2023-6-20 14:24 |

As the Bitcoin price continues to struggle, some metrics have begun to emerge that could mean that the current bearish trend is only temporary. The realized profit and loss levels for BTC have continued to fall over the last six months and have now hit a level that suggests the start of another upward rally.

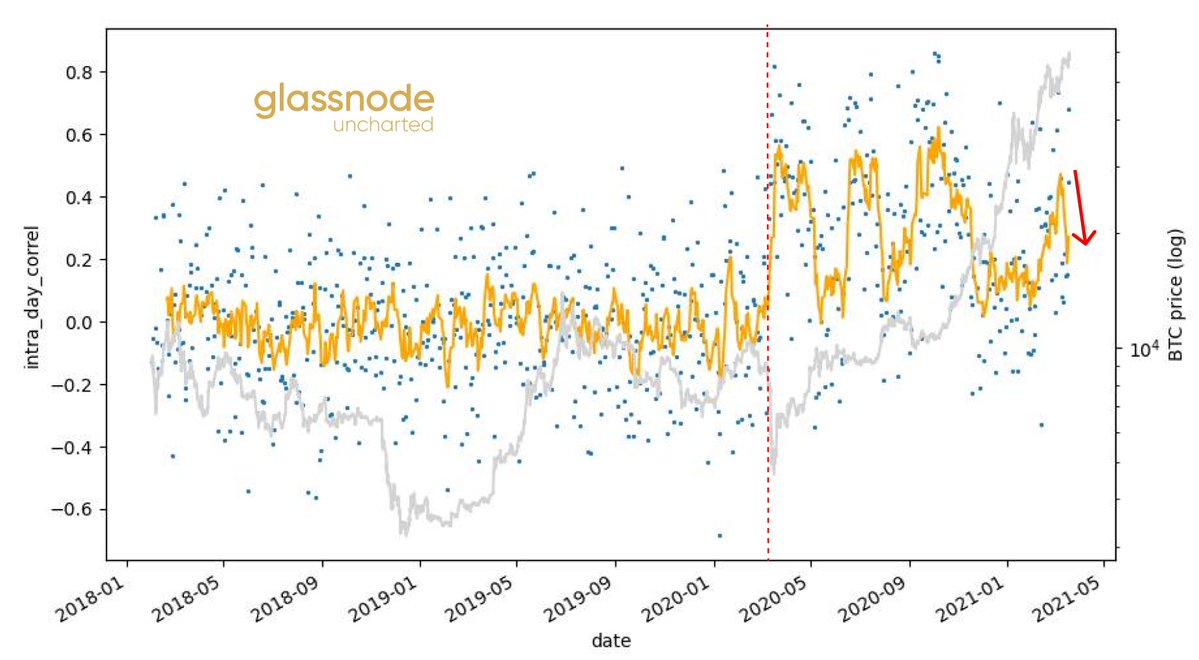

Bitcoin Realized Profit And Loss At Two-Year LowsData from on-chain aggregator Glassnode shows that the realized profit and loss among Bitcoin holders have been on the decline. This fall in realized profit and loss follows the rollercoaster price action recorded over the course of 2023 so far, and as the price has struggled with the $26,000 level, the realized profit and loss margins have fallen to October 2020 levels.

Now, the realized profit and loss levels are important because it shows the amount of profit-taking and loss-taking happening in the market. Profit-taking occurs when investors are selling their BTC for a higher price than they purchased them, and loss-taking is when they are selling for a lower amount than it was purchased. A drop in both of these indicates that there is less selling happening in the market right now.

This is bullish for the price of Bitcoin because the selling pressure is now dropping, making room for the price of BTC to rebound. It also means a reduction in the available BTC supply in the market as investors opt to hold rather than sell. This allows room for growth in demand and can translate to a further increase in the price of the digital asset.

The Start Of Another BTC Bull Run?The last time that the realized profit and loss levels fell this low was back in October 2020 which marked the start of the bull market. It was an almost non-stop climb from October 2020 to the new year where BTC went from around $11,000 to over $30,000 in a matter of months.

If this exact scenario were to repeat once more, then it is possible that the price of BTC would climb as high as $40,000 in a month, provided that the bulls are able to sustain this rally. This also presents a more bullish scenario for the digital asset, showing that the bearish trend may have reached the end of its rope.

A similar climb to the October 2020 rally would mean a 200% rise over the next couple of months, and from the current level, a 200% increase would see BTC peaking above $60,000.

Nevertheless, the bulls continue to battle the bears as BTC was rejected at the $27,000 resistance on Monday. The digital asset remains in the green, however, up 1.46% in the last 24 hours to trade at $26,765 at the time of writing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Profit Hunters Coin (PHC) на Currencies.ru

|

|