2021-4-14 22:00 |

Bitcoin’s price has reached a new ATH after a long period of consolidation. At the time of writing, BTC is trading at $63.235 with 5.1% profits in the past day and 7.7% in the 7-day chart.

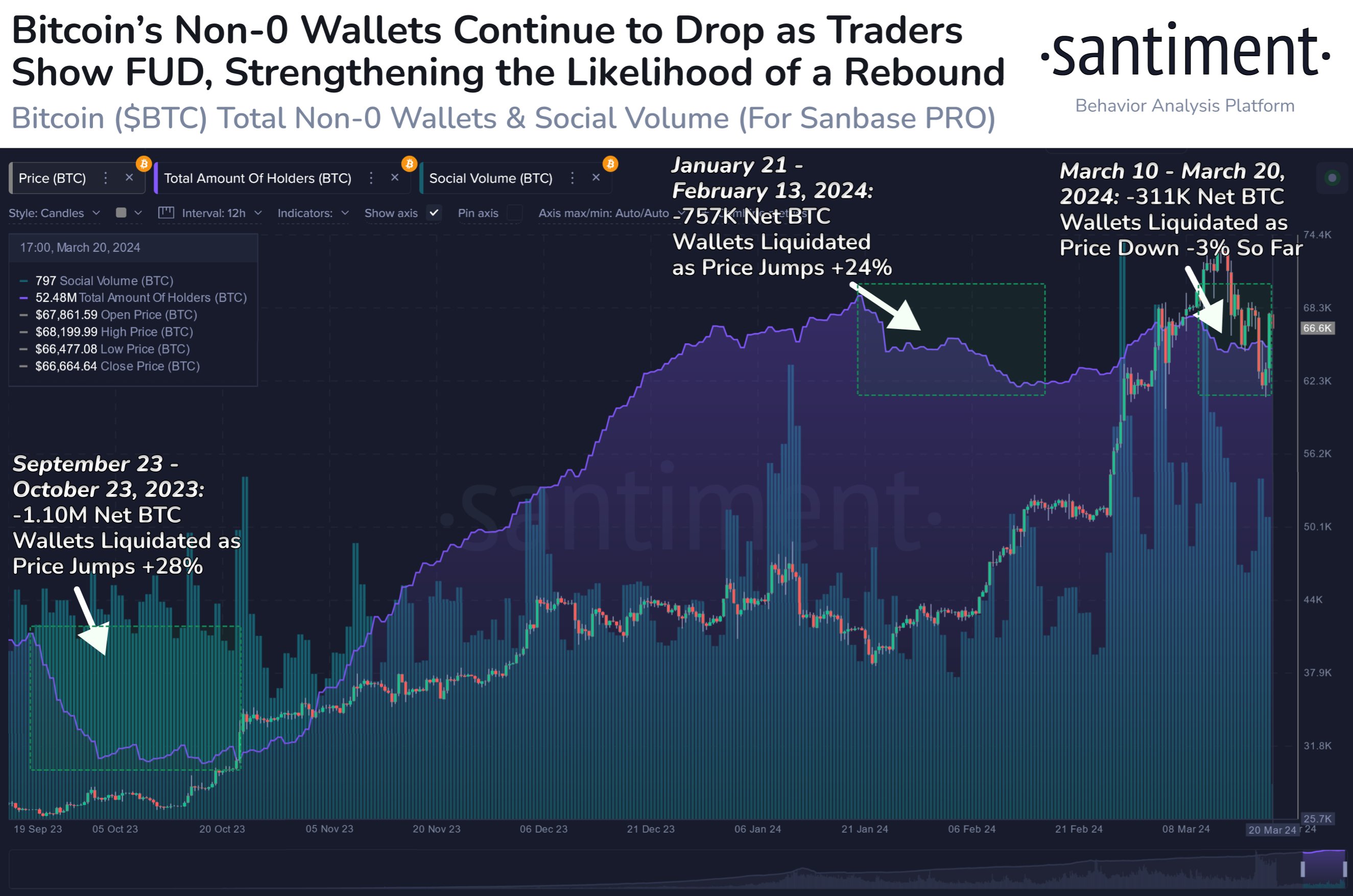

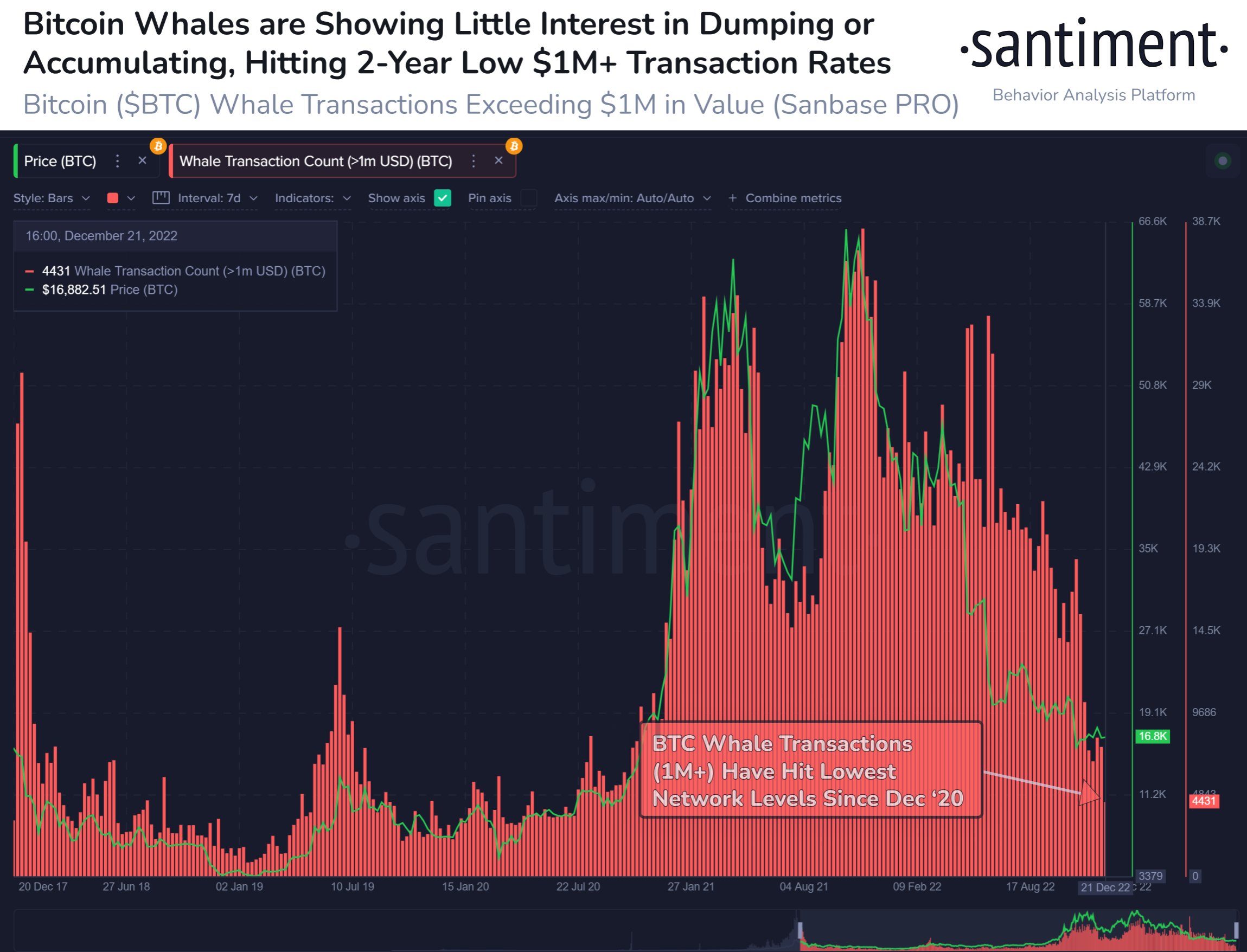

BTC on a bullish trajectory in the 24-hour chart. Source: BTCUSD TradingviewBefore the rally, data from Santiment pointed to high levels of bearish sentiment across social media platforms. During the bullish price action, there was an ATH in address activity with 1.36 million when BTC touch $63.4000.

Source: SantimentNow, the Fear & Greed Index is near the Extreme Greed levels. On the derivatives market, investors pushed the funding rate across all exchanges towards 0.08%, as shown by Glassnode data. A “tolerable” level, according to Lex Moskovski.

#Bitcoin hit ATH and the funding is tolerable.

Good sign. pic.twitter.com/gfzsDFV42M

— Lex Moskovski (@mskvsk) April 13, 2021

However, this metric can increase over the next hours. Over the weekend, when BTC was gaining momentum and tried to break the $61.000 resistance, the funding rate skyrocketed to 0.16%. Levels not reached since mid-February this year.

Per an Arcane Research report, the spike in this metric preceded a correction in BTC’s price. Since the beginning of 2021, when the funding rates go high, BTC’s price follows as investors “heavily” positioned themselves for the upside.

