2022-8-5 22:00 |

Data shows the Bitcoin trading volume has remained near one-year highs recently as activity on Binance stays elevated following the fee removal.

Bitcoin 7-Day Average Trading Volume Has Kept At High Values In Recent WeeksAs per the latest weekly report from Arcane Research, around 80% of the latest activity on the BTC network is driven by the crypto exchange Binance.

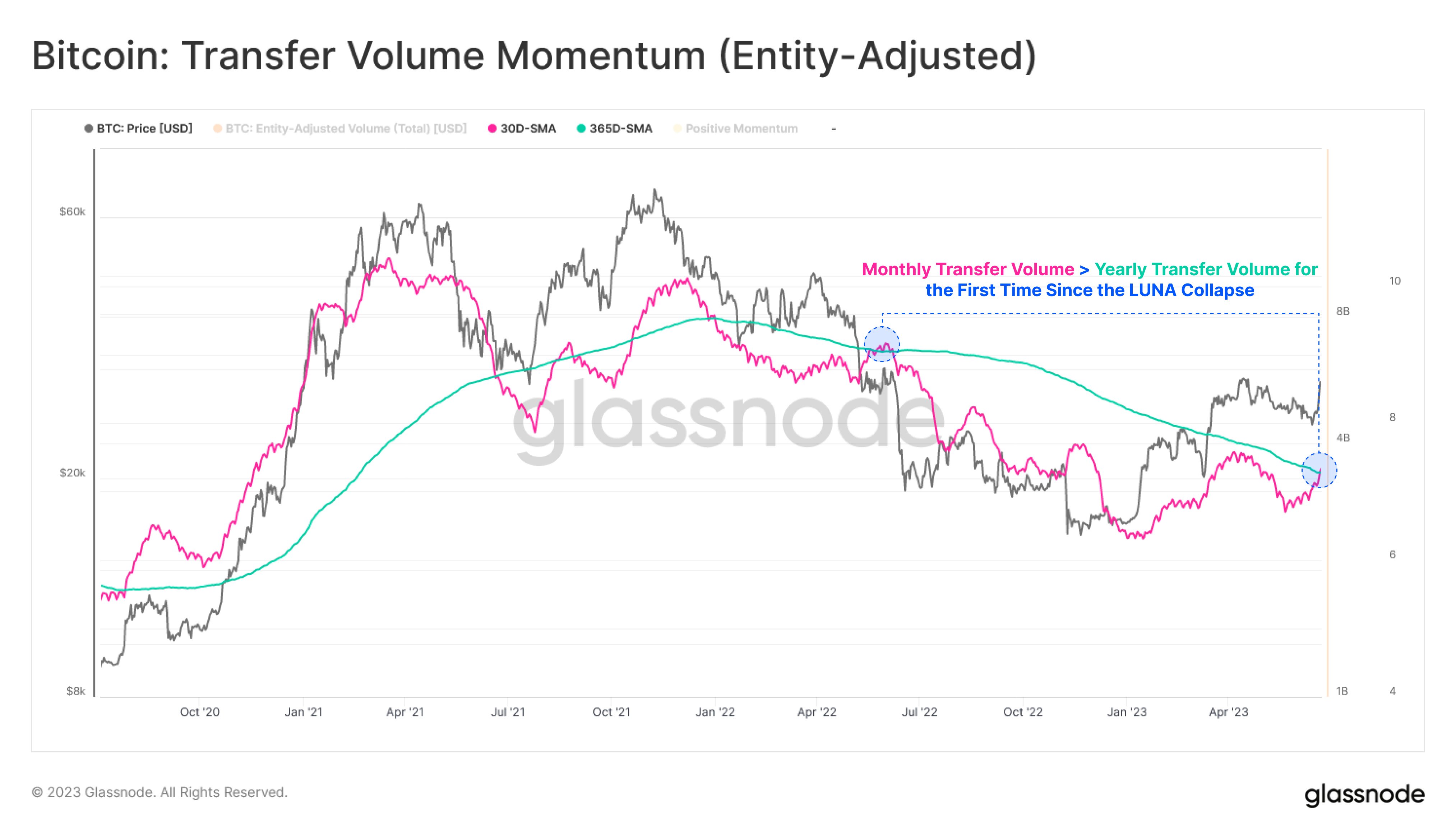

The “trading volume” is an indicator that measures the total amount of Bitcoin moved on the blockchain on any given day.

When the value of this metric is high, it means a significant number of coins are changing hands on the network right now. Such a trend can suggest that the chain is quite active currently as investors are being drawn to the crypto.

On the other hand, low values of the indicator imply the network activity isn’t that high at the moment. This kind of trend can be a sign that the general interest around the crypto among traders is low currently.

