2020-8-29 20:47 |

As we enter the last week of August, several traders opine that the Bitcoin price’s performance over the next two weeks will determine if the value will drop below $10,000 or a positive surge will go on.

The week’s candle comes at a time when CME’s Bitcoin futures, as well as Deribit’s options contracts, are set to expire. This has the potential of setting the tone of prices for September. More so on whether Bitcoin will end the month above or below various key levels.

Mohit Sorout, Bitazu Capital founding partner, states that $11,800 is a crucial level for Bitcoin. He argues that an upsurge to $11,800 is likely to “put sellers to sleep.”

There are only a few days before the end of August and the Bitcoin futures sector has remained cautious. The number of long contracts in the market is more than the short-sellers with Bybt showing that longs are 53.36% of the total futures market. This indicates that traders are highly cautious and that a couple of scenarios might happen in September.

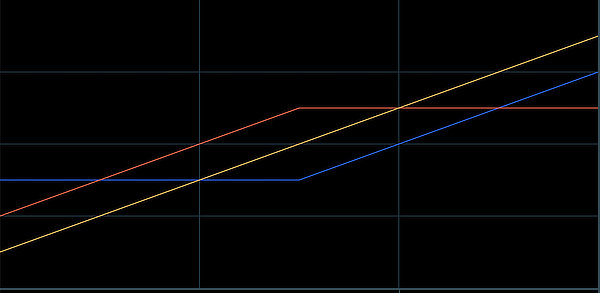

Bullish Short-term ScenarioIn order for Bitcoin to continue with its upward trend in the short-term, traders state that Bitcoin’s price needs to trade above the $11,800 level. If this was to occur, traders forecast that Bitcoin is likely to trade above $12,500. Consequently, others believe that if Bitcoin trades between $10,900 and $11,500, then a bullish scenario is likely in the short-term.

Nunya Bizniz, a crypto analyst, explains that if monthly candle structure at the moment was to follow the previous ones, then a newfound bull run is likely in the short-term.

Bitcoin’s Stagnation ScenarioAn alternative scenario, as advanced by some investors, is that the leading cryptocurrency may experience several months of low volatility or price remaining stable before a significant price surge. 10T Holdings co-founder, Dan Tapiero, explained that each price cycle has taken about 800 to 1,100 days for it to be complete. At the moment, the current cycle is not even 400 days old which means that Bitcoin’s price is likely to stagnate in the next one year. He said:

“Each upcycle takes longer to play out and is less extreme as absolute dollar value gets much larger. May or may not be another 6-12 months before price breaks up. It should not matter as the end price point obscenely higher. Holders rejoice.”

Historically, September has been a slow month for the crypto market, and as expected traders have mixed opinions on the next move for Bitcoin.

What’s your opinion on the next price move for Bitcoin? Let us know in the comments section.

Bitcoin (BTC) Live Price 1 BTC/USD =$11,540.5402 change ~ 0.31%Coin Market Cap

$212.98 Billion24 Hour Volume

$3.68 Billion24 Hour VWAP

$11.52 K24 Hour Change

$35.2250 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD");The post Will Bitcoin's Price Over the Next Two Weeks Set the Pace for September's Bulls or Bears? first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Two Prime FF1 Token (FF1) íà Currencies.ru

|

|