2023-10-14 05:00 |

In a recent report, The New York Times has uncovered alleged national security concerns surrounding Chinese-owned Bitcoin (BTC) mining operations on US soil.

The focus is on a crypto-mining facility in Cheyenne, Wyoming, which raised alarm bells due to its proximity to a Microsoft data center supporting the Pentagon and an Air Force base responsible for nuclear-armed intercontinental ballistic missiles.

Growing Presence Of Chinese Bitcoin Mines In The USPer the report, Microsoft’s national security threat assessment team expressed deep concerns about the potential for “full-spectrum intelligence collection operations” that could be carried out by the Chinese company in such a strategic location.

Following Microsoft’s warning, US government officials said anonymously that they had been monitoring the Wyoming mining operation for months.

Measures were taken to mitigate potential intelligence collection, but specifics were not provided. The mining company cooperated with inquiries from the federal investment committee.

This Wyoming case sheds light on a larger trend of Chinese Bitcoin mines increasing across the United States, triggering unease and raising additional security concerns.

Beyond intelligence-gathering worries, these mining operations, consisting of large warehouses or containers packed with specialized computers, exert significant pressure on power grids.

The mining computers run continuously, consuming vast amounts of electricity while “mining” for digital coins, particularly Bitcoin.

Brian Harrell, former assistant secretary for infrastructure protection at the Department of Homeland Security, warned that if these mines were to collaborate in causing havoc, they could place “enormous stress” on the grid, potentially leading to targeted blackouts or cyberattacks.

Harrell emphasized that any Chinese infrastructure impacting key energy systems should prompt further investigation and scrutiny.

The New York Times investigation identified Chinese-owned or -operated Bitcoin mines in at least 12 states, including Arkansas, Ohio, Oklahoma, Tennessee, Texas, and Wyoming.

Collectively, these mines consume as much energy as 1.5 million homes. When operating at full capacity, the Cheyenne, Wyoming mine alone requires enough electricity to power 55,000 houses.

Controversy Surrounds BitmainMany of these mining facilities use computers manufactured by Bitmain, a Chinese company with no apparent direct connection to Chinese authorities.

However, import records indicate that Bitmain has sent shipments to the United States through a subsidiary at a Communist Party site in southern China.

Since China banned Bitcoin mining in May 2021 due to concerns about energy usage and economic destabilization, Bitmain has increased its equipment shipments to the United States fifteen-fold compared to the previous five years.

According to the New York Times, the company claims to control 90 percent of the global market for Bitcoin mining equipment.

Overall, per the report, the surge in Chinese-owned Bitcoin mining operations in the United States has raised significant national security and energy infrastructure concerns for US authorities.

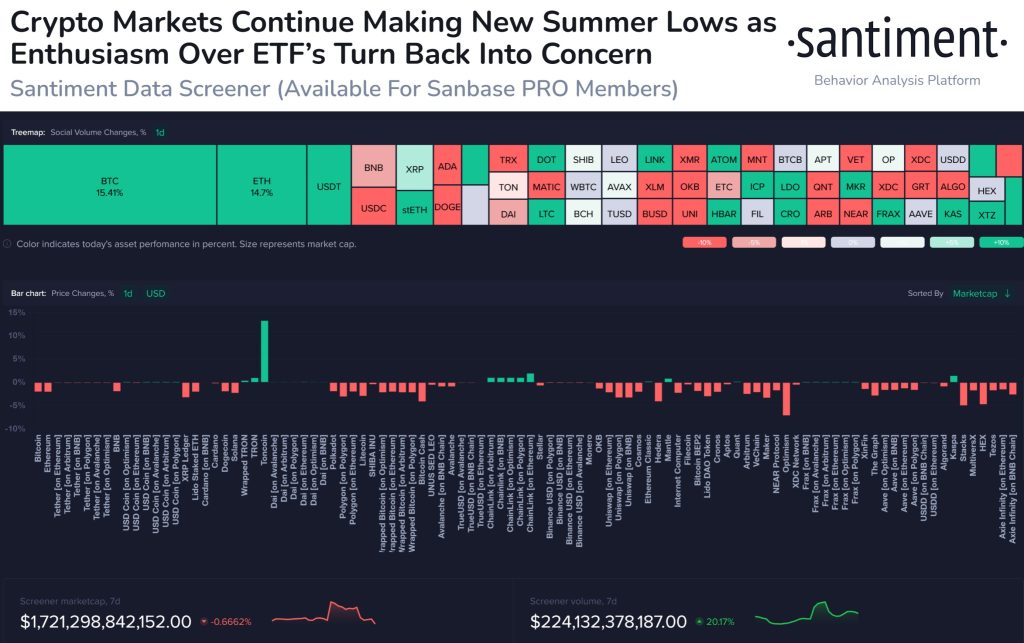

As of the time of writing, the price of BTC stands at $26,700. Over the past seven days, the largest cryptocurrency in the market has experienced a sideways price movement following the loss of the crucial psychological level of $27,000 for bullish investors. During this period, BTC has recorded a decline of 3.4%.

Featured image from Shutterstock, chart from TradingView.com

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|