2021-1-22 11:53 |

Featured image: Free Algorithmic Crypto Bots

Cryptocurrency trading isn’t easy. However, there are many people who have honed the art of trading bitcoins and altcoins on a daily basis. Trading bots are used by many cryptocurrency traders to execute trades faster and more efficiently, and sometimes even in their sleep. This is a comprehensive crypto trading bots review where we examine all pros & cons of top 15 automated trading platforms on the market.

Crypto trading bot review – What are Trading Bots?Trading bots are software programs that connect to an exchange (usually via API protocol) and make trades on behalf of the users. They work using a variety of trading indicators and strategies. Since trading is all about mathematics and fast complex probability calculations, bots should be better at trading than humans.

The bots make trading decisions by following the market’s price changes and reacting according to a set of predefined and pre-programmed rules. Typically, a crypto trading bot will follow and analyze technical indicators and signals such as volume, orders, price, and time. Most of the more advanced bots can be customized to execute your own trading strategy so they are great if you know what you are doing.

Traditional markets also have algorithms and bots that are, however, not accessible to regular mortals as they are super complex and cost a fortune.

That is not the case in cryptocurrency markets as you will see and read below.

Top Crypto Trading Bots (Bitcoin and Altcoin Trading Bots)This article is very long and if you need a quick solution and recommendation, these three trading bots have proven to be on top of the game when it comes to automated trading.

CryptohopperQuadencyBitsgapIntegrationsBinanceBinance US

Bitfinex

Bittrex

CEX.io

Coinbase Pro

Cobinhood

Cryptopia

HitBTC

Huobi

Kraken

KuCoin

PoloniexBittrex

Bitfinex

Binance

Binance US

Kucoin

Poloniex

HitBTC

Coinbase Pro

OKex

Kraken

LiquidBittrex

Bitfinex

Binance

Bitstamp

Coinbene

Kucoin

Poloniex

HitBTC

CEX.io

Coinbase Pro

OKex

Huobi

OkCoin

Kraken

Liquid + 10 otherPrice From$19 Monthfree/$49 per Month$19 per MonthTypeCloudCloudCloudExternal SignalsYesNoYesReviewReadReadReadVisitVisitVisit

Below is a tabular overview of all notable altcoin trading bots on the market, most of them are described in more detail in the second part of the article.

NamePriceSupported ExchangesCryptohopper$19 to $99 per month12Quadencyfree to $49 per month12Bitsgap$19 to $109 per month25Margin.de (“Discount10” for 10% off) $129 to $2999 one time fee 25Trade Santa Free to $100/month 4 Gunbot$260 to $1,961 one-time10ZenBotFree9Haasbot$475 to $1,360 per year7Gekko Free 7 Autonio$50 per month2KryllFree to 20,000 KRL (~$1,400)4ZignalyFree (Beta Version)5HodlBotFree to $10/month23Commas $30 to $100 per month 23 (only 9 support automated trading)CryptoTrader $16.50 to $199 per month 9BTCRobot$19.99 to $39.99 per month or $399 one-time2We will shift right into the high gear and talk about the best crypto trading bots while you can find more information about types of bots, their major features, how to assess what bot fits your needs etc. below the list, in the second part of the article.

So here is a list of top bitcoin day trading bots for 2021: CryptohopperCryptohopper is a leading crypto trading bot that offers some unique and interesting features, including cloud trading, extensive social trading options and a large variety of coins/exchanges to trade on/with. Stop losses and trailing stops are especially welcome elements here, as they help you tremendously with risk management. This is arguably one of the best crypto trading bots on the market which is best reflected in their huge customer base (over 150k users) and large signals marketplace.

Here is a full review of Cryptohopper crypto trading bot.

Created by two brothers from the Netherlands, one a day trader, and the other a web developer, this crypto trading bot can brag about having a perfect blend of experience and knowledge – both in the worlds of trading/technology – behind it from the start. The two merged their ideas, skills, and experiences and created Cryptohopper.

Cryptohopper comes with a range of features such as: mirror trading, paper trading, trading strategies designer (simple drag and drop design), automatic trading and trailing stop loss. Their marketplace is huge and divided in three sections where you can buy templates, trading strategies or simple signals (when to enter or exit a position) from more experienced traders that are transparently ranked on Cryptohopper by their to-date success.

