2021-3-15 17:49 |

SushiSwap is a decentralized, community-owned, and community-run cryptocurrency exchange built on the Ethereum network.

Instead of an order book, SushiSwap uses a mechanism called automated market-making (AMM), which leverages smart contracts to create and manage liquidity pools of tokens that users can then tap into to swap cryptocurrency assets.

The Sushiswap platform

The automated market-making model allows users to trade cryptocurrencies and earn yields in the form of trading fees and SUSHI tokens without relying on a centralized platform operator.

SushiSwap’s native cryptocurrency SUSHI also acts as a governance token;

SushiSwap’s fate is entirely in the hands of the SUSHI holders. Holding SUSHI allows users to vote on various protocol improvement proposals, set the fees structure, vote for new liquidity pools, or collectively fund grants for Sushi-related projects.

How Was SushiSwap Created?SushiSwap emerged amidst the DeFi euphoria of summer 2020 as a fork of the biggest and one of the most well-known decentralized exchanges in the space, Uniswap.

The project was initially envisioned by an individual operating under the pseudonym of Chef Nomi, who was soon joined by another pseudonymous core contributor called 0xMaki.

The founding team created SushiSwap by copying the open-source code of Uniswap. The platform’s initial liquidity was ported from Uniswap using a very creative, novel and somewhat ethically questionable method dubbed a vampire attack.

This strategy for bootstrapping automated market makers and sourcing liquidity is called a vampire attack because the initial liquidity is not drawn organically but rather sucked out of one platform for the sake of porting it to another.

SushiSwap heavily incentivized liquidity providers on Uniswap to stake their LP tokens by using extra rewards paid out in SUSHI, which represents supplied liquidity, on the SushiSwap exchange.

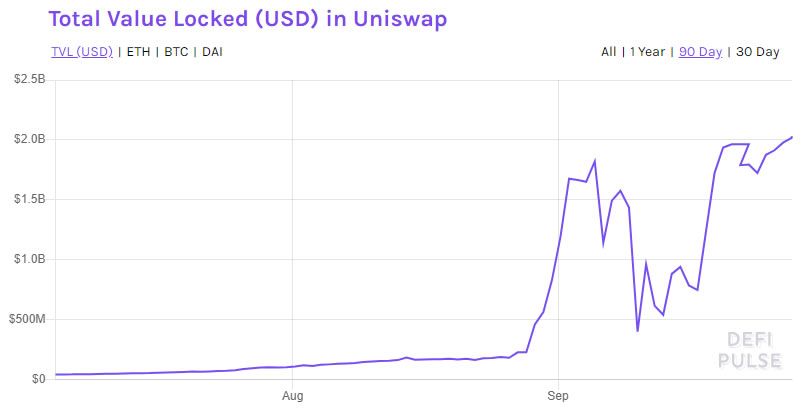

Once about $1 billion worth of liquidity pool tokens had been staked on the platform, the SushiSwap team initiated the vampire attack; on September 9th, 2020 migrated a total of $840 million worth of liquidity from Uniswap.

An interesting tidbit to note here is that, just days before the final migration, when the SUSHI token was breaking new all-time highs, Chef Nomi—who was still the sole beneficiary of the project’s admin key—decided to sell all of their SUSHI, worth around $14 million, which singlehandedly crashed the token’s price nearly 50%.

10% of the minted SUSHI tokens were allocated to the devfund, over which Chef Nomi had full control at the time. The tokens were rightfully his, so he decided to sell them all at once, crashing the price and upsetting the SUSHI community.

After an initial effort to justify his actions as good for the project, the community lost faith in Chef Nomi and effectively forced Chef Nomi out of the project.

Before leaving, Chef Nomi transferred the project’s control to Sam Bankman-Fried, CEO of cryptocurrency exchange FTX and quant fund Alameda Research. After finalizing the liquidity migration, Sam moved the admin key’s control to a multi-signature wallet managed by nine individuals chosen by the community.

Days after the successful migration, Chef Nomi returned, bought the same amount of SUSHI tokens he sold, and put them all back in the devfund, and apologized to the community.

