2021-1-14 05:00 |

Yearn.finance (YFI), a leading decentralized finance protocol, has been hyping up the launch of its v2 Vaults.

While Yearn.finance is an umbrella DeFi ecosystem, it is currently best known for its Vaults product. Vaults are contracts where users can deposit cryptocurrencies such as Ethereum, USDC, YFI, and others to earn a regular yield paid in the coin they deposit. Vaults allow holders of cryptocurrency to earn passive income on their holdings. The v2 iteration of these Vaults are expected to boost returns, and as a result, drive more capital to YFI holders and more value to the overall Yearn ecosystem.

Related Reading: Wall Street Veteran Kickstarts Own Bitcoin Fund With $25m Investment YFI Could Soon See New VaultsYearn.finance’s (YFI) v2 Vaults have long been rumored. Details about them have been somewhat scarce but they are expected to drive more yields to Vault depositors through more advanced smart contracts and more moving parts to increase capital efficiency.

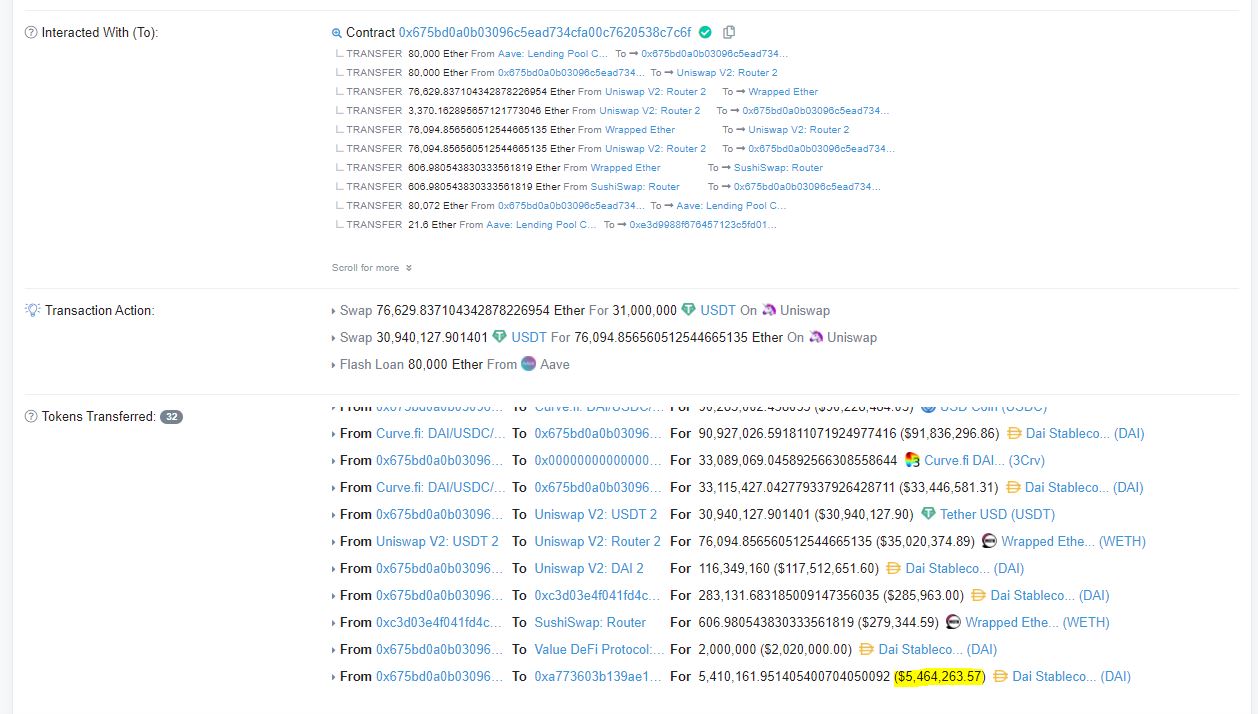

Project founder Andre Cronje recently shared the tweet below, seemingly showing the potential yields for new v2 Vault strategies.

As can be seen, the yields offered are much higher than those seen in traditional finance, along with a fair bit higher than those seen on most DeFi applications.

For instance, the USDC v2 Vault reports having a 55.7% APY, which is a few orders of magnitude above what is offered in traditional finance today.

v2 .@bantg pic.twitter.com/apKthQacmj

— Andre Cronje (@AndreCronjeTech) January 13, 2021

Yields are expected to boost YFI’s value proposition as it will drive more capital into these Vaults, which will increase the dividends that YFI stakers earn.

Related Reading: DeFi Founder Targeted in $8m Hack Says He Has His Hacker’s IP Cross-Protocol IntegrationsThe yields offered on Yearn.finance Vaults (and the dividends accrued to YFI by extension) will likely be boosted by cross-protocol integrations.

Cronje commented last week on these integrations:

“With Cream v2 (Iron Bank), Alpha Homora v2, and Yearn v2, all vaults become leveraged vaults, and cross asset strategies become viable. Deposit 1k DAI can deposit 1k DAI and 1k USDC into Alpha Curve or 1k DAI and 1 ETH into Alpha Sushiswap borrowed indirectly via Iron Bank. These cross platform strategies allow up to 90x leverage on stable coins and 80x leverage on ETH and allows users to either sell and compound or accumulate the asset. As more collateral is introduced into Iron Bank and Alpha v2 yield becomes agnostic.”

YFI is up a few percent on the recent announcements and tweets.

Related Reading: 3 Bitcoin On-Chain Trends Show a Macro Bull Market Is Brewing Featured Image from Unsplash Chart from TradingView.com Price Tags: YFIUSD, YFIBTC Yearn.finance Founder Andre Cronje Drops Hints About v2 Vaults origin »Bitcoin price in Telegram @btc_price_every_hour

Wish Finance (WSH) на Currencies.ru

|

|