Supported exchangesIt currently offers integration with the following crypto exchanges:

Huobi – premium Cryptohopper partnerPoloniexKrakenBittrexBinanceCoinbase ProKuCoinCryptopiaBitfinexWork is apparently being done to integrate the cryptocurrency trading bot platform with other well known crypto platforms like HitBTC, Cobinhood, Cex.io, Bitstamp and bitFlyer APIs.

Cryptohopper was one of the first BTC bots that was completely cloud-based which meant that investors didn’t have to download and run auto cryptocurrency trading software from their local machines (like you have to do with Margin, Gunbot or Haasbot).

Pros & Cons most trusted brandlargest customer baselargest marketplace regular improvements smaller number of supported exchanges in comparison to its top competitors visit nowCryptohopper QuadencyQuadency is a new trading platform that offers comprehensive crypto experience. Its main feature are trading bots – seven of them currently deployable with a click of a button. The platform additionally offers portfolio management, unified interface with advanced trading tools for manual trading and research&news section for a deep research into the fundamentals of an asset you want to invest in.

As for the crypto trading bots, as we mentioned, Quadency has seven different bots: smart order, market maker, accumulation, MACD based bot, Bollinger Bands based bot, Mean Reversal bot and multi-level RSI bot.

Quadency is along with Cryptohopper and Bitsgap the best Binance bot on the market. Considering it works great with Coinbase Pro, it is also a contender for the title of best Coinbase bot as well.

Supported exchangesThe bot supports 12 major crypto exchanges while others are in the works to be added as well.

BinanceBinance USKucoinLiquidKrakenOkEXBittrexCoinbase ProGeminiBitFinexPoloniexHitBTC Pros & cons very affordableeasy to setupbeginner-friendlyfull-fledged trading terminal smaller number of supported exchanges in comparison to its top competitorsno trading signals marketplaceHere is a full Quadency bot review.

visit nowQuadencyGet 3 months free by connecting your Binance, Kucoin, OkEx or Liquid account.

BitsgapBitsgap is a new young startup from Estonia that built a powerful cryptocurrency trading terminal that plans to rock the boat of the established incumbents.

The number of supported exchanges is impressive – 25. This fact also means more arbitrage opportunities since there are a lot of exchanges that are tracked and hence there is a high probability of finding a big price difference between them.

So Bitgsap is a platform that supports trading, portfolio tracking, arbitrage, trading signals, bots – a full spectrum of cryptocurrency service that can be managed from one dashboard.

Of course, Bitsgap also has a demo version that you can take for a test ride and try out all your trading strategies without risking real money.

Prices are around what competitors charge – $19 for the lowest package and $109 for the advanced account that offers 15 bots and has no limit on the amount of funds you can trade.

Bitsgap shines especially when it comes to arbitrage and it is certainly the best crypto arbitrage bot.

Click here to read our complete Bitsgap review.

visit nowBitsgap ShrimpyShrimpy is the social trading platform that focuses on portfolio management strategies. Unlike other trading bots that rely on swing trading or day trading strategies, Shrimpy is specifically designed for optimizing your portfolio over the long term. Rebalancing, dollar-cost averaging, and stop-losses can all be set up in a matter of minutes. As a result of the simple user interface and convenient features, Shrimpy has become the go-to place for cryptocurrency investors who are getting into trading for the first time.

Launched in January 2018, Shrimpy has grown to become one of the largest social trading services in the crypto market. The platform now supports thousands of traders who manage over $350 million dollars in cryptocurrency.

In addition to the popularity of the portfolio management platform, Shrimpy also offers a set of Developer APIs for builders. These APIs can be used to seamlessly integrate trading into mobile applications, websites, and trading bots without requiring significant work. These APIs are used by some of the largest applications in the crypto market, such as CoinStats.

Here is a full review of Shrimpy bot.

