2018-8-10 23:03 |

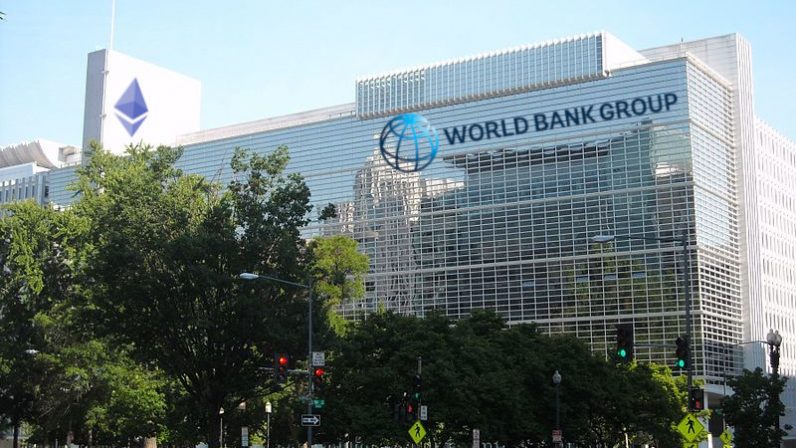

Australia’s Commercial Bank (CommBank) has partnered with the World Bank Group to offer a bond over the blockchain technology.

In a statement released on Friday, the bank which is among the top four largest commercial banks in Australia informed the public about the partnership. The bank has been entrusted by the World Bank Group to issue the blockchain based bond.

What Does The Partnership Entail?Basically, the bank will use blockchain technology to create, manage and transfer the bond. The bank’s blockchain lab has already developed the process that will be used to issue the bond. The bank had hinted that such a product was in the pipeline in a statement back in December. Now that the World Bank Group has given CommBank this mandate, it’s all systems go.

The product dubbed ‘bond-I’ has attracted the attention of formidable investors such as Northern Trust and the Insurance and Treasury Corporation of Victoria.

According to the World Bank Group’s treasurer, Arunma Oteh, the groundwork for the technology has been in the pipeline for almost one year. The team at CommBank has carried out intensive research and analysis to ensure that the bond issuance is carried out smoothly. However, there are no much details about the terms and size of the debt issuance.

More About ‘Bond-I’The issuance of this bond is in line with World Bank’s agenda of issuing $50 to $ 60 billion to countries in its fight against poverty around the world. The use of blockchain technology will help accelerate this agenda and bring transparency to the process. The bank will now be in a position to advice client on how Blockchain can impact their lives.

According to CommBank, the platform is built on the Ethereum network. Microsoft has also reviewed its structure in terms of security and its resilience. The bank joins major financial institutions that have embarked on looking at blockchain as a way to offer viable and convenient financial solutions to clients.

It will be great to see how this revolutionary step to embrace blockchain technology in bond issuance will impact on the cryptocurrency space.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) íà Currencies.ru

|

|