2023-11-8 03:00 |

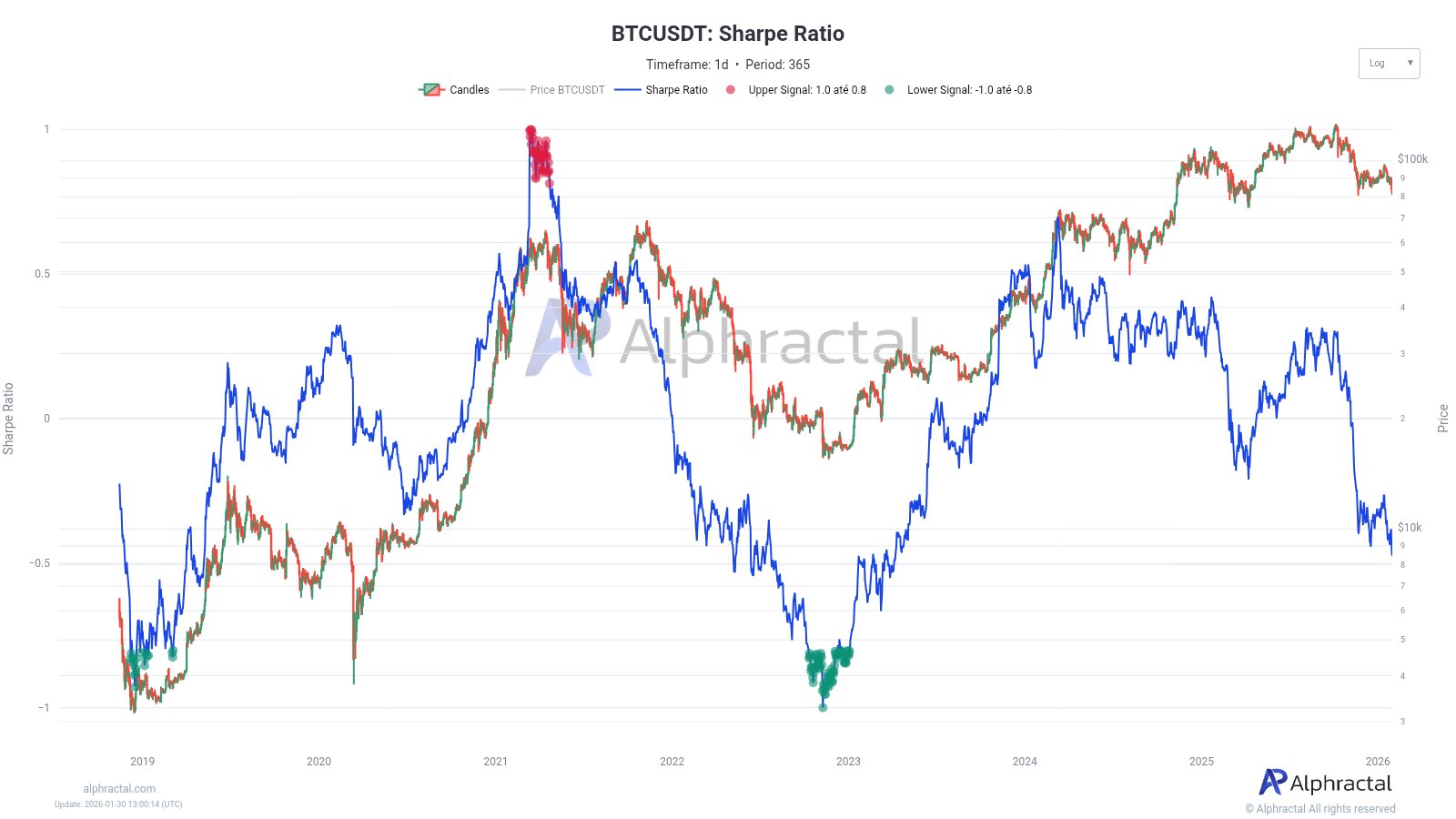

While still recording some profits, the Bitcoin price shows signs of exhaustion, at least on low timeframes. When zooming out, recent data shows the massive rally experienced by cryptocurrencies over the past few months and the sector’s potential for additional gains.

As of this writing, the Bitcoin price trades at $34,800 with sideways price action in the last 24 hours. Over the previous week, BTC recorded a 2% profit, while the altcoins market trends much higher, retaining more gains.

Bitcoin’s 110% Year-To-Date Leap Signals A New Era BTC?According to a report from Bitfinex, This year has marked a significant milestone for cryptocurrencies as Bitcoin (BTC) and Ether (ETH) have shown remarkable growth, leaving traditional assets like gold behind. Bitcoin has soared by 93% and Ethereum by 3%, indicating a solid performance correlation that has remained consistently tight.