Supported Exchanges

Shrimpy offers integrations to the following exchanges:

BinanceBittrexKuCoinCoinbaseKrakenPoloniexGeminiBiboxBitMartHuobiHitBTCOKExBitstampBitfinex visit nowShrimpy Coinrule.ioCoinrule stands out among competitors with its If-This-Then-That rule logic. This approach allows even less advanced traders to build their trading strategy in minutes. The user-friendly interface guides users in developing the trading bot step-by-step.

Over 150 templates help beginners in finding the perfect trading strategy that suits their needs. The platform allows plenty of different trading strategies, including stop loss and take profit in one and integrates the most common technical indicators such as Moving Averages.

Another exciting feature is the built-in Demo exchange. Traders can test their trading system in a safe environment with a virtual allocation of coins. The Demo exchange is modelled entirely on Binance and you can try your strategies risk-free.

You can use Coinrule on a free plan with some limitations or subscribe to one of the premium plans priced between $29.99 and $249 USD. With a yearly subscription, you get access to a 20% discount on the price.

Coinrule supports Coinbase Pro, Binance, Binance US, Bitstamp, Kraken, HitBtc, Bitpanda Pro, Okex, Liquid, Poloniex and additional exchanges are added regularly.

If you want to find out more, here is our full Coinrule Review.

visit nowCoinrule Margin.deMargin (Use code “Discount10” to get 10% off) is a trade bot that has 17 supported exchanges, 2 new crypto trading bots, and great features like a profit/loss indicator, cryptocurrency market scanner, social integrations & more. Plus, they still offer the free demo to try everything out first!

Use code “Discount10” to get 10% off on the checkout!

Margin currently comes bundled with two trading strategy bots:

• Ping Pong Strategy

• Margin Maker Strategy

Just as the name suggest, the ping pong strategy allows you set a buy and sell price and the bot will do the rest. The mArgin maker strategy is a bit more advanced and can buy and sell based on price action adjusting with the course direction of the market.

They obviously have a good designer on their team as their GUI is by far the best looking out of all bots and has lots of customization options.

Prices are paid for lifetime licenses and range from $129 for starter package over $259 for standard to whopping $2999 (but these are aimed at enterprise clients).

One drawback is that it is not a cloud-based software, rather a downloadable progmram that you run from your local machine.

If you want to find out more, here is our full Margin bot review.

visit nowMargin.de(Use code “Discount10” to get 10% off)

ZignalyZignaly is another bitcoin day trading software that is cloud based and since recently also offers additional service of crypto signals.

It is handicapped to the leading platforms in the number of exchanges it supports – right now it only works with Binance, Kucoin, BitMex, Poloniex and Bittrex with a promise of addition of new exchanges in the near future.

With Zignaly crypto signals you can manage the Buy / Sell signals from external integrated signals providers like Mining Hamster Signals or Crypto Quality Signals.

It works well with TradingView as you can send your own signals from TradingView by using indicators or their “Cryptocurrency Signal Finder” recommendations.

It also has a trailing stop loss option, a feature that is evolving into a must-have for all trading platforms, especially automated software like Zignaly.

Just like other bots from this list, Zignaly works via API keys, has no ability to withdraw your coins and all activity is done directly on the exchanges and not routed through their servers – meaning, the bot is as safe as it gets.

As for the prices – it currently has only one package of $15.99 as they still consider themselves in beta mode. You can also do a DEMO for 30 free days before buying the subscription.

Here is a full Zignaly review.

visit nowZignaly 3Commas3Commas is one of the most well-known bitcoin trading software bots in the market. The name referencing the billion-dollar club is a Russian made software solution.

3Commas is a crypto trading terminal which features bot trading and portfolio management. It features a SmartTrade terminal which allows users to execute orders and trades, set bot-trading and stop-loss/profit positions.

Price

Their plans range in pricing from $22 to $75 per month.

Supported Exchanges

Binance, CEX.io, Coinbase Pro, Bittrex, BitMEX, Poloniex, YoBit.net, KuCoin, Bitfinex, OKEX, HitBTC, Huobi Global, Bitstamp, Cryptopia.

