2020-9-15 18:17 |

Bitcoin options traders have been aggressively buying call options at exorbitantly high prices. Leading crypto derivatives exchange Deribit saw 752, 462, and 230 contracts bought on Sept. 13 at strike prices of $36,000, $32,000, and $28,000, respectively. Each contract allows a buyer to purchase one Bitcoin at the strike price at the time of expiration.

The flood of purchases thus indicates that many traders expect Bitcoin to be at or above these three prices before the end of the year.

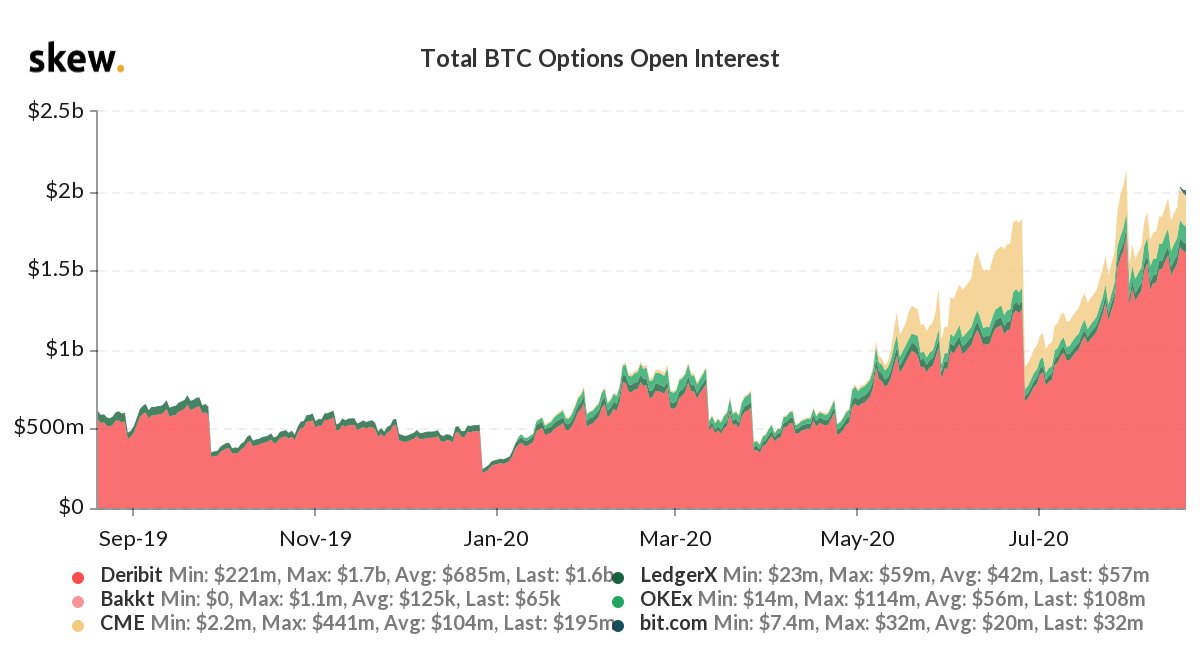

Bitcoin Options Open Interest Daily Change Source: SkewThough traders are willing to bet on BTC prices skyrocketing to new highs, the current macro environment presents many uncertainties.

Bitcoin Options Upside RiskThe aggressive accumulation of call options at strike prices of $24,000 and $36,000 is indicative of “tail risk management.” Tail events are rare events with drastic changes in price.

The chart below shows that the most number of bids are around the mean at the $10,000 mark. However, there is a significant tail to the right, which extends from the strike price of $20,000 to $36,000.

Source: TwitterExtensive call options buying at such extreme prices are a reflection of the potential “up-jumps” in prices. In the case of an upswing in BTC price, these call options will become more expensive, profiting higher than the actual increase in the spot price.

Bitcoin Options Market Probabilities Source: SkewNevertheless, the market only places a 6% chance that BTC will break above its previous all-time high at $20,000 by Dec. 20. This figure drops off much further after $28,000. By limiting the losses to the price paid for the options, the investors can efficiently tap low-probability, but high reward surges.

Moreover, while the call option creates buying pressure on the market, the entity betting on such high calls could also be decreasing his spot or futures exposure.

Uncertain Times and VolatilityThe put/call ratio of the open interest in the options market has oscillated between 0.4 to 0.75 in the last one year. A surge in the ratio usually represents increased hedging against any possible downside, which exerts negative pressure on the market.

Currently, the ratio is at par with prior levels of high exposure from sellers or put orders.

Bitcoin Put/Call Ratio Source: SkewThe implied volatility is greater than the realized volatility, which would indicate a brief period of consolidation before a clear trend kicks in. As the price has continued to range in the $10,000 to$10,500 range without any huge sell-off, the consolidation points bullish.

However, the 2020 U.S. elections due in November are inducing a lot of uncertainty in the markets.

Even the VIX index of the S&P 500 predicts a lot of volatility in traditional markets, especially towards year-end. The correlation coefficient between the stock market and Bitcoin has again grown stronger after a pullback during Q3 2020.

Bitcoin and S&P 500 Correlation Coefficient Source: TradingViewBitcoin is set up for a non-correlation and an ideological test in the coming months as the largest economy in the world chooses its new leader.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|