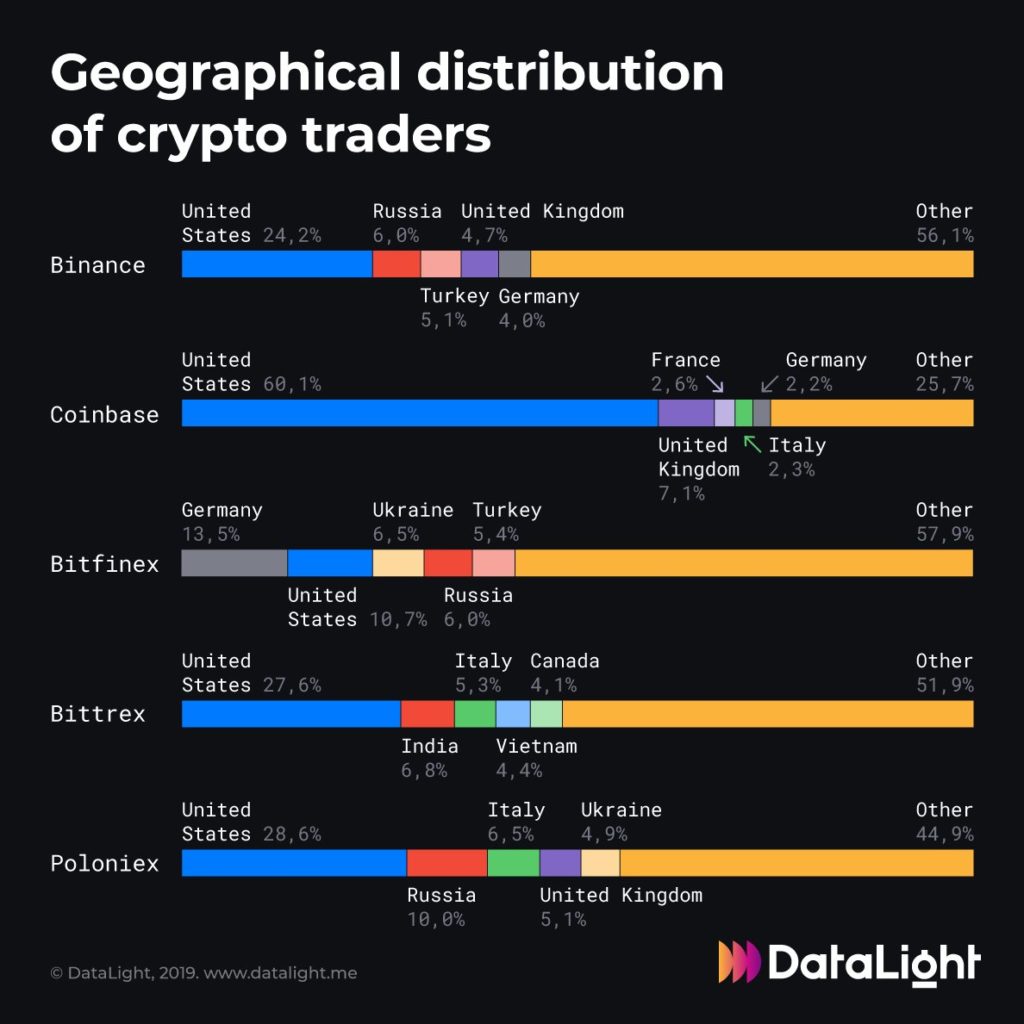

If you are about to make your first venture into the world of cryptocurrency, chances are you were directed either towards Coinbase or Binance. While these two are currently the most popular cryptocurrency exchanges out there, they do have some very distinct differences between each other. This review will focus on pointing out those differences and hopefully help you, our reader, decide which exchange will best suit your needs.

