2020-5-5 17:26 |

Ethereum's varying inflation rates due to Minimum Necessary Issuance (MNI), raising questions from the community as ETH 2.0 Phase 0 heads into launch. The second-largest blockchain employs a different rewarding structure from Bitcoin’s fixed supply rate; determining the minimum issuance rate as its difficulty bomb adjusts.

While the MNI ensures security on the network, several questions regarding the objectivity in determining the minimum rate and long term survival of the blockchain without continual forking have been raised.

In a recent podcast, Ethereum’s co-founder, Vitalik Buterin, answered these questions on the MNI, stating the mechanism ensures issuance and price of ETH remain at a “reasonable cost” in the long term. He said,

“In the longer term, a minimal viable issuance is an explanation for why the parameters like issuance are set up – it seems empirical that these parameters can motivate particular amounts of Ether to be sticking at a reasonable cost.”

ETH 2.0: Inflation set to Drop by 50%Vitalik believes that the solution to high inflation will be quickly solved with the launch of Ethereum 2.0 Phase 0, expected in less than two months. In the podcast, Vitalik explained that the new proof-of-stake (PoS) mechanism will lower the inflation rate by over 50% despite the MNI remaining variable.

“One of the reasons why we’re doing Proof of Stake is because we want to greatly reduce the issuance. So in the specs for ETH 2.0 I think we have put out a calculation that the theoretical maximum issuance would be something like 2 million a year if literally everyone participates.”

Furthermore, Vitalik claims there is a good chance that the staking process will lower the inflation rate to only 1 million ETH tokens per year.

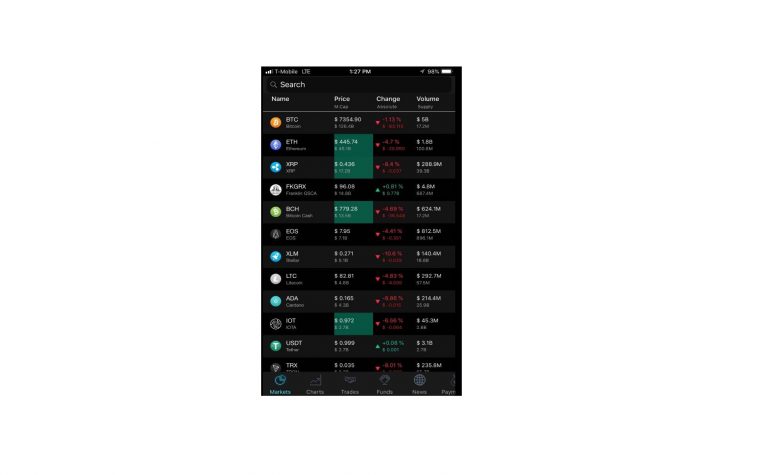

ETH Steady Rise to Continue Following PoS Launch?Ether’s price skyrocketed past $200 last week as potential stakers filled their bags to reach the 32 ETH minimum limit needed to stake on the blockchain. Stakers will earn around 4-5% returns on their investments per year to keep transactions safe on the blockchain.

Adam Cochran, a partner at MetaCartel Ventures, said the ETH supply may see a huge reduction following the staking and buying frenzy. He estimated that 10 to 30 million Ether could be taken off the open market and with the supply rate dipping 50% following the launch of ETH 2.0, ETH price may appreciate significantly.

Ethereum (ETH) Live Price 1 ETH/USD =$207.7405 change ~ -1.26%Coin Market Cap

$23.02 Billion24 Hour Volume

$4.64 Billion24 Hour VWAP

$20324 Hour Change

$-2.6075 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~ETH~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|