2024-3-22 11:15 |

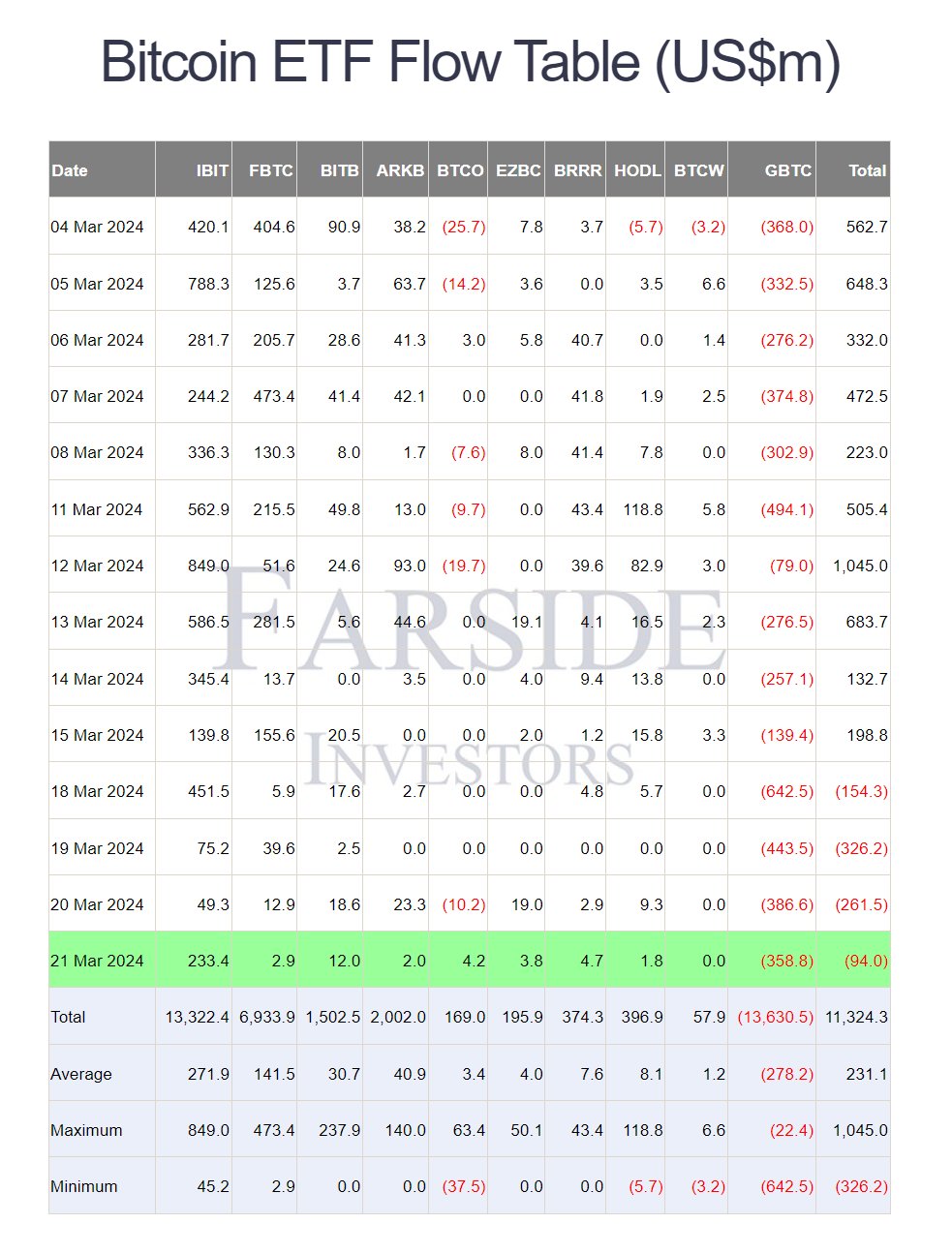

Despite a continuous four-day streak of net outflows from Bitcoin spot exchange-traded funds (ETFs) totaling $93.85 million, the Bitcoin price has impressively climbed to reclaim the $66,000 mark. According to data from Farside Investors, Grayscale ETF GBTC experienced a significant outflow yesterday, with a single-day net outflow of $358 million, culminating in a historical net outflow of $13.63 billion for GBTC alone.

In stark contrast, the BlackRock Bitcoin spot ETF (IBIT) witnessed a considerable net inflow of $233 million yesterday, raising IBIT’s total net inflow to $13.32 billion. This is slightly below the average for BlackRock, which has seen $271.9 million in inflows since its launch on January 11.

Other ETFs have not fared as well in recent days. Fidelity’s FBTC, the second-largest ETF, has thus far achieved an average daily inflow of $141.5 million, but experienced a disappointing $2.5 million in inflows yesterday.

The third-largest, Ark Invest’s spot Bitcoin ETF, has seen average inflows of $40.9 million to date, with yesterday’s inflows at just $2.0 million. Bitwise’s BITB, ranking fourth, has accumulated $30.7 million on average, with a modest $12 million in inflows yesterday.

Across the board, all spot Bitcoin ETFs, including GBTC, have recorded an average of approximately $230 million in daily inflows since January 11.

Bitcoin Price Stagnates: Reason To Worry?CryptoQuant CEO Ki Young Ju provided insights on the situation via X, stating, “Bitcoin spot ETF netflows are slowing. Demand may rebound if the BTC price approaches critical support levels. New whales, mainly ETF buyers, have a $56K on-chain cost basis. Corrections typically entail a max drawdown of around 30% in bull markets, with a max pain of $51K.”

Crypto analyst WhalePanda highlighted the trend, noting, “Yesterday’s ETF flows: Another negative day, that’s 4 in a row […] Honestly surprised by how big the outflows are from GBTC. Another $358.8 million and that makes a total of $1.83 billion in just 4 days.” WhalePanda also touched on Genesis’ role, suggesting the company’s “in-kind” sale of GBTC shares for BTC might explain the large outflows without corresponding market dumps.

Thomas Fahrer, founder of Apollo, offered a bullish perspective, “I know it is forbidden to post anything bullish on #Bitcoin ETFs right now, but I’m gonna do it anyway. GBTC selling is temporary. Financial advisors and institutions have barely begun buying. $100 BILLION inflows are coming next 1-2 years. Patience.”

Charles Edwards, founder of Capriole Investments, commented on the Grayscale situation, “Grayscale Bitcoin ETF holdings falling off a cliff. Down 50%, or about $20B at current BTC price. We must be days/weeks away from them slashing fees to stop the bleeding. Blackrock holdings expected to overtake Grayscale before the Halving!”

Although the last few days have been rather disappointing, it is worth noting that the outflows are coming (almost) exclusively from Grayscale’s GBTC, while other investors are holding on tight to their Bitcoin investments. This means that it is only a matter of time before Grayscale’s outflows stop, and even small inflows from the other ETFs make a big impact (without the outflows).

At press time, BTC traded $66,203.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|