Initial overviewCoinbase is a USA-based company currently operating two brands under its wings: Coinbase, focused on fiat to crypto transfers of value and Coinbase Pro, focused on crypto for crypto exchange. It gathered its initial capital required for starting up the business by using the services of the investment sector; it has since remained faithful to this method of financing, with many venture capital firms like Union Square Ventures, Ribbit Capital and the famous Andressen Horowitz deciding to invest at some point. With the reported 1 billion dollars of revenue earned in 2017, the investments have seemingly paid off extremely well. Coinbase users have choice of using fiat to purchase one of 4 cryptocurrencies on offer: Bitcoin, Ethereum, Bitcoin Cash and Litecoin.

Binance is a relatively new Chinese company founded by Changpeng Zhao, a computer whiz previously known for his role as the CTO at OKCoin. Initial funding for Binance was collected through an ICO of BNB, which serves as Binance utility token and can be traded on the exchange. Their utility mostly comes from the fact that they can be used to pay for Binance fees. Binance has been extremely successful as well so far, earning around $200 million in the second quarter since its inception (a number which surpassed the figures reported by Germany’s Deutsche Bank for that same period). The exchange is a typical crypto-for-crypto platform, giving its users an ability to trade over 300 different cryptocurrencies. There is no way to purchase crypto for fiat on Binance.

Binance also launched new platform called Binance Jersey that offers fiat on-ramp by supporting buys of crypto via credit card.

Account creationCoinbase account creation is a relatively simple process. Go to the Coinbase website and click on the Sign up button in the top right corner of the web page. This will take you to the Create your account screen.

The screen will offer you two tabs, one for creating an individual account and the other for business related accounts. On the first tab reserved for individuals you can enter your name, email and preferred password. Click the captcha to confirm you aren’t a bot, click on the user agreement box and click on the Create Account button. You will receive a verification link in the email address you choose for your account, click it to move onto the next step.

Next screen will require you to enter a phone number which will be used to secure your account and your transactions. An SMS containing the code you need to enter to complete your sign-up will be sent to this number. Enter the code and your Coinbase account will be unlocked and ready for use. Business related accounts will have an option to either sign up for Coinbase Pro, Coinbase’s cryptocurrency exchange platform or to enable cryptocurrency payments for their goods/services through the Coinbase Commerce option.

Most of the process with Binance is similarly simple. You’ll need your e-mail, a strong password (they require that your password has at least 8 letters/one number/one capital letter), and optionally a referral ID that gives bonuses to the person who linked you to Binance via his referral link. When all of this is filled out, click Registration and complete the slide verification that will pop up on your screen. You’ll receive the verification mail and be asked to log in again, once you click on the verification mail.

A safety risk notice will pop-up to ensure that your account is fully protected. Click all the boxes and continue. This unlocks the Level 1 account on the platform, and you will need to submit further verification (personal/business) to upgrade your account to levels 2 and 3.

Interface and tradingCoinbase offers a pretty sleek, beginner friendly interface. A dashboard with an overview of your portfolio, your transactions and your desired coin’s price and graph will greet you upon your initial login. Tabs in the top left offer you an ability to Buy/Sell a coin. You can only place market buy/sell orders here, limit orders or something more complicated aren’t available. Clearly this won’t suit any advanced user who is looking to place stop losses or margin trade.

You can deposit funds onto Coinbase via a bank account (should generally take 4-5 business days), while card deposits are instant. Withdrawals can take anywhere from 2 to 4 business days. On Coinbase various things will determine your maximum transfer amount: your buying history, your account age and your verification level. You can easily see your current level and how to increase it by heading to this page. Depending on your current level (range from Level 0 through Level 3), you can follow these quick steps to increase your account level:

– Verify phone number

– Verify personal information

– Verify photo ID (valid state ID for US customers)

Binance interface, while containing more features, isn’t that complicated to master either. The platform itself has two interfaces, Basic and Advanced, which can be switched in the upper left part of your Binance home screen (under the Exchange tab). The advanced view is shown in a dark theme and offers analytics tools that can be used to perform some basic TA. Some more advanced users will still find these tools somewhat lackluster. They also won’t be happy with the fact that the exchange offers only market and limit orders, again lacking both margin trading and stop-loss features.