You can read our head-to-head comparison of 3Commas vs Cryptohopper to see how well it fares against the top dog of the cryptotrading bots. As for the full 3Commas review, you can read it here.

visit now3Commas HaasbotHaasbot algorithmic trading software was created In January 2014 by Haasonline. This crypto trading bot is very popular among crypto enthusiasts and trades bitcoin and over 500 altcoins on many major crypto exchanges, including fully automated trades on platforms such as Kraken, BTCC, GDAX, Poloniex, Bitfinex, Gemini, Huobi and many more.

You can see our full review of Haasbot here.

On paper, this cryptocurrency trading bot does all of the trading legwork on behalf of the investor. However, some input is required. Haasbot bot is highly customizable and enables a variety of technical indicators, and is also capable of recognizing candlestick patterns. One has to be knowledgeable to use this trading bot and make a profit from doing so, considering it costs between 0.12 BTC and 0.32 BTC per three-month period to use this tool. There is, however, an extensive knowledge base for the traders willing to learn, provided by the creators on their site.

Click here and use “captainaltcoin10” code to get a 10% discount on your Haasbot.

visit nowHaasbot GunbotGunbot is an older crypto trading bot but still one of the more advanced BTC trading software that provides a wide range of settings and strategies which are ideal for both beginners and professionals. It is used to take over (most) of the workload of traders on the cryptocurrency markets.

The cryptocurrency trading bot gives users the opportunity to customize their trading to a level which no other trading bot can provide. Almost all the strategies and technical indicators that manual traders use on a daily basis can be found in this bot and used to trade automatically. The interface is user friendly so that everyone can easily get a hang of it. It is suited for more experienced crypto traders as well as beginners; some strategies are highly configurable while others are easier to use.

The program comes with tons of trading strategies that are highly configurable and includes different types of insurances to optimize your crypto trading which are explained on the website.

Read our full Gunbot crypto trading bot review.

Another positive feature about this crypto bot is that it’s a one-time payment, that means: no need to renew every month (pay once and get all the future updates for free)!

Don’t want the trading bot anymore? Don’t worry, Gunbot includes something that no other trading platform offers: Gunthy coin. Gunthy coin is a feature that no other trading platform offers, a cryptocurrency token that is offered to the users when buying the the bot. The amount of tokens sent to the buyer are derived from the type of license that they acquire. Why is this important? Imagine that trading is nothing for you and that you want to sell your crypto bot, that’s possible with the Gunthy token!

Gunbot is used by thousands of crypto traders daily which creates a close and helpful community. Its community is highly active on social media platforms to discuss different trading strategies and help each other out. The trading platform provides different packages which can be upgraded if needed. There are 4 different licenses available, ranging from 0.04 BTC to 0.3 BTC.

visit nowGunbot CryptoTraderCryptoTrader is less known cryptocurrency trading bot that is gaining popularity. This cloud-based automated cryptocurrency trading bot claims to allow users to build algorithmic trading programs in minutes. Not having to install unknown software is a big plus. However, it remains to be seen if this platform is legitimate. One intriguing feature is that the company also offers a “Strategy Marketplace” where users can buy and sell trading strategies.

Click here to read full CryptoTrader review!

All major crypto-currency exchanges, such as Coinbase, BTCe, Bitstamp, and more, are supported for both backtesting and live trading. Using their paper trading backtesting tool, you can see how your trading strategy would work over different market condition. Their goal is to provide traders with cloud-based automated trading solutions powered by cutting-edge technology, and the company states that its automated trading bots in are unique compared to the current best crypto trading bots on the market today.

visit nowCryptoTrader Free, open-source crypto trading bots Gekko trade bot – best free crypto trading botGekko is a Bitcoin trading bot and backtesting platform that supports 18 different Bitcoin exchanges (including Bitfinex, Bitstamp and Poloniex). Gekko is free and 100% open source that can be found on the GitHub platform.

This automated trading bot even comes with some basic trading strategies, so using it seems rather straightforward.

Gekko comes with a webinterface that was written from scratch. It allows you monitor your local data, strategies. It can also run backtests and visualize the results. Using plugins, which are available for IRC, telegram, email and a lot of other platforms, Gekko is able to update you wherever you are! Gekko runs flawlessly on all major operating systems (Windows, macOS, and Linux).

