2023-10-13 18:15 |

The US Consumer Price Index (CPI) for September rose 3.7% annually, coming in slightly hotter than consensus forecasts of 3.6%. So-called core CPI, excluding volatile food and energy categories, declined annually from 4.3% in August to 4.1% last month.

Headline inflation rose 0.4% month-on-month in September, lower than August’s increase of 0.6%, while core month-on-month prices increased 0.3%. The uptick in core inflation, coupled with last month’s slightly hotter-than-expected Producer Price Index (PPI), could nudge the Federal Reserve (Fed) toward one more rate increase at its next meeting.

CPI Good for Dollar, Bad for BitcoinThe mild decline in headline CPI numbers caused yields on 10-year treasuries to climb five basis points to around 4.6%. The US dollar index, which notched mild losses after yesterday’s PPI numbers, responded positively to the consumer price numbers, spiking to 106.1.

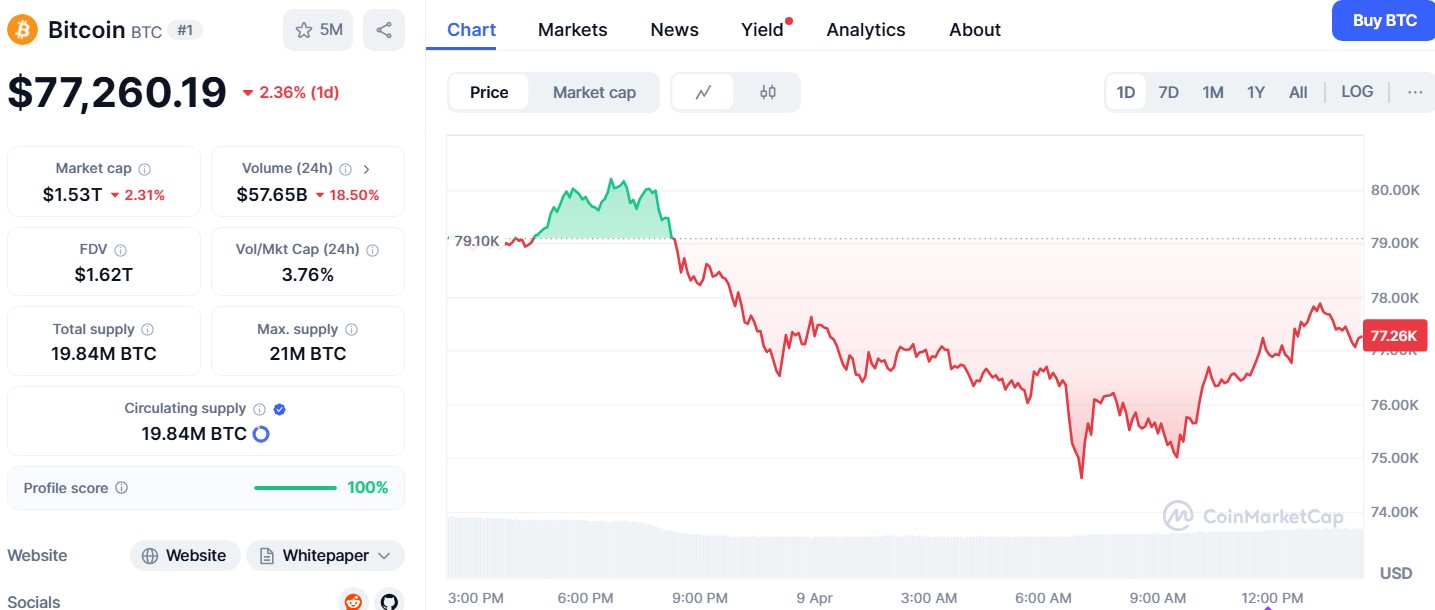

US dollar index | Source: TradingViewBitcoin (BTC) dropped from $26,836 to $26,767, while Ethereum (ETH) has recovered to $1,551 after a brief dip to $1546 following the CPI announcement. At press time, the S&P 500 hovered around 4370 after falling to a session low of 4369.5 a little while after the trading day opened.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2023

By and large, the inflation report conformed with analysts’ expectations, with previews expecting the Hamas-Israel conflict to tip prices slightly upward. Economists have penciled in a pause in Fed rate hikes for the rest of the year as a base case, with further inflation risk tipping the scale towards one more increase.

CME interest rates | Source: CME FedWatch ToolRead more: 7 Ways To Handle Retirement With Increasing Inflation

Fed Must Juggle Multiple Inflation RisksEconomists predict that if the Israel conflict causes oil prices to reach $100 per barrel, October’s headline CPI could rise 0.4%. Other sector-specific events could also influence prices, such as the ongoing United Auto Workers strike and the deadlock in Hollywood wage negotiations.

Actors are demanding a viewership bonus that would cost the Alliance of Motion Picture and Television Producers around $800 million annually. Ford has proposed a wage increase of 23%, which, with benefits, would amount to a 30% rise.

These increases would pressure the Fed to increase rates amid an already robust labor market. The central bank must also keep an eye on tightening credit conditions.

Higher rates are increasing the losses in sovereign bonds and causing many companies to raise junk bond financing at elevated rates. The “higher-for-longer” rhetoric is also pushing investors towards buying US government treasuries, increasing the US national debt.

Do you have something to say about the effect of the US CPI on the dollar and Bitcoin, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

The post Why New CPI Inflation Data Is Bullish for US Dollar and Bearish for S&P 500 and Bitcoin appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Dollar Online (DOLLAR) на Currencies.ru

|

|