2023-10-23 09:45 |

It is shaping up to be another busy week on the economic calendar with US GDP and consumer price index figures. Over the weekend, crypto markets marched upward, but is it possible to maintain this momentum?

On Oct. 23, macroeconomics outlet The Kobeissi Letter listed this week’s key economic events for the United States. It mentioned more volatility as GDP and inflation data are published and tensions are still high in the Middle East.

This Week’s Economic CalendarOn Tuesday, S&P Manufacturing Purchasing Managers’ Index (PMIs) from October will be released. These may have an impact on the expectations from the Federal Reserve’s next set of forecasts.

This is some building permits and new home data released on Wednesday which are expected to increase slightly but have no bearing on crypto markets.

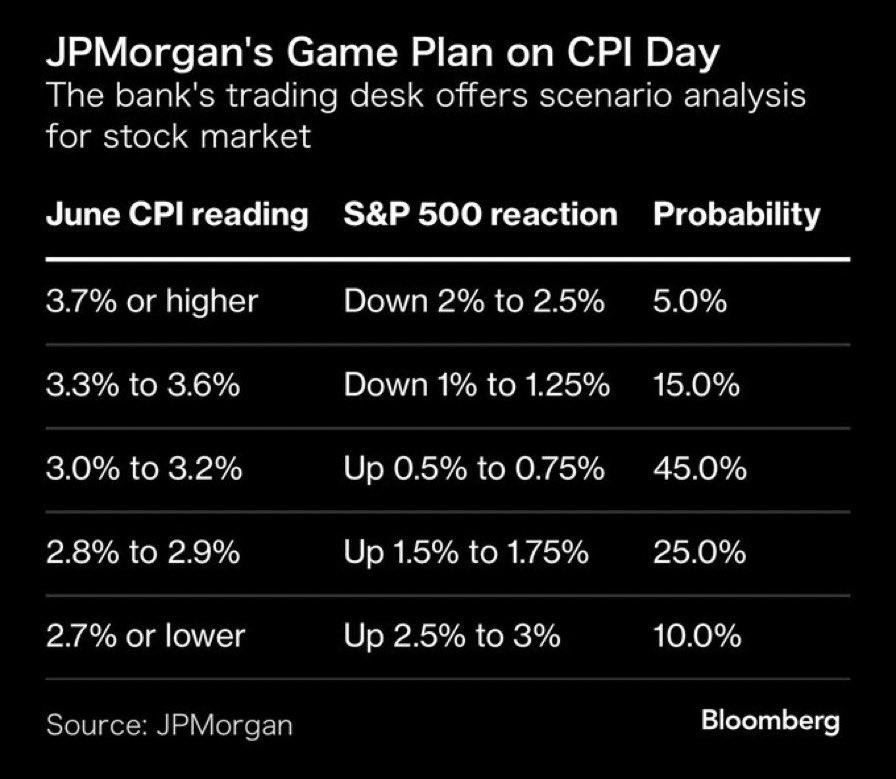

Last week, Federal Reserve chair Jerome Powell said the central bank was “proceeding carefully” regarding interest rates and raising them further. Moreover, he discussed the decision to end rate tightening and the possibility of further restrictive policy due to inflation risks.

Thursday, Oct. 26, will see the release of the Q3 gross domestic product (GDP) figures. The median forecast is 4.5%, up from 2.1% the previous quarter. Additionally, economists have raised their US growth projections through early 2024, trimming recession odds to a one-year low as consumers continue to spend.

This is good news for markets as economic recovery results in more confidence in higher-risk assets.