You can also run it in the cloud or on your raspberry PI without any issues! It will not exploit arbitrage opportunities, nor is it a high-frequency trading bot by any means. With a good list of supported cryptocurrency exchanges, Gekko is definitely a bitcoin trading bot that is worth checking out.

Zenbot – BTC trading botZenbot is another open-source trade bot for bitcoin traders. It is important to note that this trading bot has not seen any major updates over the past few months. However, it is available to download and modify the code if needed. This marks the third iteration of Zenbot, which is still a lightweight and artificially intelligent bitcoin trading bot, and it is also one of the very few solutions capable of high-frequency automated crypto trading and supporting multiple assets at the same time.

This bot supports following cryptocurrency markets – Gemini, Quadriga, Bittrex, Kraken, Poloniex, and GDAX. Work on further exchange support is ongoing. According to the GitHub page, Zenbot 3.5.15 makes a 1.531 ROI in just three months. This is quite surprising.

Types of Trading Bot StrategiesHow does automated cryptocurrency trading work?

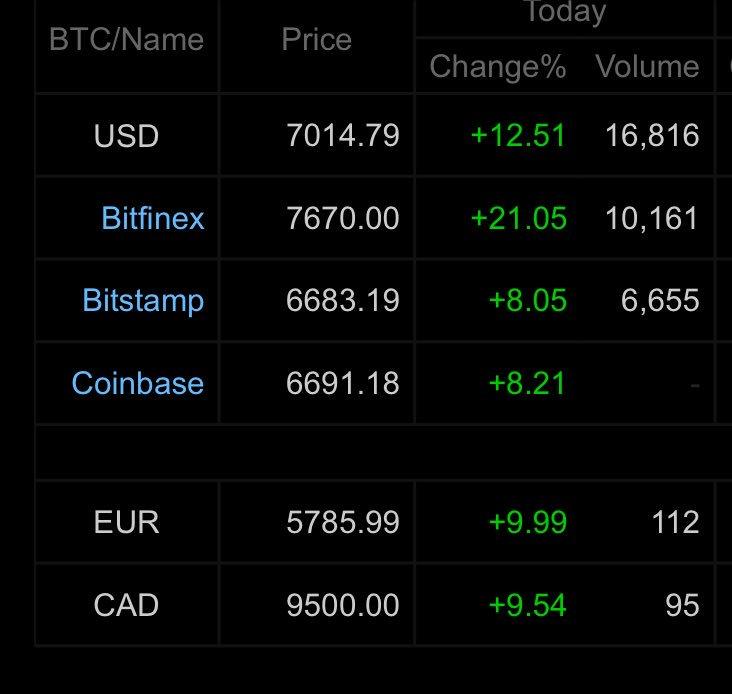

ArbitrageIn the early days of cryptocurrency trading one of the primary strategies that traders used to make profits was arbitrage – i.e. buying assets in one cryptocurrency market and then selling them in another for a higher price, thus earning profit on the difference. As cryptocurrency exchanges were decentralized, there were often large differentials between prices offered on various exchanges, meaning that profits could be made through arbitrage.

On CoinMarketCap there are currently 208 crypto exchanges listed, where exchanges with no fees are excluded. When no fees are being charged at the exchange, it is possible for a trader (or bot) to trade back and forth with themselves and generate a lot of “fake” volume without penalty. It’s impossible to determine how much of the volume is fake so they excluded it entirely from the calculations.

Due to the large number of exchanges and high volatily of cryptocurrencies, traders can take advantage in the form of arbitrage.

An arbitrage strategy is the possibility of a risk-free profit after transaction costs. For example, an arbitrage is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price. People who engage in arbitrage are called arbitrageurs, such as a bank or brokerage firm. The term is mainly applied to trading in financial instruments, such as bonds, stocks, derivatives, commodities and currencies.

With so many exchanges available, there could be the same asset but with different price on different exchange. For instance, the price of an asset A on exchange 1 is 10$, while on exchange 2 it is 15$.

Although the spread between crypto markets are getting smaller by day, they do still exist and crypto trading bots can assist traders in making the most of these differentials.