An individual trader can deposit any amount as there is no deposit limit. The withdrawal limit depends on the verification tier. Users with Level 1 verification can only withdraw currency worth 2BTC per day. However, users with Level 2 verification can withdraw currency worth up to 50BTC per day.

Available cryptocurrenciesCoinbase is extremely limited in terms of supported coins, as they started listing more coins only recently. It has been long criticized for this, and there are plans to add some ERC20 tokens in the future.

As for Binance, it is an exchange which currently offers more than 300 various coins and tokens for trade, including but not limited to Bitcoin, Bitcoin Cash, Bitcoin Gold, Ethereum, Ethereum Classic, EOS, Dash, LiteCoin, NEO, GAS, Zcash, Dash, Ripple and more. They even have their own coin, BNB, which can be used to lower your trading fees on platform. As mentioned before, Binance also supports numerous ICO projects and helps them by listing their tokens on the platform. This willingness to add new coins has brought some criticism to the platform, as many feel they don’t do their due diligence when it comes to researching if the coin is a scam or not. Some scam coins have indeed been traded on the platform, which gives weight to these accusations. Binance does not offer fiat for crypto trading.

FeesCoinbase is notorious for having some pretty hefty fees which move in the range from 1.49% to 3.99% per trade. Sometimes these fees can be even larger. The fee structure is somewhat complicated and you can check the official Binance’s support page on fees for a full insight.

Binance on the other hand offers some of the lowest industry fees out there and frankly blows Coinbase out of the water in this segment. It has a flat 0.1% fee for all trades you make on the platform. This is also a massive simplification (and improvement) on other exchanges which create complicated fee schemes based on trading volume and market maker/taker status of the user.

SecurityCoinbase is based in USA, San Francisco, and is making sure to adhere with US regulations with every action it takes. It was the third crypto exchange to receive the New York Bitlicense. In 2018, Coinbase acquired an e-money license from the Financial Conduct Authority (FCA), which allows it to provide payment services in the UK and issue e-money. Abiding by the FCA requirements, Coinbase will be keeping clients in segregated funds and will observe operational standards on par with the other regulated financial institutions. It has never been hacked before, barring some users suffering from phishing attacks (which are always the fault of users visiting the wrong website link). There was also an issue with some customers being overcharged some months ago, but the exchange still maintains a strong reputation in security circles.

Binance is a multi-location (Hong Kong, British Virgin Island, Singapore, Malta, Jersey) based company that has never been hacked so far, which isnt that suprising when you consider its age. The biggest issue with the exchange was that its base of operations was in China, which has shown an intention to limit the cryptocurrency related activities on its territory. This could’ve potentially lead to problems for Binance. In response, they moved a part of their operations to Malta stating:

“After reviewing several different locations, the company decided to invest in the European nation due to its existing pro-blockchain legislation and the stability that it offers financial technology companies through its regulatory framework.”

Malta is considered somewhat of a tax-free zone so that helps as well. The company is also listed in Hong Kong. Binance is secretive about the ways it stores its funds, but has shown in the past that it has ways of protecting them. Both Coinbase and Binance offer 2FA which is always a good thing to see.

Customer supportBoth Coinbase and Binance had their fair share of bad customer reviews, but this comes as a growing pain of every major exchange. However it would seem that Binance fared somewhat better when it comes to processing and handling user support inquiries, as there are many posts from people who are having their support tickets put on hold for months on Coinbase.

Final thoughtsBoth Binance and Coinbase Pro (formerly GDAX) are excellent platforms that have their own strengths and weaknesses. If you are a beginner looking to get into crypto, using the combination of these two might be an excellent choice. Use Coinbase to purchase BTC/ETH, and then move the purchased coins to Binance to purchase a quality altcoin. This strategy has been tried and tested many times and you will not regret using it.

The post Coinbase vs Binance Comparison: Is Binance going to render Coinbase obsolete? appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Binance Coin (BNB) на Currencies.ru

|

|