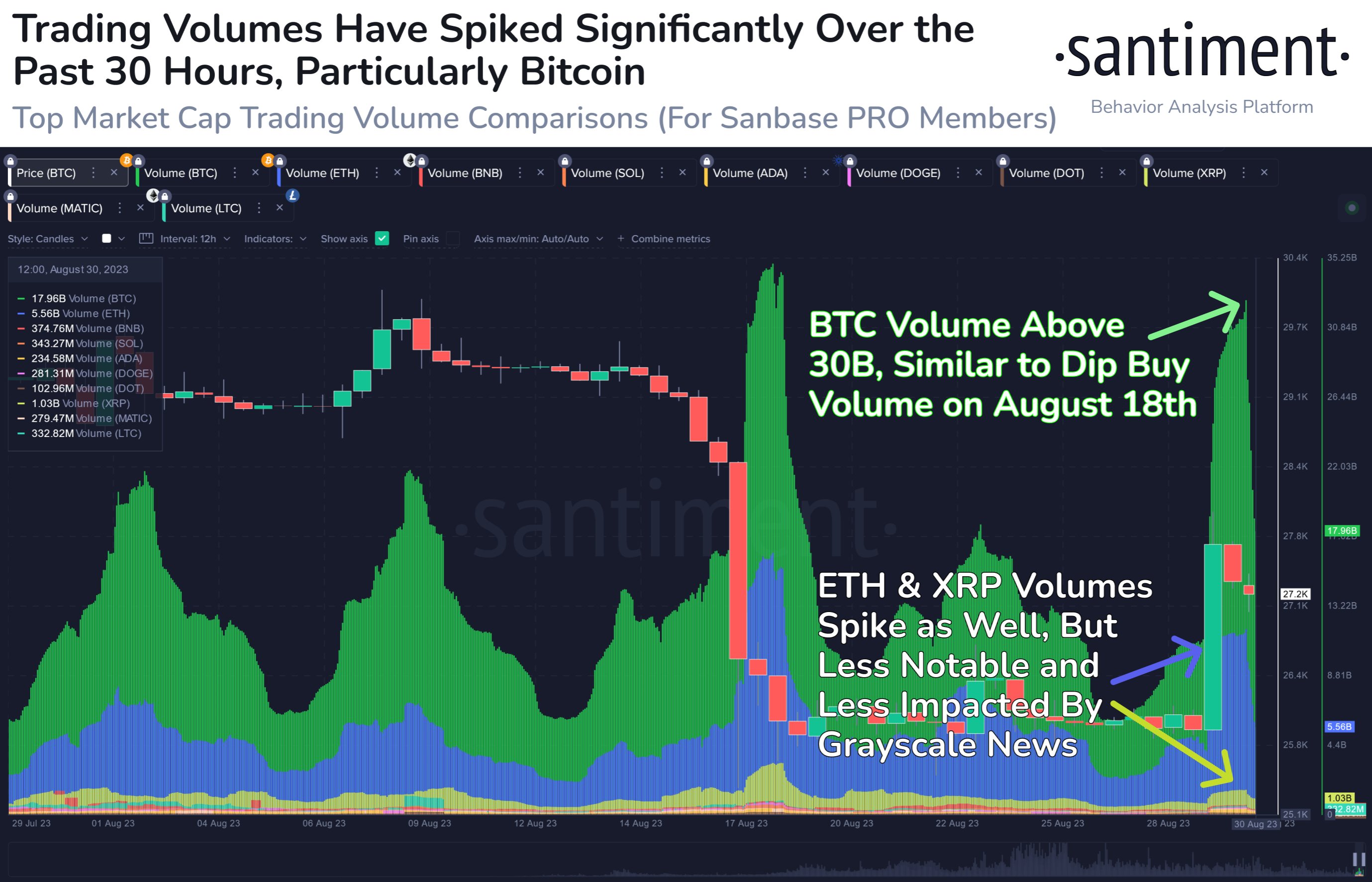

Now, here is a chart that shows the trend in the Bitcoin trading volume over the past year:

The value of the metric seems to have been high in recent days | Source: Arcane Research's The Weekly Update - Week 30, 2022As you can see in the above graph, the Bitcoin trading volume has been elevated during the last few weeks. Currently, the network activity is a little below the one-year high. However, it’s likely that not all of the the volume right now is caused by organic activity.

The chart also includes data for the Binance share of the total volume. It looks like when the indicator’s value shot up to the current high levels, the crypto exchange’s contribution to it simultaneously increased.

The reason behind this is that around three weeks ago, right when these surges were observed, Binance dropped trading fee for select Bitcoin trading pairs.

Looking to exploit this fact, many traders indulged in “wash trading” to unlock higher rate tiers on the platform. Such activity is considered inorganic and is thus falsely inflating the real volume.

However, three weeks later the volumes still haven’t budged and while Binance’s share stays around 80%, the report notes that it’s possible a significant portion of the volume could be coming from organic activity.

Such activity would come from traders preferring to trade on Binance due to the fee removal, thus helping keep the crypto exchange’s market share quite high.

BTC PriceAt the time of writing, Bitcoin’s price floats around $22.9k, down 1% in the last week.

Looks like the value of the crypto has been moving sideways at a lower level in the last few days | Source: BTCUSD on TradingView Featured image from Amjith S on Unsplash.com, charts from TradingView.com, Arcane Research origin »Volume Network (VOL) на Currencies.ru

|

|