2021-11-20 07:32 |

The top cryptocurrencies grabbed headlines this week following a market-wide market tumble that saw over $250 billion wiped off the sector

Bitcoin slid below $60,000 early on Tuesday and despites effort to bounce back, the crypto coin continued bleeding and is now trading around $58,000. Ether followed a similar path dropping to around $4,200. Both tokens are currently trading in the red and are 8.31% and 7.75% down in the last 7-days respectively.

Here is a breakdown of other exciting events outside the market.

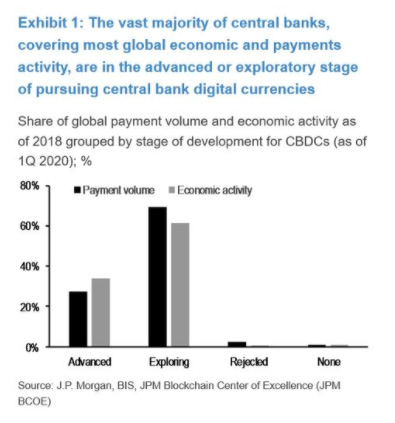

India officials are bullish on a CBDC pilot program early next yearIn a week where a parliamentary panel concluded that cryptocurrencies would not be banned but instead be regulated, it has also come out that India is planning to launch a CBDC pilot program early next year. On Monday, a group of crypto experts from various areas, including the IIM Ahmedabad, the Blockchain and Crypto Assets Council (BACC), and top crypto exchanges, met with the Parliamentary Standing Committee on finance.

The meeting led by BJP MP Jayanth Sinha discussed the crypto situation and concluded that crypto cannot be stopped but will rather be regulated. No specific body was however tasked to manage and oversee the sector.

On Thursday, reports confirmed that India could as soon as Q1 2022 launch a CBDC pilot program. P. Vasudevan, the chief general manager at the Department of Payment & Settlement of the Reserve Bank of India, was quoted saying this, adding that the central bank was also exploring “various issues and nuances related to CBDC.”

Speaking at an online event hosted by the Australian Strategic Policy Institute on Thursday, Prime Minister Modi took a combative approach when talking about crypto. He complained that crypto, more particularly Bitcoin was a threat to the younger population. This was not the first time the Prime Minister was expressing discontent. Just this month, he led a meeting that resolved that the youth should be protected from overpromising and false advertising on cryptocurrencies.

Winklevoss-founded Gemini raise $400 million to build a metaverseFacebook’s ripple effect is still seemingly being felt in the crypto space. Towards the end of last month, the social networking firm paved the way for a spree of investments by several firms entering the metaverse. The announcement and resultant transformation saw startups raise more than $4 billion in an attempt to rival contemporary big tech in the idea of a metaverse.

For the first time, Gemini’s twin-brother owners received external capital into their company with the $400 million raise that saw the crypto exchange’s valuation rise to a significant $7.1 billion. The pair, Tyler and Cameron Winklevoss, will still retain a huge chunk (75%) of ownership of the firm. Morgan Creek Digital led the round, with other financiers, including the Commonwealth Bank of Australia, ParaFi, and Marcy Venture Partners also taking part.

A fraction of the funding will be aimed at investment into the metaverse with part being used to expand the company’s geographical reach. The Winklevoss brothers have popularly in the past challenged Facebook boss Mark Zuckerberg and will be seeking to go head-to-head with his company’s planned metaverse.

In a Forbes interview published yesterday, Tyler Winklevoss said that the firm's strategy would be to spread itself across several metaverses. In addition to offering exchange services, Gemini also has $30 million of crypto assets under its custody. The exchange also runs an NFT marketplace and facilitates users to lend their crypto.

Paradigm's reveals largest-ever VC crypto fund at $2.5 billionThis week saw a series of fundings by venture capital firms, and one of the highlights was Paradigm’s $2.5 billion raise. The investment firm unveiled the fund on Monday, and with the firm having a keen eye on Web3 applications and protocols of the future, it plans to put the money into supporting innovation and incubating ideas. The invested capital is expected to support the next generation of crypto companies.

Elsewhere, the Anoma Foundation on Wednesday confirmed that it had raised $26 million at a $260 million valuation. The round was led by California-based Polychain with additional participation from Zola Capital, Maven 11 Capital, Electric Capital, Fifth Era, and others. The funding will help the firm acquire the services of Heliax – a group of developers – to help grow the protocol further.

On the same day, blockchain technology company, ConsenSys revealed via a blog post that it had raised $200 million at a $3.2 billion valuation. The firm plans to use the capital in making Web3 applications around Ethereum much more accessible and easier to use. The investors involved in the raise included HSBC, ParaFi, Coinbase Ventures, Animoca Brands, and Dragonfly Capital.

Binance is rooting for compliance in its 10 fundamental rights for Crypto usersThis week, Binance published a detailed list of rights for cryptocurrency investors and users. The world’s largest crypto exchange set the rules in what was a remarkable turnaround. Binance was largely surrounded by regulators in various countries over the last few months.

The exchange pulled off what was its first-ever publication on traditional media – a full page of the fundamental rights on the Financial Times, complemented with a web posting. The rights touched on the idea that crypto was good for all, but it still needed to be worked on. Binance advocated for a more regulated crypto space to assure the ordinary user's protection, which is something the regulators want to hear.

The document, 10 Fundamental Rights for Crypto Users, detailed what Binance believes to be the required market ideals and user rights. It reviewed economic independence, allocated responsibilities, called for user privacy, talked of the inevitability of crypto regulation, among other issues.

Binance CEO Changpeng Zhao, on his part, told Bloomberg that face-to-face meetings with regulators had helped change the regulatory view on his exchange. He further added that the exchange had been engaging with regulators about what is important in regulating crypto, and it was only now sharing the information with users.

The post Weekly Report: India looking to transform its crypto sector, potential CBDC trial run on the way appeared first on Coin Journal.

origin »WayCoin (WAY) на Currencies.ru

|

|