2018-9-12 18:28 |

How Many Bitcoins Are There? Probably Not As Many As You Think

You’ve probably heard people talk about the total supply of bitcoin. Bitcoin has a total supply of 21 million bitcoins: there can never be more than 21 million bitcoins in existence.

That’s true! The total supply of bitcoin is capped at 21 million. A total of 21 million bitcoin are available to be mined from the bitcoin network, with the last bitcoin scheduled to be mined in the year 2140.

However, there’s a big difference between the total supply of bitcoin and the actual, circulating supply.

Here’s what we know: of the 21 million total supply of bitcoin, approximately 17.3 million have been mined. This is the number most people use when they talk about the “circulating supply” of bitcoin.

When you break it all down, here’s what we’re left with:

21 Million: This is the maximum number of bitcoins that will ever exist

17.3 Million: This is the number of bitcoins that have been mined since bitcoin launched in 2009

3.7 Million: This is the number of bitcoins left to be mined, with the last bitcoin scheduled to be mined in 2140

Unfortunately, one of these numbers isn’t really accurate. Yes, we’ve mined 17.3 million bitcoins, but there certainly aren’t 17.3 million bitcoins in circulation today. In fact, some believe that as many as 4 million bitcoins – or about 20% of the total supply – have been lost and will never be recovered.

Our friends at Block Explorer recently decided to answer the question about how many bitcoins are out there. They discovered some surprising results. We’ll talk about those results below.

4 Million Bitcoins Have Been Lost ForeverYes, we’ve mined 17.3 million bitcoins since the bitcoin network launched on January 3, 2009. However, it’s estimated that 4 million of those bitcoins – almost one quarter of the circulating supply – have been lost forever.

In other words, for every 4 BTC we’ve mined, we’ve lost 1 BTC.

How do we “lose” a bitcoin? There are plenty of ways to lose bitcoins. Technically, those bitcoins still exist – and they will always exist. However, they’ve become inaccessible for some reason or another.

The bitcoins may have been forgotten on hard drives or on paper wallets, for example. You’ve probably heard stories of people accidently wiping a hard drive with thousands of bitcoins. One guy is spending months combing through a local landfill trying to find a hard drive that he threw away because the hard drive contained thousands of bitcoins, for example.

These stories might sound shocking. But remember: bitcoin wasn’t always worth thousands of dollars apiece. In the early days, people amassed hoards of thousands of bitcoins that were only worth a few dollars or a few pennies. They didn’t care about careful storage because, again, the bitcoins weren’t worth very much.

Because the bitcoin network is protected by cryptography, these bitcoins have become inaccessible. Unless you break the cryptography of the bitcoin network, these bitcoins will remain lost and inaccessible.

In any case, Block Explorer claims that up to 3.79 million bitcoins are gone forever. That’s $23.9 billion of value eliminated from the market cap of bitcoin.

5 Million Bitcoins Are Held by WhalesHere’s another shocking stat for you: of the 17.3 million bitcoins in circulation, approximately 5 million are held by a group of “whale” investors.

Whales come from all across the spectrum. Some whales are believers in the technology from the early days. They amassed a hoard of thousands of bitcoins back when it was easy to mine. They held onto their bitcoin over time, watching their fortunes grow.

Other whales are later adopters: they’re hedge funds, venture capital investors, and high net worth individuals who see bitcoin as a reliable store of value or a strong investment.

In any case, Chainalysis claims that five million bitcoins belong to just 1,600 of these whales.

These individual wallet owners are called whales, by the way, because they’re big enough to make a splash on the market every time they buy or sell.

You don’t have to look far to find the identity of some of these whales. Satoshi Nakamoto, for example, is the most famous whale and likely the largest single bitcoin holder in the world with his purported stash of one million bitcoins. The Winklevoss twins, meanwhile, also claim to own 1% of all bitcoin in circulation.

1 Million Bitcoins Have Been StolenCryptocurrency exchanges hold enormous amounts of value. These exchanges are a tempting target for hackers. Even exchanges with strict security protocols can suffer an attack. We’ve seen this happen numerous times.

Mt. Gox, for example, was famously hacked back in 2014. At the time, Mt. Gox was handling nearly 2 out of every 3 bitcoin transactions on the internet. They were the world’s largest cryptocurrency exchange. Over 850,000 bitcoins were lost during that attack.