Market MakingTrading bots can also enable users to use the market making strategy. Market making is an activity whereby a trader simultaneously provides liquidity to both buyers and sellers in a financial market. Liquidity is the degree to which an asset can be quickly bought or sold without notably affecting the stability of its price. Market makers “make a market” by quoting prices to both buy and sell an asset. In this way, the market maker (or liquidity provider) acts as both a buyer and seller of last resort where there would not naturally be another buyer or seller, thereby providing liquidity.

As prices oscillate and vary, the crypto trading bot will automatically and continuously place limit orders in order to profit from the spread.

Market making as a strategy does not work good in low liquidity environments and is a highly competitive.

Do Cryptocurrency Trading Bots Work?The main purpose of crypto trading bots is to automate things which are either too complex, time consuming, or difficult for users to carry out manually.

Good trading bots like Bitcoin Pro can save a crypto trader time and money by collecting data faster, placing orders faster and calculating next moves faster

Majority of trading bots use an indicator from technical analysis called an exponential moving average (EMA) as a principle strategy for analyzing the market. Bots can be programmed to make an action once EMA surges or drops certain thresholds.

By setting up the bots, users can set their thresholds to fit with their risk profile. However, one of the main downsides of EMA and similar indicators is that they are so called lagging indicators – based on past history, which, as all traders will know, is not indicative of future performance, especially in the cryptocurrency industry where volatility is rife.

Therefore the answer to the question of whether trading bots work is – “depends”. They do work, but not necessarily for everybody.

Trading with automated crypto trading bots is a technique that uses pre-programmed software that analyzes cryptocurrency market actions, such as volume, orders, price, and time, and they are rather common in the bitcoin world, because very few traders have time to stare at the charts all day. Bots or program trading is used within many global stock exchanges.

Most people trade bitcoin as a way to generate passive income while working their regular day jobs, and crypto trading bots are said to establish more efficient trading.

Trading bots are software programs that connect to an exchange (usually via API protocol) and make trades on behalf of the users. They work using a variety of trading indicators and strategies. Since trading is all about mathematics and fast complex probability calculations, bots should be better at trading than humans.

Crypto trading bots can be utilized on many well-known cryptocurrency exchanges today. There are crypto trading bots that are free of charge and can be downloaded online, and there are also crypto trading bot services you have to pay for, offered by various trading engine and programming companies.

With so many people relying on top crypto trading bots, the question becomes which one should be avoided and which one can be trusted. Below is a list of best crypto trading bots.

Is there a difference between bitcoin and ethereum trading bots?No, it is just semantics. These bots can be called best Ethereum bots as well or best [pick any altcoin] trading bots since they support automated trading of any coin listed on the exchanges they integrate with.

How to choose the best crypto trading botWe have made our list of top trading bots based on the following criteria:

Trading strategy.What strategies of technical analysis can the bot execute? How customizable are those strategies?User Interface.

Friendly user interface is another important factor. The bot has to have simple and intuitive processes that are easy to learn and implement.Ease of use

If you are a beginner, the crypto bot needs to have premade setups that are easy to choose and launch. For the more advanced users, ability to customize the crypto bot to the settings and preferences user has was of highest importance.

Speed.

What is the latency in transferring data from exchanges? Sometimes it is important to have the order be executed immediately and a slow bot can cost you a lot of money. Cost.

Of course, price always plays a role. You want to earn money, after all, and not break a bank for a piece of code.Security

Authentication methods, 2 Factor authentication, API key encryption mechanism. Privacy policies related to users trading data.Reputation.

Does the bot have a good reputation among the wider crypto community? Check online forums for reviews from other users to see if the crypto bot is legit and if they’d recommend using it.Exchanges.

While most reputable crypto trading bots will work with most reputable exchanges, make sure any program you choose will allow you to trade on the exchange(s) you want to use. Should you use a crypto trading bot?

Cryptocurrencies are a nascent and atypical asset class and for this reason it is hard to make a regular return off of them in the same way that cash or a stock create value. Many of the best stocks pay out dividends which is in addition to price appreciation main wealth creation mechanism from them. There isn’t really an analogue for this in the crypto market, unless crypto owners lease out their cryptos to derive an income from their holdings.

Or you can hoard staking coins and participate in the network maintenance as a block producer or at least, delegate voter.

