2019-4-21 01:18 |

During the first week of April, news.Bitcoin.com reported on a large swarm of darknet market (DNM) users flocking from Dream to the Wall Street marketplace. However, the migration hasn’t been as successful as it may have first seemed, with some vendors alleging that Wall Street has pulled an exit scam and ran off with $30 million in crypto held in escrow.

Also read: The Darknet’s Largest Marketplace Is Closing – But a Replacement Is on Its Way

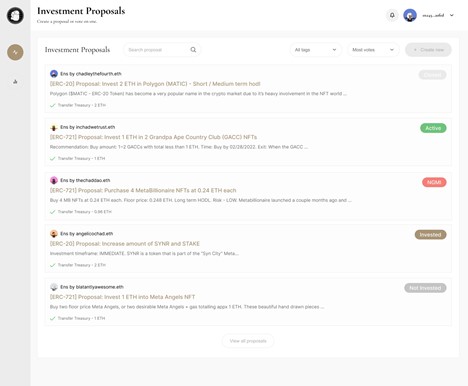

Wall Street Market Users and Vendors Complain of Payment Issues and Possible Exit ScamNot long ago, the largest DNM on the invisible web, Dream market, decided to shut down operations and transition to a new marketplace. At the time, many users flocked to other markets like Wall Street, Cannazon, and the Majestic Garden. According to user and vendor reports, since the Dream closure a huge number of users have migrated to Wall Street (WS). The WS marketplace has since reportedly amassed millions of dollars in BTC in escrow before people started noticing issues on April 17. One spectator commenting on Deepdotweb.com on April 20 claimed WS stopped paying vendors for finalized orders and all the funds collected were then transferred into a single BTC wallet.

“If you do your research you can find this wallet and see that afterward the BTC got split over several other BTC wallets,” the comment notes. “They claim to have some “technical issues” with their BTC servers. They have been saying that they are working on the issue for the last couple of days and that the missing BTC will be returned to the website.” The comment stemming from someone who calls himself a “DNM veteran” further states:

In the meantime they are making it look like nothing is going on and they are still running the website and having customers transfer BTC to the website.

Deepdotweb.com does show that the marketplace has 97.9% uptime at the moment, but the publication does display a caution notice that says “Warning: Market is exit scamming, do not deposit any funds into Wall Street market.” Further, the website’s comment section for direct links to WS is littered with commentary concerning the possibility that WS admins have exit scammed.

Essentially, an ‘exit scam’ is a confidence scheme used by a well-established darknet operation that stops shipping orders but continues to amass funds in escrow. After a good chunk of money has been collected, the DNM admins steal the funds and the site shuts down all of a sudden. On the Reddit forum r/darknet there’s a ton of posts stemming from users and vendors complaining about not being able to obtain funds from Wall Street. The top post on the forum says that “WSM has exit scammed” and some WS admins may be extorting users for more money.

Running Away With a Possible $30 Million in CryptoAccording to the extortion post, WS support allegedly messaged users who did not encrypt their support messages and asked for help in plain text. The post says that users who made this mistake need to pay 0.05 BTC to a specific address or the list of people they caught making the mistake will be sent to Europol and the FBI. Another post on the forum called “WS Exit Scam Confirmed” also details a similar situation where vendors were not getting paid this past week, according to a meeting between “27 well-established DNM vendors.” There are definitely a number of deniers on these posts who declare “post proof or stop with this bullshit” but a good majority of comments uphold the story and warn that people should not place orders on the market.

There are others who have spoken with insiders from WS and individuals who work for support who say that the market system was having “technical issues.” One post claims a WS support email details that “services will resume shortly” and they expected to resolve the issue by “Saturday morning on 4/20,” the unofficial cannabis holiday.

Conversations on the DNM discussion forum Dread explain that WS market may have scammed people out of a whopping $30 million worth of cryptocurrencies. The issue with WS strikes fears into the hearts of the many DNM users who have experienced exit scams in the past and demonstrates the fundamental problems with centralized DNMs. Since the creation of the Silk Road and its eventual takedown, there’s been a variety of DNM exit scams which have included Evolution, Oasis, East India Company, Olympus, and Sheep marketplace. The current news concerning the WS market issues has DNM users wondering once again if another popular darknet market has bit the dust.

Do you think Wall Street market exit scammed? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Reddit, r/darknet, Deepdotweb.com, Pixabay, and WS Market logos.

Need to calculate your bitcoin holdings? Check our tools section.

The post Darknet Users Allege Wall Street Market Exit Scammed, Possibly Snatching $30M appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

ExitCoin (EXIT) на Currencies.ru

|

|