2023-3-6 00:09 |

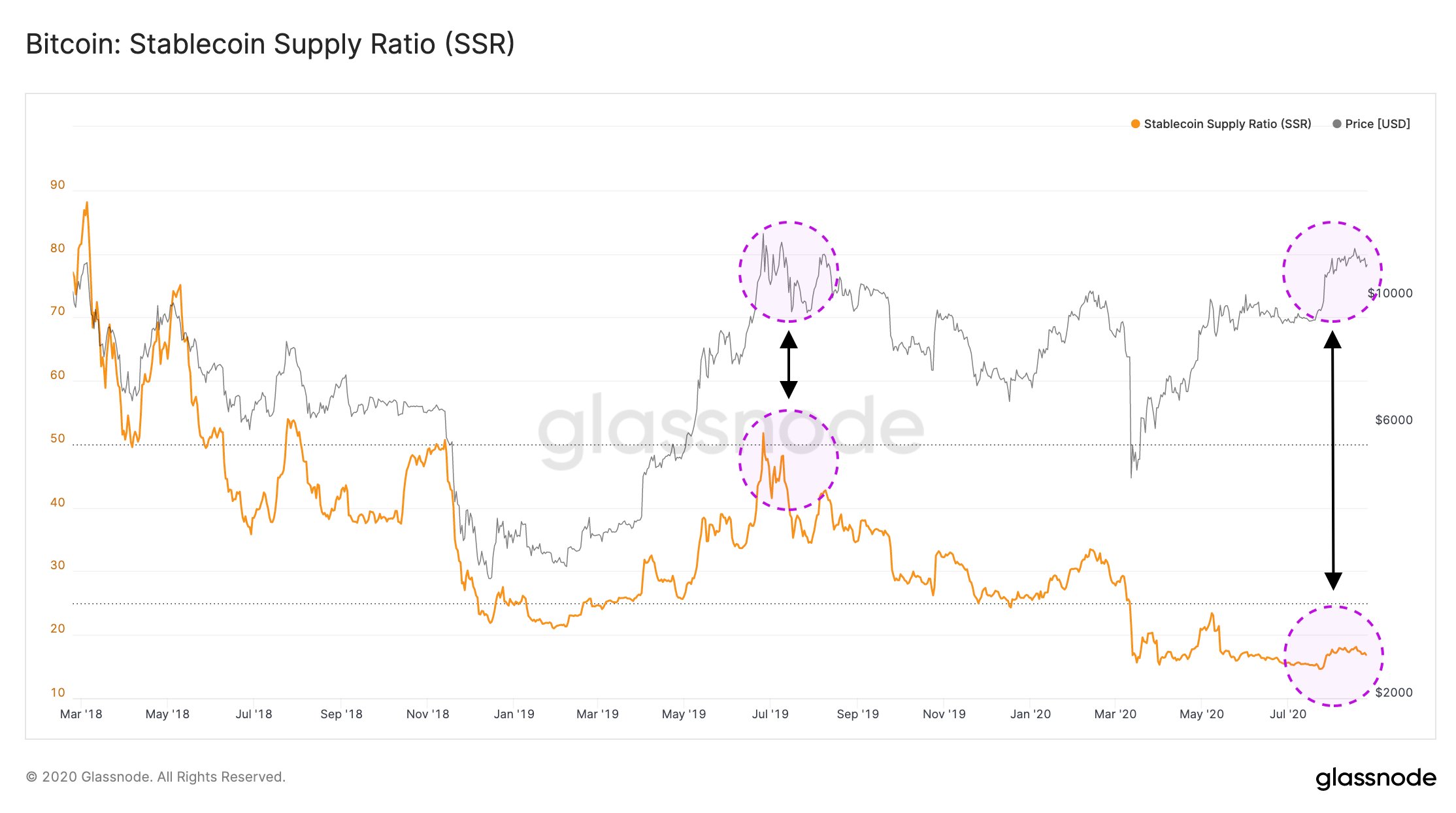

Bitcoin’s network activity is witnessing a surge in on-chain activity despite stringent market regulations, especially in the US. Analytics firm Glassnode published a report Monday showing a positive sentiment among the investors of the maiden crypto.

The most recent introduction of Ordinals – bitcoins units carrying optional extra data – and inscriptions, which led to the introduction of NFTs on the network, is one of the driving forces behind the rising transactions. As a result, the number of bitcoin’s unspent transaction output hit a new all-time high of 137 million last week, representing a rise of 117,00 per month – the highest since Dec. 22, according to the report.

The rising interest in the network comes at an interesting time in the cryptocurrency space regarding regulations. As reported by ZyCrypto last week, the US Securities and Exchange Commission (SEC) has increased scrutiny on the crypto firms selling what it terms as ‘unregistered securities’ to the public, including Kraken, which had to terminate its staking services this month.

More bitcoiners are holding the cryptoEven that has not discouraged the number of bitcoin holders if Glassnode’s data is anything to go by. ‘‘The total supply younger than six months has not increased significantly year-to-date, hovering around 4.298 million BTC. Since this is a binary system (older/younger than 6m), this broadly indicates that coins older than six months are, in the aggregate, extremely dormant at present,’’ the company noted.

Furthermore, the taproot usage in the weekly report showed an all-time high of 8.121% of all the spent outputs utilizing the newest bitcoin script type. Bitcoin taproot is an upgrade that enhances privacy and efficiency on a broader scale.

As bitcoin witnessed an increase in on-chain activities, the price of its native token is also staging a significant recovery, which pundits think could be sustainable. At press time, BTC was changing hands for $22,328, representing a difference of -3% in the last week, per data by CoinMarketCap.

origin »Bitcoin price in Telegram @btc_price_every_hour

RECORD (RCD) на Currencies.ru

|

|