Trading bots represent the other option for passive income earning in crypto industry – even though, as we emphasized earlier, they are not completely hands off and to require monitoring and manual interventions.

Trading Bots For Passive IncomeIf you want to put your crypto coins to work for you, crypto trading bots could make sense to use.

The ‘bot’ is superior to a human because it is emotionless and it is awake and looking for income opportunities 24/7. Of course, there is no such thing as free money.

Any risk that can generate a return has the potential to lose money. It is a good idea to make sure that any automated investment platform you choose to trust with your cryptos can prove that it works with a verifiable transaction history.

FAQs Are crypto trading bots legal?Bot trading is absolutely legal in cryptocurrency markets but also in the stock market (although not all brokers allow the use of such software).

Do crypto bots really work?Yes, they really do work. However, you do need a certain level of knowledge to set them up and it is not, as often marketed, a hands off money making machine. You need to monitor their performance, especially in times of high volatility – sometimes even to turn them off to prevent profit losses.

Are there really free bitcoin bots?Yes, there really are free crypto bots that work – Gekko and Zenbot are two most known free bitcoin bots. They are completely free and safe to use and people do make money by using them.

What are best Binance bots?Best Binance bots are:

Cryptohopper

3Commas

Zignaly

Margin.de

CWE

Haasbot

Best Coinbase Pro bots are:

Cryptohopper

3Commas

Zignaly

Margin.de

CWE

Haasbot

Best Kucoin bots are:

Cryptohopper

3Commas

Zignaly

Margin.de

CWE

Haasbot

Best Bittrex bots are:

Cryptohopper

3Commas

Zignaly

Margin.de

CWE

Haasbot

Yes, cryptocurrency bots we listed in this article are all legit and safe. They do not require withdrawal rights from your exchange account so there is no fear of theft.

Are crypto trading bots profitable?With a correct setup, these automated trading software are worth it and profitable. The better your trading strategy, the more profitable your bot will be.

What is the best trading bot for beginners?Quadency is miles ahead of the others when it comes to simplicity of setup and management. Bitsgap and Cryptohopper are also very intuitive and easy to grasp for a newcomer.

ConclusionThe software can be difficult for inexperienced crypto traders to understand, which means that bot trading may not be for everyone. Furthermore, traders have to trust in the reliability and efficiency of companies that offer algorithmic cryptocurrency trading. There are many different businesses online offering crypto bot services. But be careful, because some of them may not be legitimate. However, if used correctly, reputable and functioning trading bots may increase trade profits.

.wp-block-advgb-list ul.advgblist-f61e72b8-e26f-4040-829f-4607e6d7ac00 > li{font-size:16px;margin-left:21px}.wp-block-advgb-list ul.advgblist-f61e72b8-e26f-4040-829f-4607e6d7ac00 > li:before{font-size:19px;color:#00d084;line-height:18px;margin:2px;padding:2px;margin-left:-23px}.wp-block-advgb-list ul.advgblist-ba2c1221-6475-4bab-8c0a-588344970cda > li{font-size:16px;margin-left:18px}.wp-block-advgb-list ul.advgblist-ba2c1221-6475-4bab-8c0a-588344970cda > li:before{font-size:16px;color:#ff0000;line-height:18px;margin:2px;padding:2px;margin-left:-20px}.wp-block-advgb-list ul.advgblist-f61e72b8-e26f-4040-829f-4607e6d7ac00 > li{font-size:16px;margin-left:21px}.wp-block-advgb-list ul.advgblist-f61e72b8-e26f-4040-829f-4607e6d7ac00 > li:before{font-size:19px;color:#00d084;line-height:18px;margin:2px;padding:2px;margin-left:-23px}.wp-block-advgb-list ul.advgblist-ba2c1221-6475-4bab-8c0a-588344970cda > li{font-size:16px;margin-left:18px}.wp-block-advgb-list ul.advgblist-ba2c1221-6475-4bab-8c0a-588344970cda > li:before{font-size:16px;color:#ff0000;line-height:18px;margin:2px;padding:2px;margin-left:-20px}The post Best Bitcoin Trading Bots 2021 – Automated Crypto Trading Guide appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|