2019-5-21 21:16 |

By its very nature, Ethereum, just like any permission-less blockchain is open sourced. This means that the underlying code that creates this decentralized infrastructure is open and accessible for anyone to look at, review, and contribute to. This represents the culmination of the individual efforts of tens, if not hundreds of developers around the world. Such distributed collaboration is no easy feat. So how does this community structure the process by which new ideas are proposed, vetted, and eventually implemented onto Ethereum’s mainnet? Through an improvement process known as EIPs (Ethereum Improvement Proposals).

There are some well-known EIPs like ERC20 which is for token issuance, EIP721, which is for non-fungible tokens and rose to popularity through the CryptoKitties project. Lastly is EIP145, which is specifically designed for Ethereum Hard Forks. Although EIPs are an open-sourced protocol that anyone can contribute to, getting your EIP approved is still a rigorous process. Highly established projects such as Polymath (ERC-1400) have only gotten their EIPs to the Draft and Pull Request stages respectively. This speaks volumes to the demanding evaluation process required to get an EIP approved. Although EIPs are an open-sourced protocol that anyone can contribute to, getting your EIP approved is still a rigorous process. Highly established projects such as GitCoin (ERC-1081) and Polymath (ERC-1400) have only gotten their EIPs to the Draft and Pull Request stages respectively. This speaks volumes to the demanding evaluation process required to get an EIP approved.

To add more context into the amazing work put forth by the KrawlCat team, let’s look at the overall process for submitting an EIP.

How To Publish an EIP

There are various forms of EIPs; those that occur on the core layer, which affects the Ethereum blockchain itself, and the application layer, which affect the tokens and projects that are built on top of the Ethereum blockchain. If you want to submit an improvement proposal on the Application Layer (ERC), then it is a three-step process:

Draft: An EIP is open for consideration. Last Call: The EIP has gone through the initial review process and has been deemed acceptable. The proposal will now go through a peer-review from a wider audience. Final: An EIP that has been in ‘Last Call’ for at least 2 weeks and all technical changes requested during the last call stage have been implemented by the EIPs author(s).KrawlCat’s contribution to ERC-1973 is on the application layer, so this proposal will affect tokens and projects built on top of the Ethereum blockchain. Therefore, the EIP has to provide utility to multiple projects, not just KrawlCat. So, let’s analyze what EIP1973 aims to accomplish, how this EIP applies to KrawlCat, and also look at what other use cases this EIP can provide utility towards as well.

ERC-1973: Programmatically Tiered Token Rewards:

ERC-1973 proposes the implementation of a programmatic token rewards interface. The inclusion of this interface would allow for Dapps to scale out their respective token economies much more efficiently. ERC-1973 has been designed so that reward distribution is on a per/block basis, and the value of each reward is dependent on the number of participants in the network. At the beginning, when the network has low volume, per/participant rewards are high in order to incentivize more people to onboard onto the network. However as the network scales the token rewards will decrease proportionately, relative to the amount of people on the network.

KrawlCat’s focus was to design an automated payout structure for token rewards on its network, but there was no standardized process. This led us to evaluating various methodologies, such as a “push system”, whereby developers are ‘pushing’ out the rewards to users. However, as networks scale to the tens of thousands, keeping track of this participant-inventory and each user’s corresponding reward becomes unmanageable. ERC-1973 has instead proposed a “pull system” where users can withdrawal their funds, and based off their usage on the network, a corresponding reward is automatically distributed to their wallet.

KrawlCat is the ideal first use case for ERC-1973:

There are a lot of EIPs in various stages of development, however many of them are not ready to integrate with current projects. In contrast, ERC-1973 has been designed to provide utility to projects that are in the space today, and therefore is ready to create tangible value for the KrawlCat ecosystem, as well as other projects.

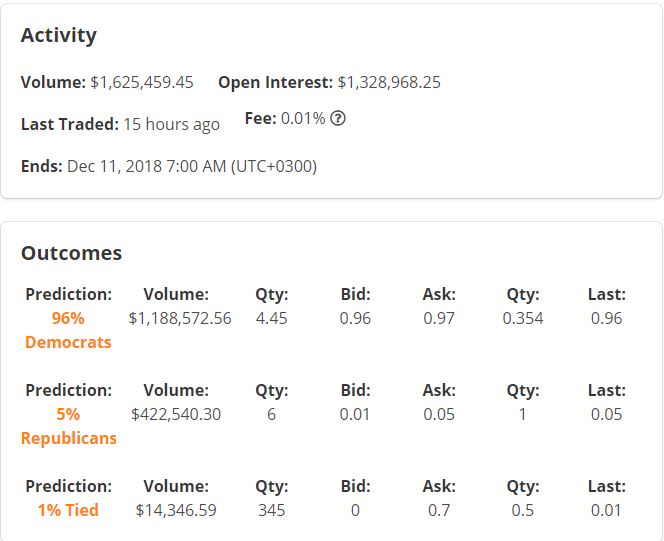

KrawlCat is a decentralized data feed provider that allows blockchain projects to access off-chain data like stock prices and other predictable events like aviation information and weather forecasts. KrawlCat’s infrastructure consists of a distributed network of computers that have been specifically manufactured to scrape the web for internet statistics. As each computer scrapes data, they are rewarded in the form of KrawlCat tokens; the more they scrape, the more they earn. ERC-1973 would help expedite KrawlCat’s reward-payouts. Rather than utilizing a push system where developers must send the appropriate rewards to each address, which also raises centralization concerns, a pull system would be much more efficient as rewards could be automatically withdrawn.

The idea of token rewards, and tokenized economies is relatively new, so let’s explore some other use cases that highlight ERC-1973’s functionality.

Other Use Cases that can generate value from ERC-1973:

Compensation:

ERC-1973 works especially well for projects that require people to contribute work to the blockchain network, such as miners who are responsible for verifying transactions.

Profit Sharing & Usage Incentives:

Some projects are designed to redistribute the cash flows generated from network activity. ERC-1973 would work especially well for such a function, as the distribution of rewards could be done much more efficiently so developers don’t need to push the rewards to each user’s wallet.

Fractional Ownership and Dividend Distribution:

One of blockchains most exciting use cases is fractional ownership; the process of tokenizing real-world assets like real-estate and selling equity in these assets in the form of tokens on the blockchain. ERC-1973 would fit seamlessly into this operation as now these asset-backed tokens can be distributed to the appropriate party through automated means, rather than through centralization.

One of the strongest inhibitors preventing blockchain adoption is the ability to distribute token rewards without centralization, as it prevents these projects from scaling and servicing their customers in a truly decentralized manner. Based off these short comings, this EIP should be seriously considered by the community. ERC-1973 can improve the service delivery of projects within Ethereum’s ecosystem, while also weakening their reliance on centralization.

Want to learn more about EIP 1973 or help contribute?

Check out https://eips.ethereum.org/EIPS/eip-1973 to learn more!

Interested in learning more about KrawlCat’s decentralized data feed?

Check out KrawlCat.com to learn more!

News Provided By:

SOURCE:

Yesbit Technology Ltd.

The post What is EIP 1973 and how can it Impact Decentralized Applications appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|