2021-3-1 02:14 |

Bitcoin markets saw a drastic correction over the last week which carried over to the weekend. But data shows miners are buying.

Miners buyingData on Glassnode showed miners sold hundreds of thousands of Bitcoin in the period from the last week of December until last week. The “Miner Net Position Change,” a tool that calculates the 30-day change of the supply held in miner addresses has turned “green” after months of being “red,” charts show.

Bitcoins miners utilize massive equipment to validate the network and solve millions of complicated calculations per second. They receive “rewards” in the form of Bitcoin for every block they mine, which incentivizes them to continue supplying resources to the network.

Doing so is an expensive process. Electricity and cooling costs of the mining rigs add up in a big way, meaning miners have to continually sell their rewards to keep their business running. This becomes a constant sell pressure on the asset, one that is bought up by other market participants such as retail investors or institutions.

But the past few days have been different. On-chain data shows miners are purchasing more Bitcoin as the asset fell over 10% in the past 48 hours. There was no fundamentally negative news to explain the correction, but Bitcoin fell in line with global technology stocks and macro bonds.

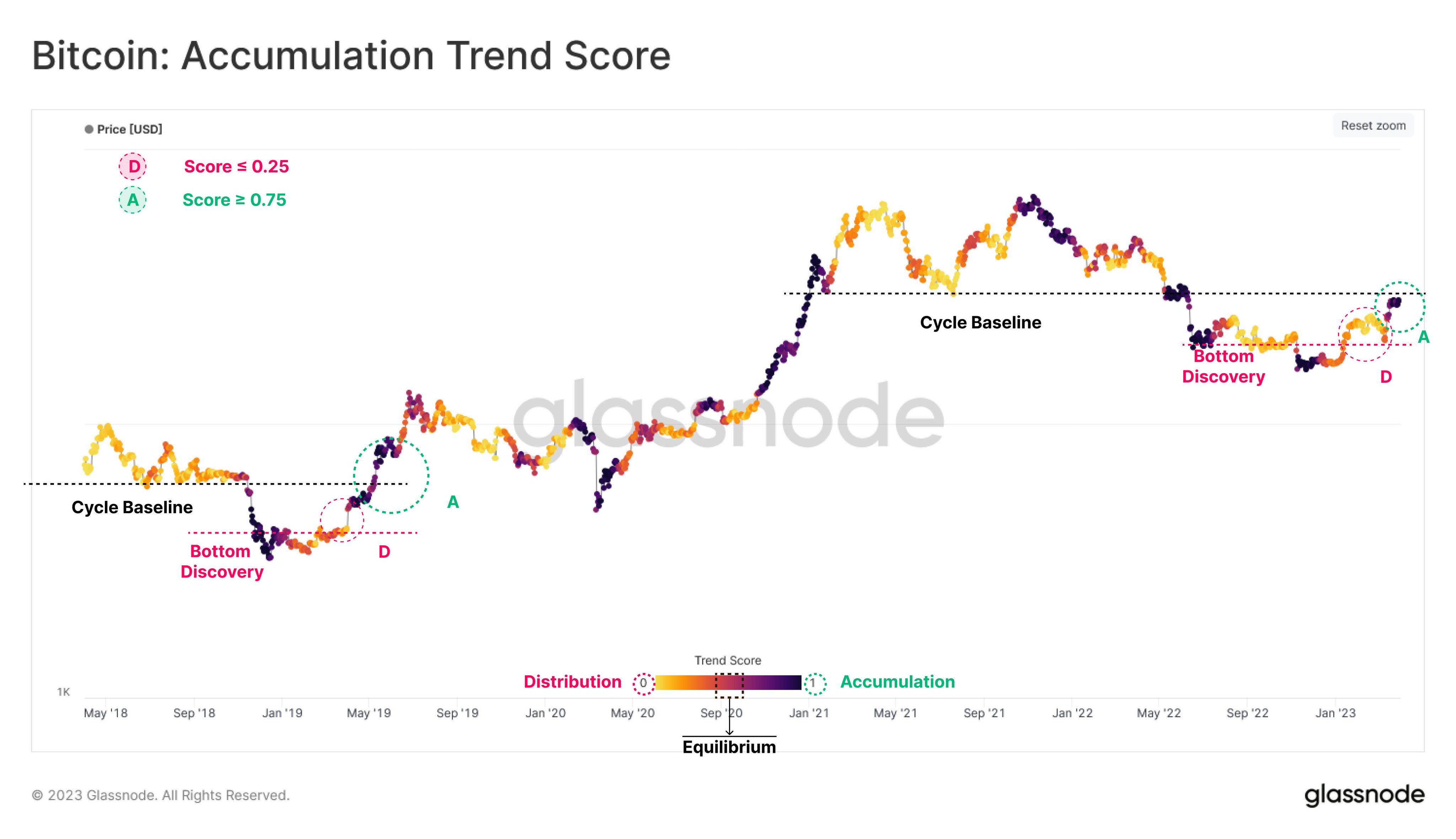

Accumulation of BitcoinLex Moskovski, CEO of crypto fund Moskovski Capital, cited Glassnode data on Twitter and said that miners were seemingly “accumulating” Bitcoin instead of selling the asset en masse.

“Miners have stopped selling and started accumulating #Bitcoin. Yesterday was the first day since Dec, 27 when Miners Position change turned positive,” he said, adding that miners were previously selling their Bitcoin since December last year.

Miners have stopped selling and started accumulating #Bitcoin

Yesterday was the first day since Dec, 27 when Miners Position change turned positive.

Miners were selling their bitcoins for two months.

Bullish. pic.twitter.com/S89iBcz4k3

— Lex Moskovski (@mskvsk) February 27, 2021

Moskovski noted that previous “positive” periods on the miner charts suggested a “good” buying opportunity for the miners. He explained that miners will accumulate the asset until the price is both “a. good enough and b. there are enough buying orders to absorb their Bitcoin.”

The second point is a basic market rule—no buy orders mean a sudden, drastic fall in prices while a well-stacked order book means enough buying power that can avoid such a fall.

Meanwhile, Moskovski added that miners could also likely be accumulating if they had more information than that available to retail audiences. “They might also know something (together with Saylor and Square) we don’t,” he said. But in a perfect decentralized world, does insider information even exist?

The post Data shows miners are “accumulating” as Bitcoin falls to $44,000 appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|