Other bitcoins have been stolen during smaller exchange hacks. Bitfinex, for example, lost 150,000 bitcoins in 2016. Smaller exchanges periodically lose a few hundred or a few thousand bitcoin due to lax security procedures.

There Are 7 Million Available BitcoinsWhen you run the numbers, this is what you get: there are 7 million bitcoins available today. Sure, there are over 17 million bitcoin in circulation, but more than half of those bitcoins are lost forever, owned by whales, or lost due to theft.

To put the 7 million bitcoin number in perspective, there aren’t enough bitcoins for everybody in New York City to own 1 BTC. If you consider that there are approximately 30 million millionaires in the world today, then it’s impossible for each of these millionaires to own 1 BTC simultaneously.

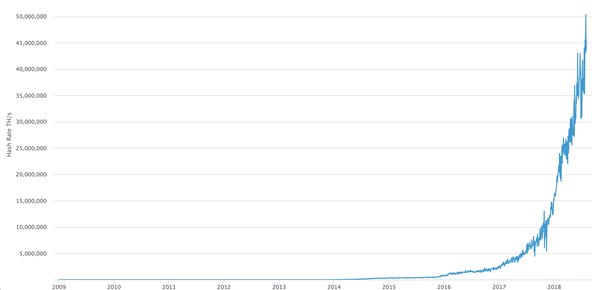

Bitcoin Has an Inflation Rate of 1800 BTC Per DayThere is one caveat to the number above: bitcoin’s circulating supply is inflating every day.

The bitcoin network issues 12.5 BTC as a block reward to the miner who mined the last bitcoin block. This means 12.5 BTC is added to the circulating supply of bitcoin every 10 minutes. Over a 24 hour period, that means we get 1800 new BTC in circulation.

This inflation rate won’t last forever: the bitcoin network has a pre-programmed halving process where the block reward diminishes over time. In 2020, the block reward is scheduled to be sliced in half from 12.5 BTC to 6.25 BTC.

Back in 2009 when the network first launched, the block reward was 50 BTC. By the time the last bitcoin is scheduled to be mined in 2140, the block reward will be fractions of a bitcoin.

This is why the vast majority of bitcoins already exist: out of the total supply of 21 million bitcoins, 17.3 million, or 81%, already exist.

What Happens When Every Bitcoin is Mined?The last bitcoin is scheduled to be mined in 2140. What happens when that last bitcoin is mined? How will miners get rewarded when block rewards don’t exist?

Well, the bitcoin network will continue functioning after the last bitcoin is mined. The main difference will be that miners get paid in transaction fees and not by block rewards. Today, the miner who mined the last bitcoin block gets a 12.5 BTC block reward along with all the transaction fees in that block. Eventually, we’ll reach a point where transaction fees are worth more than the block reward, and the block reward will matter less and less over time. We’re already approaching that point, in fact, and the value of transaction fees has steadily increased over time.

What’s the Difference Between Bitcoin’s Total Supply and the Total Supply of ETH or XRP?Bitcoin has a fixed total supply of 21 million. A number of other cryptocurrencies have a similar fixed total supply.

Bitcoin Cash (BCH), for example, has an identical total supply of 21 million because it forked off of bitcoin in August 2017.

Two of the largest digital currencies, however, are more unique than bitcoin. Ethereum (ETH) and Ripple’s XRP have no fixed total supply.

Ethereum’s supply is capped at 18 million per year, with new ETH released with every block. Ethereum, however, technically has no cap. Today, there are over 100 million ETH in circulation.

Ripple, the third largest cryptocurrency by market cap, has a different system. XRP has a fixed total supply of 100 million XRP. There can never be more than 100 million XRP in existence. The big difference with XRP, however, is that all 100 million XRP tokens were mined at once at the inception of the XRP network. There’s no mining, and all 100 million XRP already existence (with the majority of XRP held by Ripple, the company).

Conclusion: Bitcoin’s Supply is Extremely LimitedBen Brown, editor of Block Explorer News, sums up bitcoin’s total supply debate best when he says that the “bitcoin supply is incredibly limited.”

Even if we assume there are 21 million bitcoins in circulation, that’s not enough bitcoins for every millionaire in the world to own a single bitcoin simultaneously. This number gets reduced even further when you consider the bitcoins lost forever (approximately 4 million) and the bitcoins held by whales (approximately 5 million).

As bitcoin’s emission rate halves in 2020, the supply of bitcoin will tighten even further – assuming demand continues to increase.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|