2022-10-27 23:48 |

Bitcoin (BTC) is at its highest levels since mid-September, keeping bulls keen on a price rally to end October on a high note.

BTC has gained over 5% in the past 24 hours to trade above the $20,000 mark, just enough to push the crypto market cap above $1 trillion. The digital asset giant trades at $20,729 after weeks of average price movements slightly below $20,000.

BTCUSD Chart by TradingViewEthereum (ETH) has a more significant increase as it surged 14.1% over the past 24 hours and currently exchanges hands at $1,551. This year, ETH has lost over 60% of its value and dipped further following its Merge that switched its consensus mechanism model. The new price movement above $1,500 is the ETH’s highest level since the post-merge decline.

Outside the top two largest cryptocurrencies, other assets are also having a field day, with Dogecoin (DOGE) and Solana (SOL) also making double-figure gains as they jumped more than 14% and 11%, respectively. Cardano (ADA) is up 14% and trades as $0.40 per coin. Away from coins, UniSwap (UNI), the native token of the decentralized exchange, is up above 8%, with AXIE (AXS) making a slight 3% rise.

The recent turn of events puts the overall market in the green, with most users and traders alike in community paces viewing this as the start of something good, although there are worries about how long this would last.

The market cap climbs the ladderThe cryptocurrency market cap is back above $1 trillion after gains over the past 24 hours. The market cap, which stood at $2.16 trillion at the start of the year, lost over 55% of its value, with over $1 trillion wiped from the market. Though recent gains show promise, the market cap is still a shadow of its all-time high of just over $3.1 trillion last November.

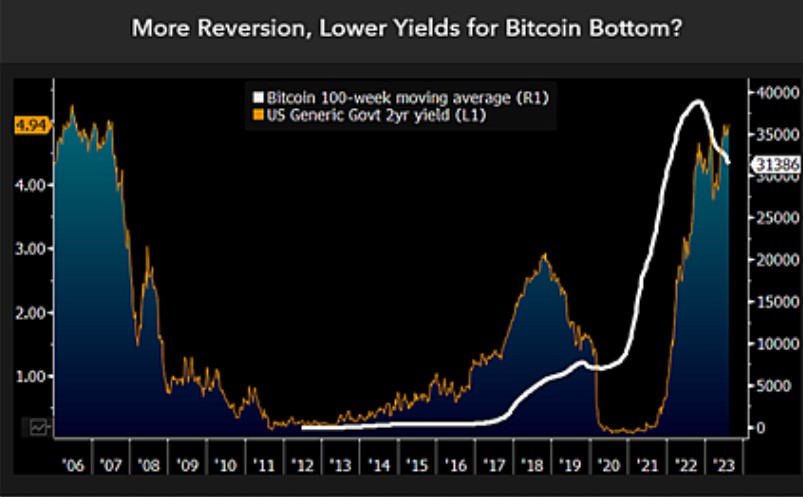

The reason for the rally of most virtual assets can be linked to macroeconomic trends with a better performance of the stock market. The Dow Jones Industrial Average (DJIA) and tech-driven NASDAQ climbed an average of 1.1% and 2.3%, respectively.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|