2023-2-3 17:41 |

The US Labor Department recently released a report that has left policymakers with mixed feelings. The report showed a surprising fall in the unemployment rate to 3.4%, the lowest since 1969. However, the number of new jobless claims reached 517,000, the highest since August 2022.

Source: US Bureau of Labor StatisticsDespite the concerns raised by the high number of jobless claims, there is a silver lining in the report. The average hourly wage growth remained at the 0.3% M/M pace, which has been seen as a cooling effect in the labor market. Despite the lack of progress in labor market tightness, fears of wage growth picking up again are present.

Market React to Strong US Nonfarm Payrolls ReportFederal Reserve Chairman, Jerome Powell, commented on the report during a recent speech, stating that the current state of the labor market is encouraging. Powell added that in his view, the labor market would have to see some weakening in order to make further progress towards the 2% inflation target set by the Federal Reserve.

“We can now say for the first time that the disinflationary process has started,” says Fed Chair Jerome Powell after today’s rate hike. https://t.co/0OyCyFDEI9 pic.twitter.com/5Vc13VhNSt

— CNBC (@CNBC) February 1, 2023The release of the US Nonfarm Payrolls Report had a significant impact on financial markets. The S&P 500 futures fell from $4,171.25 to $4,138.5, while 10-year T-Note futures fell from 115-19 to 114-24. The DXY rallied from $101.68 to $102.34 and terminal rate pricing rose 5bps to 4.95%, up from just beneath 4.90% prior to the release.

Global Bond Mkts plunge w/US 10y and German 10y yields jump 11bps as latest US NFP data show that the labor economy is lightyears tighter than the Fed wants. pic.twitter.com/dSggyu1QbA

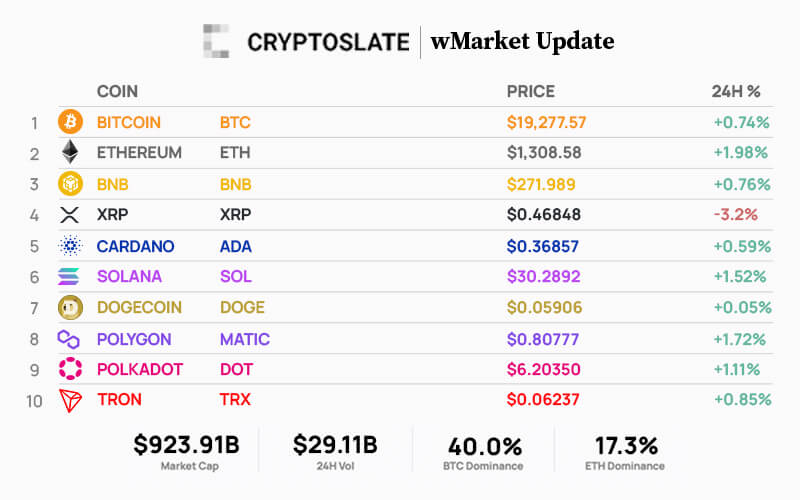

— Holger Zschaepitz (@Schuldensuehner) February 3, 2023The crypto market also experienced a spike in volatility following the report, with Bitcoin taking a 1.25% nosedive, Ethereum losing 30 points in market value, and Ripple’s XRP token retesting the $0.40 support level.

Source: Google FinanceThe mixed signals in the report have left many experts and investors cautious as they try to interpret the state of the US economy and what it means for their investments. The ongoing challenges posed by the COVID-19 pandemic and the reaction of the labor market will continue to be closely watched in the coming weeks and months.

The post Strong US Nonfarm Payrolls Report Causes Volatility in Cryptos, Stocks, and Treasury Markets appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|