BTC, in particular, has enjoyed the spotlight with its first-mover advantage, earning the moniker of ‘digital gold’ and garnering broad institutional support.

While these digital assets reach new heights, traditional stock indices such as the S&P 500 and NASDAQ are navigating through a correction phase. This contrast hints at a shifting investment landscape, with cryptocurrencies emerging as a dominant force capable of outperforming established markets, the report suggested.

As seen in the chart below, data hints at the Bitcoin price outperforming other assets and Gold “playing catch up” with a 0.8 correlation with the cryptocurrency.

Bitcoin’s price rally of over 110 percent since the start of the year signals a “transition” for holders from unrealized losses to profits.

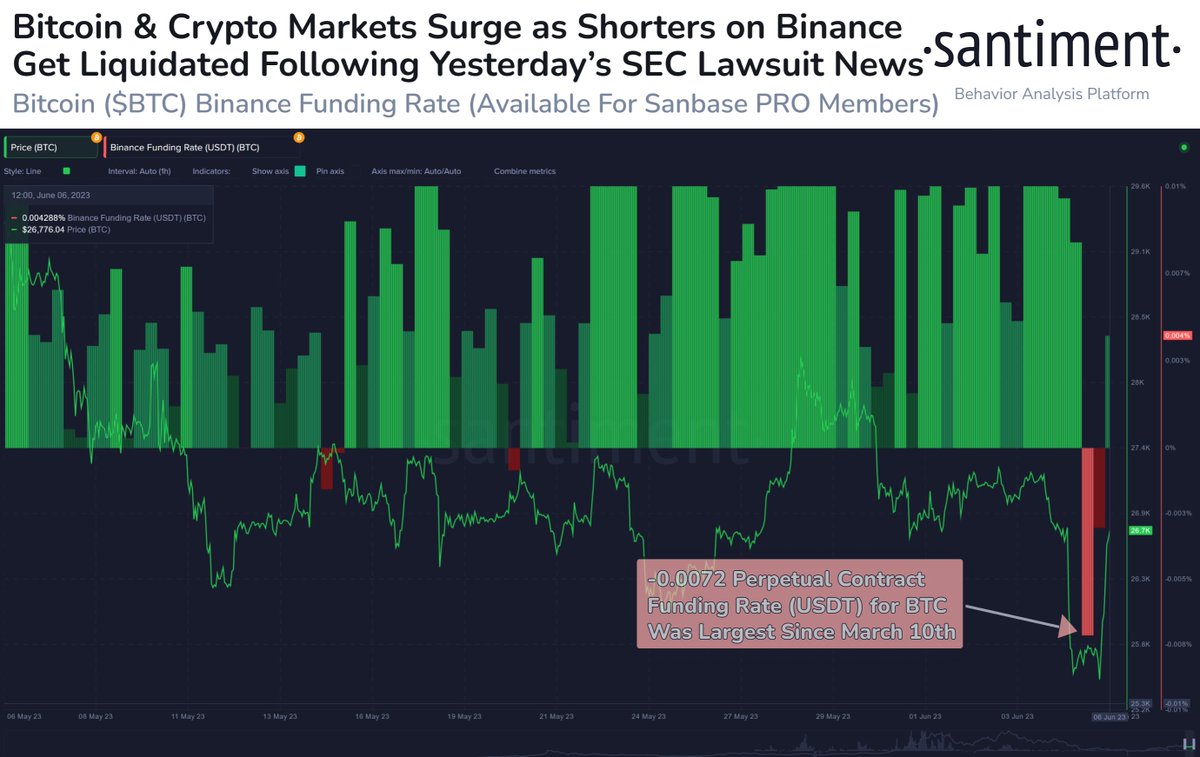

Typically, such surges lead to market consolidation or sharp pullbacks. Yet, the current trend of declining Coin Days Destroyed, a metric used to gauge market activity and sentiment, suggests that long-term investors remain steadfast, the chart below shows.

The lack of movement in wallets containing significant Bitcoin sums further points to a bullish outlook or a defensive strategy against economic uncertainties.

Amidst this crypto resilience, the Federal Reserve’s latest decision to maintain interest rates between 5.25 and 5.50 percent reflects a cautious but non-restrictive economic approach, the report claims.

Crypto Stands Firm In Economic UncertaintyDespite the Fed’s updated, confident view of the U.S. economy, the manufacturing sector experienced a downturn in October, mainly due to strikes in the automotive industry. This suggests a significant impact of labor disputes on the sector.

The broader U.S. economy is feeling the effects, with a slowdown in job creation and the slowest wage growth since mid-2021, indicating a shift in labor market conditions. This data supports a continuation of the current bullish trend.

However, as mentioned, traders should be looking for spikes in volatility, which could create obstacles, especially for those speculators taking leverage positions.

Cover image from Unsplash, chart from Tradingview

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) íà Currencies.ru

|

|