After coming back, he bought back the same amount of coins he sold and put them back in the devfund.

To everyone. I fucked up. And I am sorry.

— Chef Nomi #SushiSwap (@NomiChef) September 11, 2020

Despite its initial furor and dubious origins, today SushiSwap is the second-largest decentralized exchange on the market with total liquidity locked of approximately $4.8 billion.

SushiSwap volume

How Does SushiSwap Work?SushiSwap’s primary function is to facilitate cryptocurrency trading in a decentralized manner. To do this, SushiSwap relies on so-called Automated Market Makers (AMMs); which are smart contacts that create and manage liquidity pools of tokens, and set these tokens’ prices based on algorithms or mathematical formulas.

If you want to learn more about how automated market makers work in the background, please refer to our more comprehensive guide on Uniswap.

Using SushiSwap is simple. All you have to do is connect your wallet to the platform, select Swap in the sidebar on the left-hand side of the interface, select which tokens you want to swap, set the amount and click on Swap.

Using SushiSwap

After you confirm the swap in your wallet, you’re all good to go. The tokens will arrive directly in your wallet as soon as the Ethereum blockchain processes the transaction.

SushiSwap fees: It is important to note here that whenever you swap on SushiSwap, you’re paying a 0.30% fee — 0.25% of which goes to liquidity providers in the selected pool and 0.05% to SUSHI token holders who have staked their tokens in the SushiBar.

If you want to earn some passive income on the SushiSwap exchange, you can either purchase SUSHI tokens and stake them in the SushiBar or provide liquidity to some of the pools listed on Sushi’s Farms page.

Using Sushiswap (yields)

The annual percentage yield (APY) on some of these farms has gone upwards of 217% and more.

How Does SushiSwap Coin (SUSHI) Work? GovernanceSushiSwap effectively started as a direct fork of Uniswap, with the only key difference being the SUSHI token. The whole idea behind the project, and the need to issue a SUSHI token, was creating a better, more decentralized, community-owned Uniswap.

Uniswap was founded by Hayden Adams, who was leading a small team funded and guided by venture capital. Aside from the pool fees for providing liquidity, the users (at the time) had no control and nothing else to gain from the platform. Recognizing the need for a community-owned, community-led decentralized exchange, SushiSwap set out to correct this. Through the SUSHI token, SushiSwap gave users control over the platform and a fair share of the exchange’s profits.

SUSHI token holders can vote on protocol improvement proposals, UI/UX updates, set the yield farming fees, vote on how the treasury devfunds (development funds) are used, propose future improvements, and so on.

Why Do SUSHI Tokens Have Value?The SUSHI token’s value proposition is relatively straightforward: $SUSHI has value because it entitled users to a portion of profits generated by the SushiSwap exchange.

If you’re a SUSHI holder, you can stake your tokens in the SushiBar and earn a percentage of the profits generated by the platform proportional to your stake in the SushiBar pool. The earnings in this pool are distributed in the form of xSUSHI tokens, which effectively represent SUSHI tokens that have been bought on the open market using the profits from the exchange.

Aside from generating passive revenue for SUSHI stakers, this open market operation also creates constant buy pressure for the token. Considering that SushiSwap averages about $0.5 billion in trading volume daily, the profits made from the 0.05% fee charged across all pools equates to roughly $250,000 per day.

Final Thoughts: Is SushiSwap Legit?SushiSwap is one of the more innovative DeFi products on the market and is led by some of the most reputable smart contract developers in the space, which speaks to the credibility of the platform.

Its products have also been audited by some of the most reputable smart contract auditing firms in the space: PeckShield, and Quantstamp.

The project announced a very ambitious roadmap in January 2021 for the following year, which includes products franchised pools, double yield, integrated 1-click Zap, new LP curve options (a change in how the AMM algorithm works), and a surprise project developed by the legendary Yearn Finance creator Andre Cronje.

The post What is SushiSwap (SUSHI)? How to Use the DeFi Platform appeared first on CoinCentral.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|