2018-7-19 20:00 |

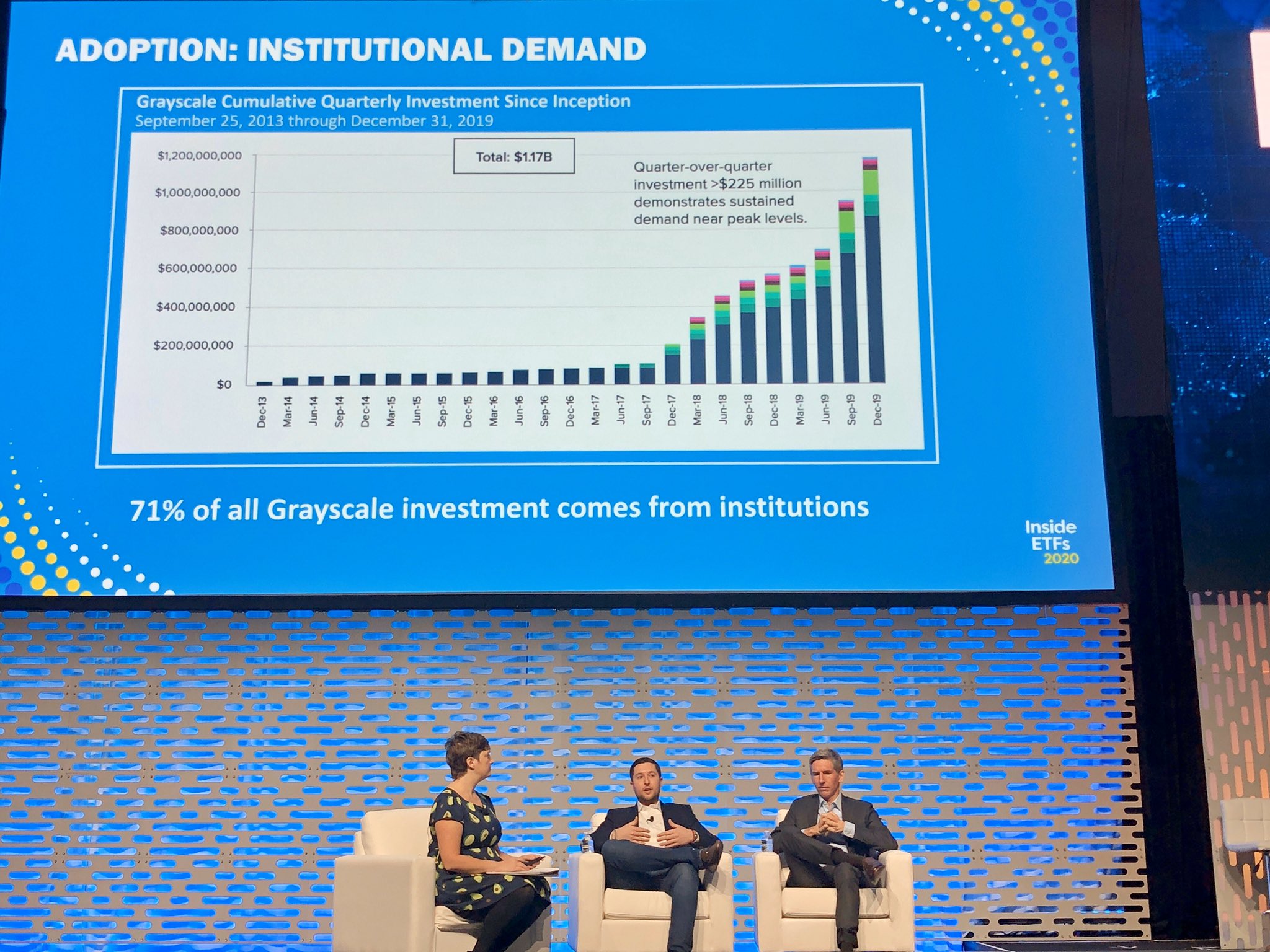

While bitcoin and other cryptocurrencies have experienced a significant drop in price since the beginning of the year, the story is entirely different for Barry Silbert’s Grayscale Fund as the firm has seen quite exponential growth so far, due to massive investor interest in its crypto-linked investment offerings.

Forging Ahead in spite of the OddsGrayscale’s first Digital Asset Investment report for the first half of 2018 released in July 2018, shows the cryptocurrency investment managers are not feeling the brunt of the bearish crypto markets in any way.

The platform which was established in 2013 as a subsidiary of Barry Silbert’s Digital Currency Group (DCG) has experienced steady growth and massive net inflows into its cryptocurrency funds so far.

As stated in the Grayscale report, a total of $248.39 million was invested in its products, with an average weekly investment of $6.04 million pumped into its Bitcoin Investment Trust, while other digital assets generated a combined $9.55 million weekly.

“Over the last six months, the digital asset market experienced one of the largest price drawdowns since the inception of Bitcoin in 2009,” Grayscale stated, adding:

“However, what is more interesting, and somewhat counterintuitive, is the pace of investment into Grayscale products has accelerated to a level we have not seen before.”

In what could be described as a massive triumph for digital currencies, away from its origin of retail-driven successes, about 56 percent of the firm’s interest this year were drawn from institutional investors, according to Grayscale’s report.

The report found the market for initial coin offerings (ICOs) has increasingly expanded this year with Wall Street firms swiftly taking on technologies related to cryptocurrencies. This further reinforces Grayscale’s findings that financial institutions have become more attracted to the burgeoning cryptospace.

Grayscale further noted that an average of $848,000 came from institutional investors, while family offices, retirement accounts, and individuals invested $553,000, $335,000, and $289,000 respectively. “In fact, we raised nearly $250 million in new assets in the first half of this year, marking the strongest inflows of any six month period in the history of our business,” Grayscale declared.

At current, Grayscale has $2 billion under management with a vast array of cryptocurrency funds including, Bitcoin Investment Trust, bitcoin cash, and ethereum.

2018 to End on a Bullish Note for Cryptos?Even with the reign of the bears, many renowned crypto analysts have predicted that bitcoin will moon again this year like it did last year.

And from all indications it appears these prophecies may come to pass, considering the fact that vast loads of institutional monies will soon be sent into the cryptosphere.

Notably, on July 18, BTCManager reported that BlackRock Inc., a global asset management big whale with $6.3 trillion in assets under management, is making concrete plans to venture into the crypto industry. An event that has the potential to single-handedly launch the price of bitcoin to the moon when it finally happens.

The post Barry Silbert’s Grayscale Investments Cryptocurrency Fund Sees Green despite Bitcoin Price Slump appeared first on BTCMANAGER.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|