Read more: Best Upcoming Airdrops in 2023

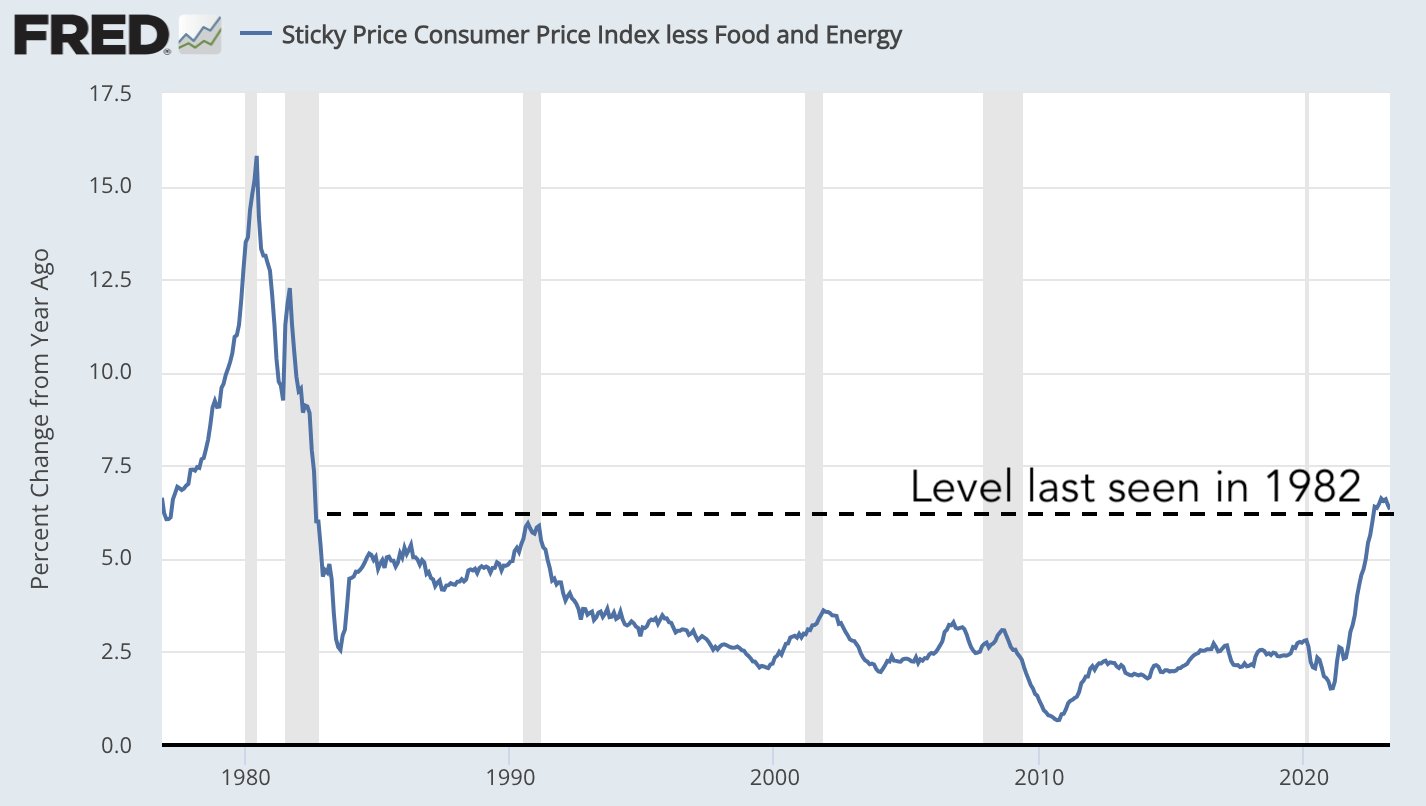

Inflation data is due on Friday in the form of the core PCE index. The Personal Consumption Expenditures price index is a measure of the prices that people living in the US pay for goods and services.

“Meanwhile, earnings season is in full swing and Fed speculation continues,” commented The Kobeissi Letter before adding, “volatility is great for traders.”

Crypto Market OutlookCrypto market capitalization has cranked around $30 billion over the weekend. As a result, it has climbed to $1.19 trillion, its highest level since mid-August.

Gains continued during early Asian trading on Monday morning notching up 1.4% over the past 24 hours.

Bitcoin was leading the pack with a 1.1% climb on the day to reach $30,219 at the time of writing. The asset is now up a whopping 11% over the past week, returning to 2023 resistance levels.

In a rare upward move, Ethereum has increased 3% to reach $1,674 while Chainlink (LINK) skyrocketed almost 20% to top $10, its highest since May 2022.

The post Weekly Economic Calendar: Q3 GDP Figures and More Market Volatility appeared first on BeInCrypto.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Market.space (MASP) на Currencies.ru

|

|