Source: Arkane ResearchIf this metric stays in the current levels, the rally could be prolonged, but an increase in the funding rates could be a key indicator pointing to short-term bearish price action, a return to support, and further consolidation. Arcane Research’s report claims:

High funding rates and futures premium hint towards a lot of leverage towards the upside. Leverage is an essential ingredient in the recipe for liquidations, and we would not be surprised to see an influx in long liquidations soon.

Presently, the threat for a cascade of liquidations hurting Bitcoin’s price action is yet to materialize, but that seems to be a predominant trend in the past months.

On the bull’s side, Trader “Pentoshi” said it would be “unwise” to take a short position against Bitcoin. Pentoshi believes that a 50-day consolidation period turns into support and ATH points to the market accepting BTC’s price. The trader added:

(…) the market has accepted price above the highs unless it’s a scalp. There’s a clear trend and that trend is up. Easy to get steamrolled.

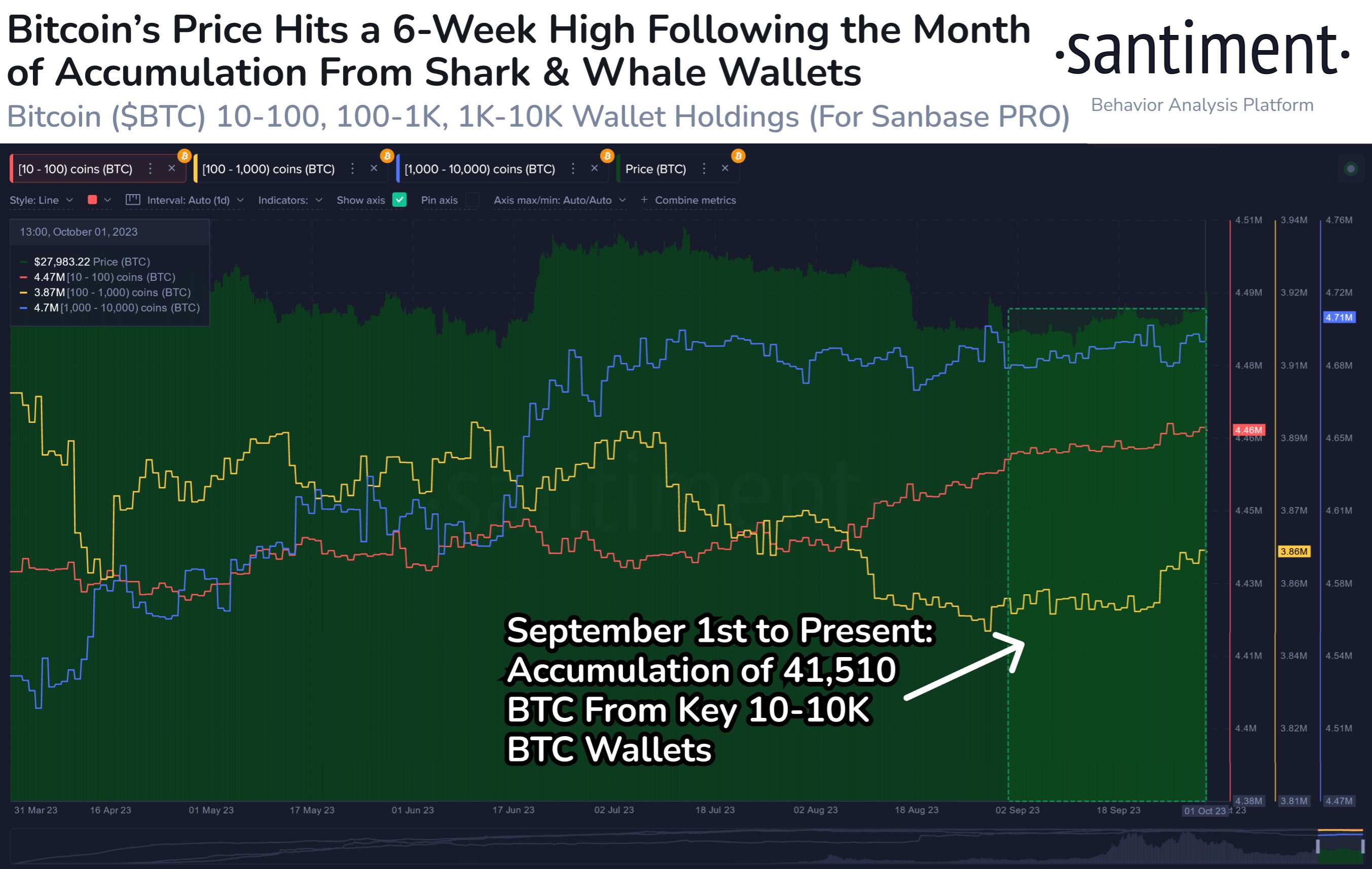

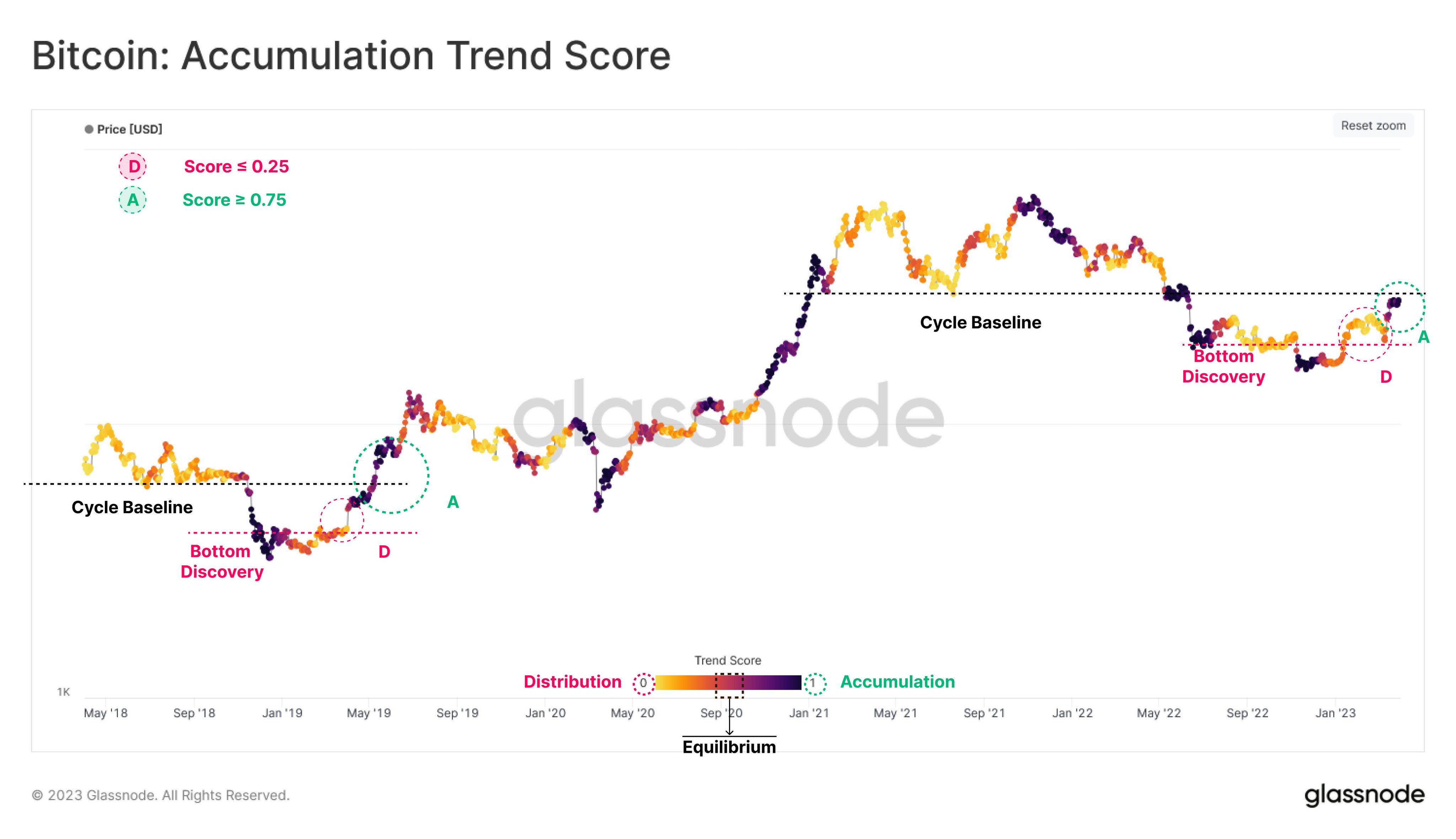

Bitcoin’s price in discoveryFurther data from Glassnode signals a correlation between the increase in USDT, USDC, BUSD’s supply, and Bitcoin’s price appreciation. As shown below, the growth in stablecoins’ market cap is an indication of growing demand for BTC.

Source: GlassnodeOver the past two weeks, USDT supply alone has increased by $3.36 Billion, said Glassnode. In the meantime, BTC’s price has been moving sideways, but seems to have enough fuel to sustain the rally and strong support at $60,000, as monitor Whalemap said:

60k is a big macro support now. A lot of Bitcoin was accumulated in that range so selling pressure will not be high there. Easy invalidation if we get into the red zone (just pointing it out for risk management purposes). Price discovery activated.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|